solve the question

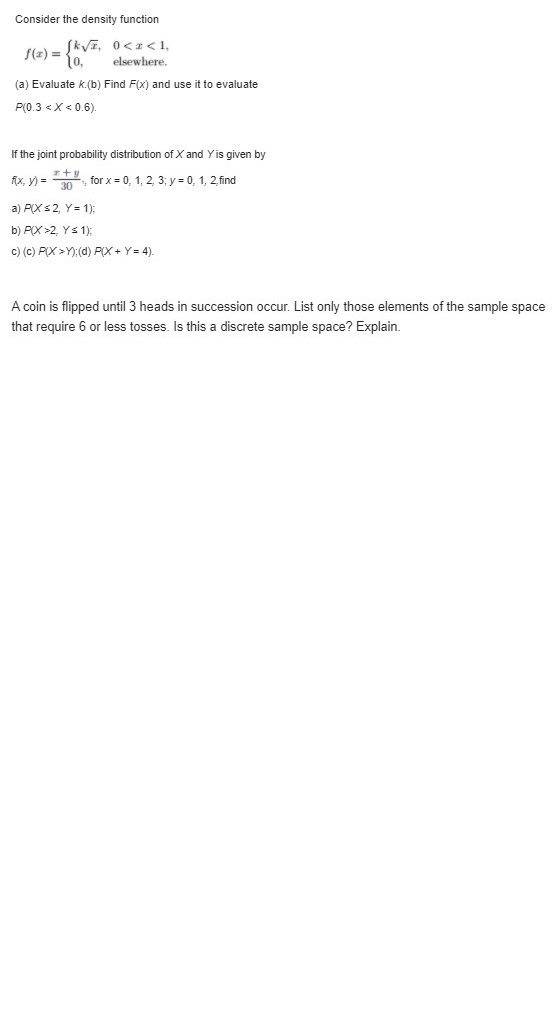

If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits, disbenefits, costs, or savings? The cost of grading and spreading gravel on a short rural road is expected to be $300,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously could only be reached with off-road vehicles. The improved accessibility has led to a 150% increase in the property values along the road. If the previ- ous market value of a property was $900,000, calculate the B/C ratio using an interest rate of 6% per year and a 20-year study period. Arsenic enters drinking water supplies from natu- ral deposits in the earth or from agricultural and industrial practices. Since it has been linked to cancer of the bladder, kidney, and other internal organs, the EPA has lowered the arsenic standard for drinking water from 0.050 parts per million to 0.010 parts per million (10 parts per billion). The annual cost to public water utilities to meet the new standard is estimated to be $200 per house- hold. If it is estimated that there are 90 million households in the United States and that the lower standard can save 50 lives per year valued at $4,000,000 per life, what is the benefit/cost ratio of the regulation?For the data of Exercise 1.4 on page 13, compute both the mean and the variance in "flexibility" for both company A and company B. Does there appear to be a difference in flexibility between company A and company B? Reference: Exercise 1.4: In a study conducted by the Department of Mechanical Engineering at Virginia Tech, the steel rods supplied by two different companies were compared. Ten sample springs were made out of the steel rods supplied by each company, and a measure of flexibility was recorded for each. The data are as follows: Company A: 9.3 8.8 6.8 8.7 8.5 6.7 8.0 6.5 9.27.0 Company B: 11.0 9.8 9.9 10.2 10.1 9.7 11.0 11.1 10.2 9.6 (a) Calculate the sample mean and median for the data for the two companies. (b) Plot the data for the two companies on the same line and give your impression regarding any apparent differences between the two companies.The following measurements were recorded for the drying time, in hours, of a certain brand of latex paint. 3.4 2.5 4.8 2.9 3.6 2.8 3.3 5.6 3.7 2.8 4.4 4.0 5.2 3.0 4.8 Assume that the measurements are a simple random sample. (a) What is the sample size for the above sample? (b) Calculate the sample mean for these data. (c) Calculate the sample median. (d) Plot the data by way of a dot plot. (e) Compute the 20% trimmed mean for the above data set. (f) Is the sample mean for these data more or less descriptive as a center of location than the trimmed mean?Management at Hirschman Engineering has asked you to determine the cost of equity capital based on the company's common stock. The company wants you to use two methods: the dividend method and the CAPM. Last year, the first year for dividends, the stock paid $0.75 per share on the average of $11.50 on the New York Stock Ex- change. Management hopes to grow the dividend rate at 3% per year. Hirschman Engineering stock has a volatility that is higher than the norm at 1.3. If safe investments are returning 5.5% and the 3% growth on common stocks is also the premium above the risk-free investments that Hirschman Engineering plans to pay, calculate the cost of cq- uity capital using the two methods. Common stocks issued by Meggitt Sensing Sys- tems paid stockholders $0.93 per share on an aver- age price of $18.80 last year. The company expects to grow the dividend rate at a maximum of 1.5% per year. The stock volatility is 1.19, and other stocks in the same industry are paying an average of 4.95% per year dividend. U.S Treasury bills are returning 4.5%. Determine the company's cost of equity capital last year using (a) the dividend method and (b) the CAPM. Last year a Japanese engineering materials corpo- ration, Yamachi Inc., purchased some U.S. Trea- sury bonds that return an average of 4% per year. Now, Euro bonds are being purchased with a real- ized average return of 3.9% per year. The volatility factor of Yamachi stock last year was 1. 10 and has increased this year to 1.18. Other publicly traded stocks in this same business are paying an average of 5.1% dividends per year. Determine the cost of equity capital for each year, and explain why the increase or decrease seems to have occurred.Why is it financially unhealthy for an individual to maintain a large percentage of debt financing over a long time, that is, to be highly leveraged? In a leveraged buyout of one company by another, the purchasing company usually obtains borrowed money and inserts as little of its own equity as pos- sible into the purchase. Explain some circum- stances under which such a buyout may put the purchasing company at economic risk. Grainger and Company has an opportunity to in- vest $500,000 in a new line of direct-drive rotary screw compressors. Financing will be equally split between common stock ($250,000) and a loan with an 8% after-tax interest rate. The estimated annual NCF after taxes is $48,000 for the next 7 years. The effective tax rate is 50%. Grainger uses the capital asset pricing model for evaluation of its common stock. Recent analysis shows that it has a volatility rating of 0.95 and is paying a pre- mium of 5% above a safe return on its common stock. Nationally, the safest investment is cur- rently paying 3% per year. Is the investment finan- cially attractive if Grainger uses as the MARR its (a) equity cost of capital and (b) WACC?A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.Consider the density function SAVE, 02, Y= 1); c) (C) P(X > Y);(d) P(X + Y = 4). A coin is flipped until 3 heads in succession occur. List only those elements of the sample space that require 6 or less tosses. Is this a discrete sample space? Explain.A continuous random variable X that can assume values between x = 2 and x = 5 has a density function given by f(x) = 2(1 + x)/27. Find (a) P(X 0, y>0, elsewhere, find P(0