solve the question

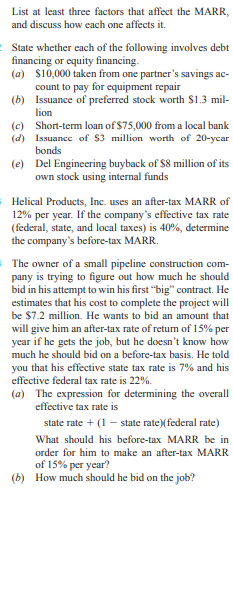

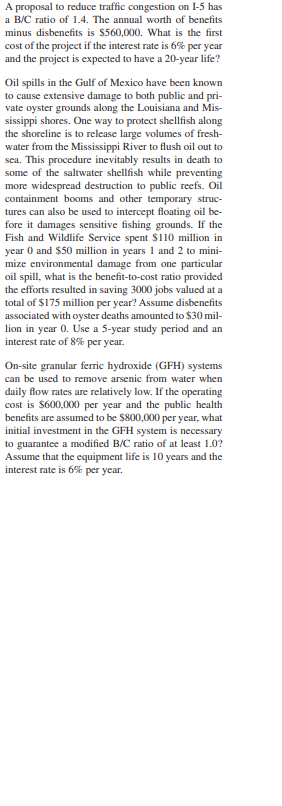

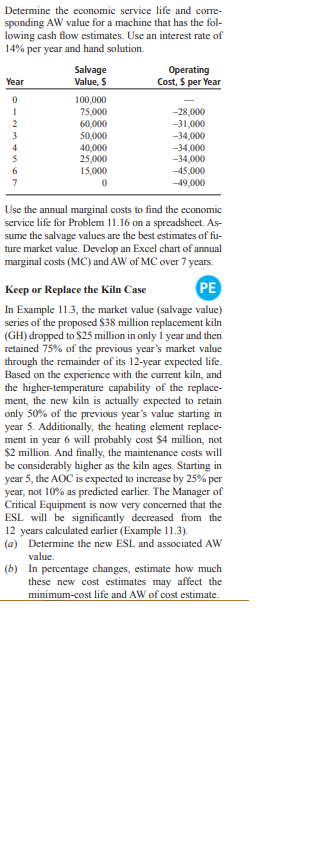

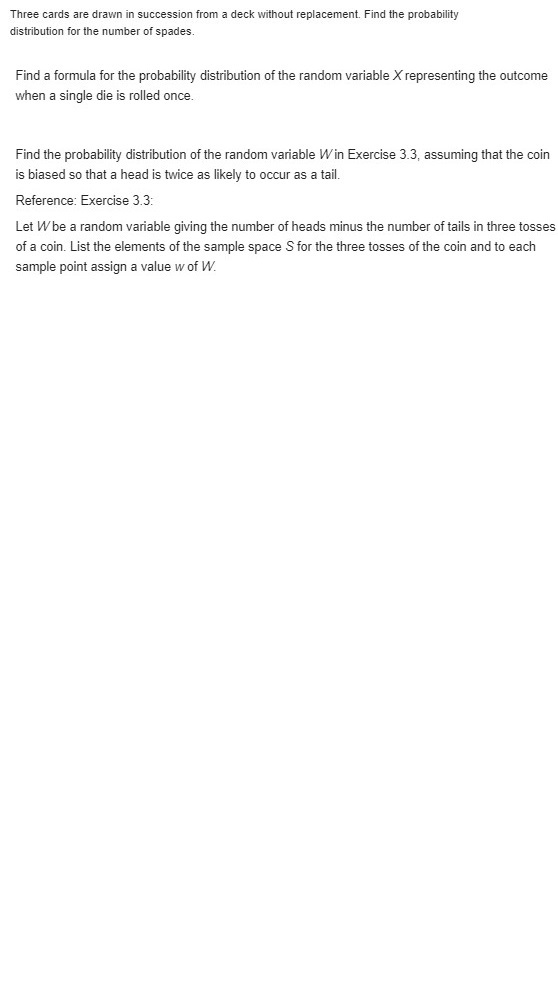

List at least three factors that affect the MARK, and discuss how each one affects it. State whether each of the following involves debt financing or equity financing. (a) $10,000 taken from one partner's savings ac- count to pay for equipment repair (b) Issuance of preferred stock worth $1.3 mil- lion (c) Short-term loan of $75,000 from a local bank (d) Issuance of $3 million worth of 20-year bonds (e) Del Engineering buyback of $8 million of its own stock using internal funds Helical Products, Inc. uses an after-tax MARR of 12% per year. If the company's effective tax rate (federal, state, and local taxes) is 40%, determine the company's before-tax MARK. The owner of a small pipeline construction com- pany is trying to figure out how much he should bid in his attempt to win his first "big" contract. He estimates that his cost to complete the project will be $7.2 million. He wants to bid an amount that will give him an after-tax rate of return of 15% per year if he gets the job, but he doesn't know how much he should bid on a before-tax basis. He told you that his effective state tax rate is 7% and his effective federal tax rate is 22%. (a) The expression for determining the overall effective tax rate is state rate + (1 - state rate)(federal rate) What should his before-tax MARR be in order for him to make an after-tax MARK of 15% per year? (b) How much should he bid on the job?A proposal to reduce traffic congestion on 1-5 has a B/C ratio of 1.4. The annual worth of benefits minus disbenefits is $560,000. What is the first cost of the project if the interest rate is 6% per year and the project is expected to have a 20-year life? Oil spills in the Gulf of Mexico have been known to cause extensive damage to both public and pri- vate oyster grounds along the Louisiana and Mis- sissippi shores. One way to protect shellfish along the shoreline is to release large volumes of fresh- water from the Mississippi River to flush oil out to sea. This procedure inevitably results in death to some of the saltwater shellfish while preventing more widespread destruction to public reefs. Oil containment booms and other temporary struc tures can also be used to intercept floating oil be- fore it damages sensitive fishing grounds. If the Fish and Wildlife Service spent $110 million in year 0 and $50 million in years 1 and 2 to mini- mize environmental damage from one particular oil spill, what is the benefit-to-cost ratio provided the efforts resulted in saving 3000 jobs valued at a total of $175 million per year? Assume disbenefits associated with oyster deaths amounted to $30 mil- lion in year 0. Use a 5-year study period and an interest rate of 8% per year. On-site granular ferric hydroxide (GFH) systems can be used to remove arsenic from water when daily flow rates are relatively low. If the operating cost is $600,000 per year and the public health benefits are assumed to be $800,000 per year, what initial investment in the GFH system is necessary to guarantee a modified B/C ratio of at least 1.0? Assume that the equipment life is 10 years and the interest rate is 6% per year.Determine the economic service life and corre- sponding AW value for a machine that has the fol- lowing cash flow estimates. Use an interest rate of 14% per year and hand solution. Salvage Operating Year Value, $ Cost, $ per Year 100,000 75,000 -28,000 60,000 -31,000 50,00 0 -34,000 40,000 -34,000 25,000 -34,000 15,000 -45,000 0 -49,000 Use the annual marginal costs to find the economic service life for Problem 11.16 on a spreadsheet. As- sume the salvage values are the best estimates of fu- ture market value. Develop an Excel chart of annual marginal costs (MC) and AW of MC over 7 years. Keep or Replace the Kiln Case PE In Example 11.3, the market value (salvage value) series of the proposed $38 million replacement kiln (GH) dropped to $25 million in only 1 year and then retained 75% of the previous year's market value through the remainder of its 12-year expected life. Based on the experience with the current kiln, and the higher-temperature capability of the replace- ment, the new kiln is actually expected to retain only 50% of the previous year's value starting in year 5. Additionally, the heating element replace- ment in year 6 will probably cost $4 million, not $2 million. And finally, the maintenance costs will be considerably higher as the kiln ages. Starting in year 5, the AOC is expected to increase by 25% per year, not 10% as predicted earlier. The Manager of Critical Equipment is now very concerned that the ESL will be significantly decreased from the 12 years calculated earlier (Example 11.3). (a) Determine the new ESL and associated AW value. (b) In percentage changes, estimate how much these new cost estimates may affect the minimum-cost life and AW of cost estimate.Three cards are drawn in succession from a deck without replacement. Find the probability distribution for the number of spades. Find a formula for the probability distribution of the random variable X representing the outcome when a single die is rolled once. Find the probability distribution of the random variable Win Exercise 3.3, assuming that the coin is biased so that a head is twice as likely to occur as a tail. Reference: Exercise 3.3: Let Wbe a random variable giving the number of heads minus the number of tails in three tosses of a coin. List the elements of the sample space S for the three tosses of the coin and to each sample point assign a value w of W.A continuous random variable X that can assume values between x = 2 and x = 5 has a density function given by f(x) = 2(1 + x)/27. Find (a) P(X 0, y>0, elsewhere, find P(0