Answered step by step

Verified Expert Solution

Question

1 Approved Answer

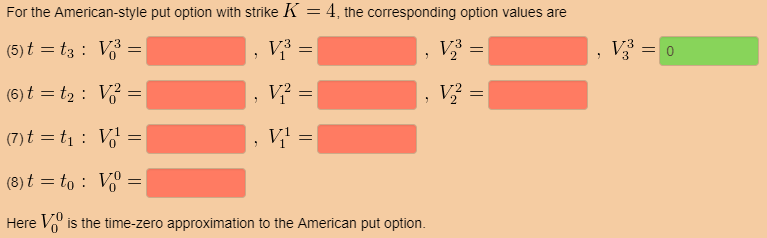

Solve the RED cells. The green is already correct. 0, 1, and 3 are not correct answers to any red cell. And generally, that bunch

Solve the RED cells. The green is already correct. "0", "1", and "3" are not correct answers to any red cell. And generally, that bunch of asset values that are provided are not correct answers - the answers are not in these images.

Your account will be reported if you post spam.

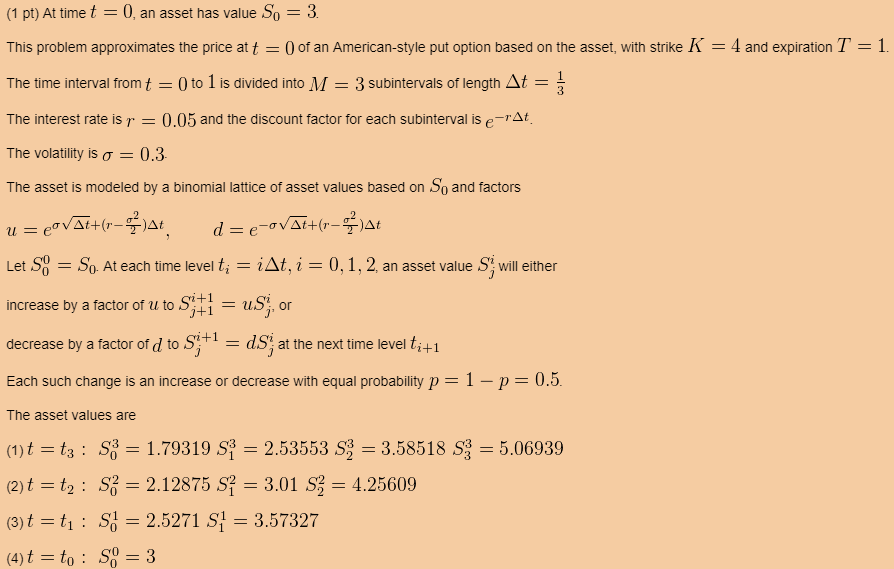

(1 pt) At timet0, an asset has value So 3 This problem approximates the price at t 0 of an American-style put option based on the asset, with strike K = 4 and expiration T-1 The time interval from t 0 to 1 is divided into M-3 subintervals of length The interest rate is r- 0.05 and the discount factor for each subinterval is e-At The volatility is ? 0.3 The asset is modeled by a binomial lattice of asset values based on So and factors 3 Let S:-S0 At each time level ti ???.-0, 1, 2, an asset value Sl will either increase by a factor of u to Sitl us.. or decrease by a factor of d dS Each such change is an increase or decrease with equal probability pI-p- The asset values are (1t t3 S3 1.79319 S 2.53553 S 3.58518 S 5.06939 (2)t t2 S3 2.12875 S? 3.01 S? 4.25609 (3) t-t1: S 2.5271 S1 3.57327 3" oSdS at the next time level 11+1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started