Answered step by step

Verified Expert Solution

Question

1 Approved Answer

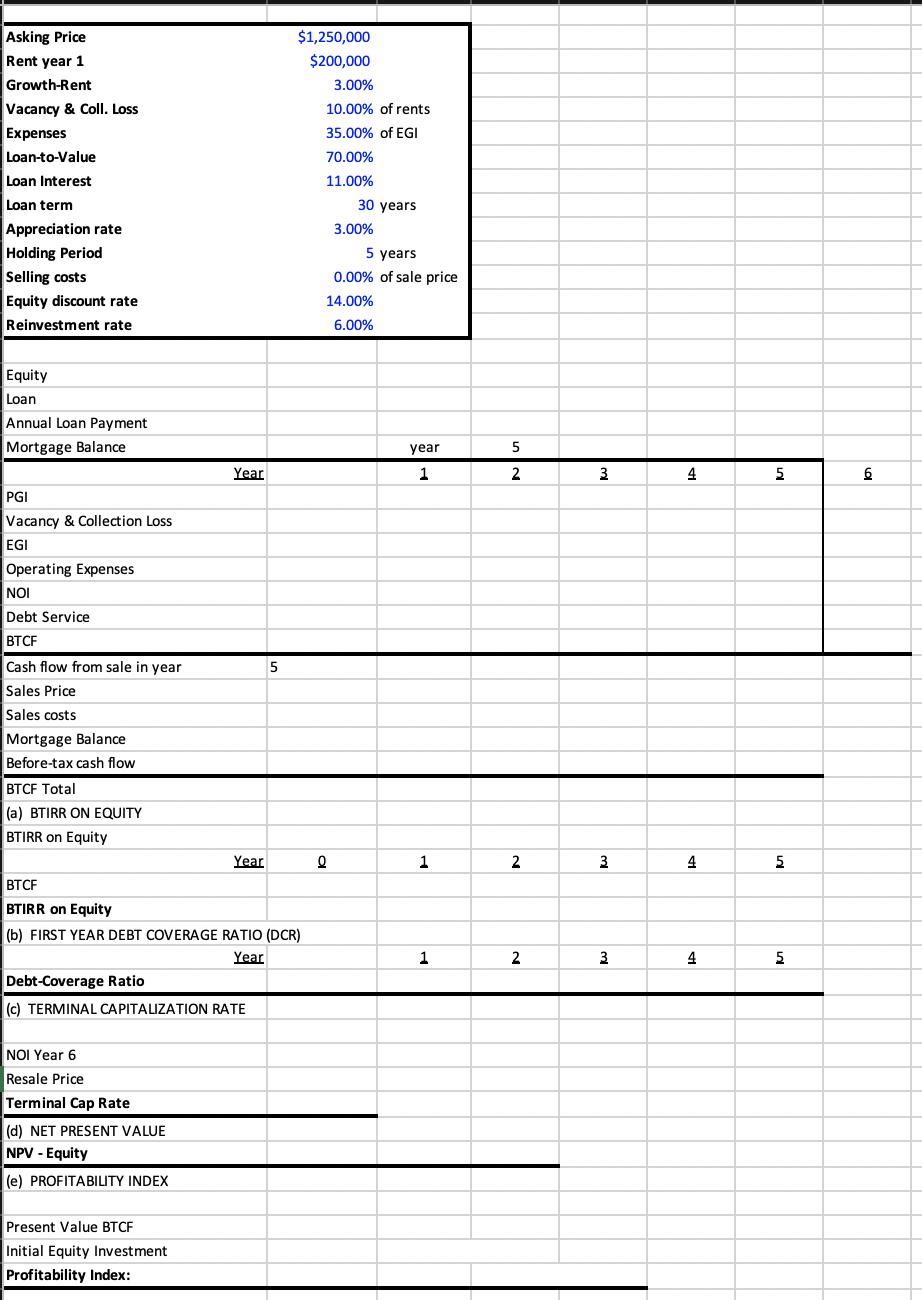

Solve the spreadsheet with the assumptions in the box at the top. Asking Price Rent year 1 Growth-Rent Vacancy & Coll. Loss Expenses Loan-to-Value Loan

Asking Price Rent year 1 Growth-Rent Vacancy & Coll. Loss Expenses Loan-to-Value Loan Interest Loan term Appreciation rate Holding Period Selling costs Equity discount rate Reinvestment rate Equity Loan Annual Loan Payment Mortgage Balance PGI Vacancy & Collection Loss EGI Operating Expenses NOI Debt Service BTCF Cash flow from sale in year Sales Price Sales costs Mortgage Balance Before-tax cash flow BTCF Total (a) BTIRR ON EQUITY BTIRR on Equity Year NOI Year 6 Resale Price Terminal Cap Rate (d) NET PRESENT VALUE NPV - Equity (e) PROFITABILITY INDEX Year Debt-Coverage Ratio (c) TERMINAL CAPITALIZATION RATE Present Value BTCF Initial Equity Investment Profitability Index: BTCF BTIRR on Equity (b) FIRST YEAR DEBT COVERAGE RATIO (DCR) Year 5 $1,250,000 $200,000 3.00% 10.00% of rents 35.00% of EGI 70.00% 11.00% 30 years Q 3.00% 5 years 0.00% of sale price 14.00% 6.00% year 1 1 1 5 2 2 2 3 3 100 4 stl 4 4 5 5 5 6

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Asking Price The asking price is 1250000 2 Rent Year 1 The rent in year 1 is 200000 3 GrowthRent The growth in rent is 300 annually 4 Vacancy Collection Loss The vacancy and collection loss i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started