Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the test please. 5) Definition: The difference the present value of the expected FCF (free cash flow) and the cost of the investment are

Solve the test please.

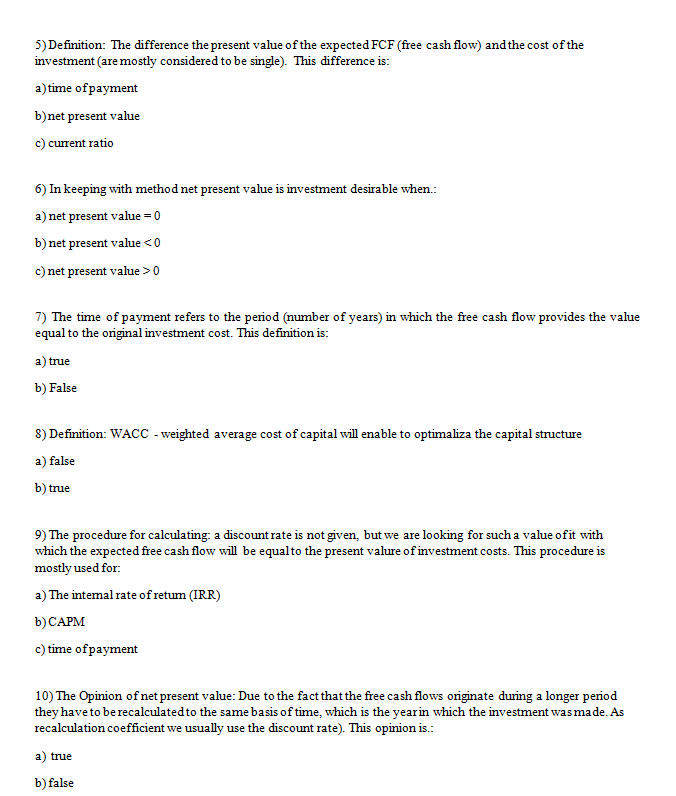

5) Definition: The difference the present value of the expected FCF (free cash flow) and the cost of the investment are mostly considered to be single). This difference is: a) time of payment b)net present value c) current ratio 6) In keeping with method net present value is investment desirable when: a) net present value = 0 b) net present value 7) The time of payment refers to the period (number of years) in which the free cash flow provides the value equal to the original investment cost. This definition is: a) true b) False 8) Definition: WACC - weighted average cost of capital will enable to optimaliza the capital structure a) false b) true 9) The procedure for calculating a discount rate is not given, but we are looking for such a value ofit with which the expected free cash flow will be equalto the present valure of investment costs. This procedure is mostly used for: a) The intemal rate of retum (IRR) b) CAPM c) time of payment 10) The Opinion of net present value: Due to the fact that the free cash flows originate during a longer period they have to be recalculated to the same basis of time, which is the yearin which the investment was made. As recalculation coefficient we usually use the discount rate). This opinion is.: a) true b) falseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started