solve the three parts please.

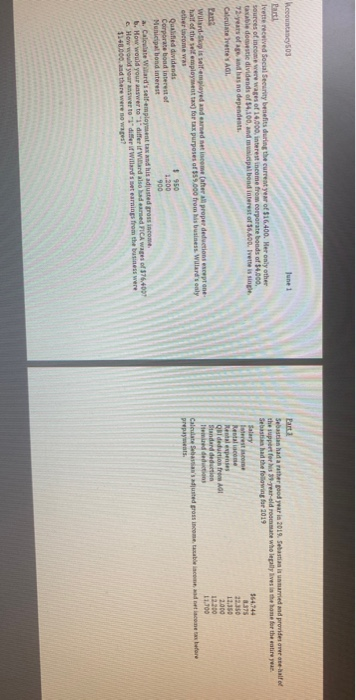

coountancy503 June 1 Patti Ivette received Social Security benefits during the current year of $16,400. Her only other sources of income were wages of 14,000 interest income from corporate bonds of $4.000, taxable dosi dividends of 54,100, and municipal bond interest of 56.600. Tvette is single 72-year of whas no dependent Calle vette YAGI Part1 Sebastian hada na podyear in 2019. Sebastian is married and provider over at half of the support for a year old roommate wholepally lives in the home for the entire year Sebastid the following for1019 Salary Interest.com Metalice 23:30 11.15 QR deduction from Al 2.000 Standard deduction minded Calende gros con com come before prepayments expenses 12.000 12700 an Willard is self-employed and earned to her al proper deductions except one half of the wifemployment tax) for tax purposes of $59.000 from his business, Willard's only other income was Qualified dividends $950 Corporate bond interest of 1.200 Nunepal bond interest 900 a. Calowate Ward's self-employment and his adjusted gross income 6. How would your answer to differ if Ward also had earned PICA wages of 76,4001 c. How would your answer to differt Willard's earnings from the business were 1140.000. and there were no we? coountancy503 June 1 Patti Ivette received Social Security benefits during the current year of $16,400. Her only other sources of income were wages of 14,000 interest income from corporate bonds of $4.000, taxable dosi dividends of 54,100, and municipal bond interest of 56.600. Tvette is single 72-year of whas no dependent Calle vette YAGI Part1 Sebastian hada na podyear in 2019. Sebastian is married and provider over at half of the support for a year old roommate wholepally lives in the home for the entire year Sebastid the following for1019 Salary Interest.com Metalice 23:30 11.15 QR deduction from Al 2.000 Standard deduction minded Calende gros con com come before prepayments expenses 12.000 12700 an Willard is self-employed and earned to her al proper deductions except one half of the wifemployment tax) for tax purposes of $59.000 from his business, Willard's only other income was Qualified dividends $950 Corporate bond interest of 1.200 Nunepal bond interest 900 a. Calowate Ward's self-employment and his adjusted gross income 6. How would your answer to differ if Ward also had earned PICA wages of 76,4001 c. How would your answer to differt Willard's earnings from the business were 1140.000. and there were no we