solve these problems

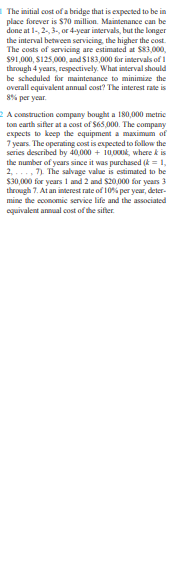

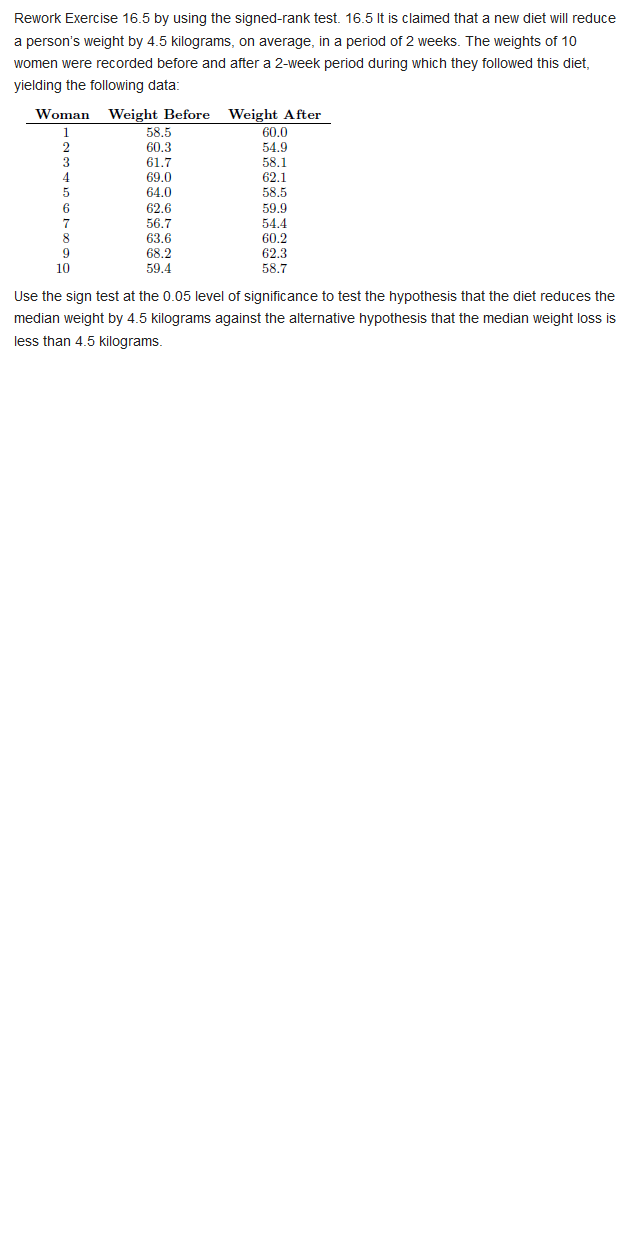

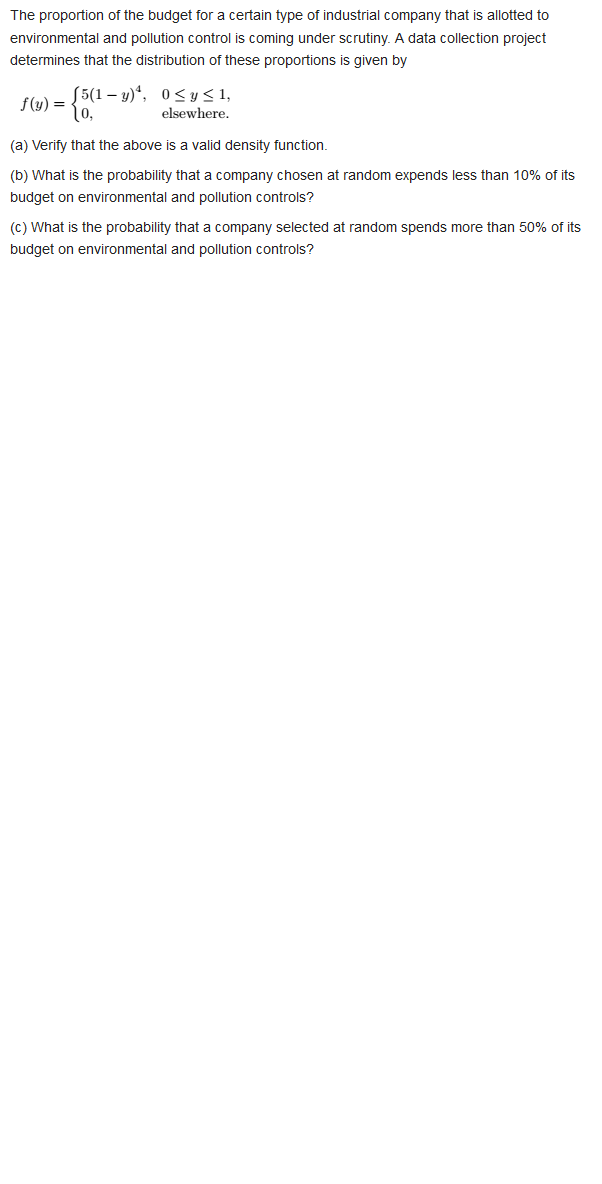

The initial cost of a bridge that is expected to be in place forever is $70 million. Maintenance can be done at I-, 2-, 3-, or 4-year intervals, but the longer the interval between servicing, the higher the cost. The costs of servicing are estimated at $83,000, $91,000, $125 000, and $183,000 for intervals of i through 4 years, respectively. What interval should be scheduled for maintenance to minimize the overall equivalent annual cost? The interest rate is 8%% per year. A construction company bought a 180,000 metric ton earth sifter at a cost of $65,000. The company expects to keep the equipment a maximum of 7 years. The operating cost is expected to follow the series described by 40,000 + mojoout, where & is the number of years since it was purchased (t = 1, 2, . . . . 7). The salvage value is estimated to be $30,000 for years I and 2 and $20 000 for years 3 through 7. At an interest rate of 10%% per year, deter- mine the economic service life and the associated equivalent annual cost of the sifter.A crashing machine that is a basic component of a metal recycling operation is wearing out faster than expected. The machine was purchased 2 years ago for $400,000. At that time, the buyer thought the machine would serve its needs for at least 5 years, at which time the machine would be sold to a smaller independent recycler for $30,000. Now, however, the company thinks the market value of the diminished machine is only $50,000. If it is kept, the machine's operating cost will be $37,000 per year for the next 2 years, after which it will be scrapped for $1000. If it is kept for only 1 year, the market value is estimated to be $10,000. Altema- tively, the company can of nice the process now for a fixed cost of $56,000 per year. At an interest rate of 10%% per year, should the company continue with the current machine or o arce the process? The data associated with operating and maintain- ing an asset are shown below. The company man- ager has already decided to keep the machine for I more year (ie., until the end of year 1), but you have been asked to determine the cost of keeping it more year after that. At an interest rate of 10% ber year, estimate the AW of keeping the machine from year I to year 2. Operating Cost. Year Market Value, $ $ per Year 30,000 -15,000 25,000 -15,000 14,000 -15,000 10,000 -15,000A machine that cost $120,000 three years ago can be sold now for $34,000. Its market value for the next 2 years is expected to be $40,000 and $20,000 one year and 2 years from now, respectively. Its operating cost was $18,000 for the first 3 years of its life, but the M&( cost is expected to be $23,000 for the next 2 years. A new improved ma- chine that can be purchased for $138,000 will have an economic life of 5 years, an operating cost of $9000 per year, and a salvage value of $32,000 after 5 years. At an interest rate of 10% per year, determine if the presently owned ma- chine should be replaced now, I year from now, or 2 years from now. The projected market value and MA( costs asso- ciated with a presently owned machine are shown (next page). An outside vendor of services has of- fered to provide the service of the existing ma- chine at a fixed price per year. If the presently owned machine is replaced now, the cost of the fixed-price contract will be $33,000 for each of the next 3 years. If the presently owned machine isA design-to-cost approach to product pricing in- the copper rehing volves determining the selling price of the product $12 million. The equipment and then figuring out if it can be made at a cost lower of 15 years with no salvage value. Its operating than that. Banner Engineering's QTSUR radar-based cost is represented by the relation ($2,600,000) sensor features frequency-modulated technology to where E is the efficiency of the metal re every op- accurately monitor or detect objects up to 15 miles eration (in decimal form). The amount of metal away while resisting main, wind, humidity, and ex- currently discharged is 2880 pounds per year prior treme temperatures. It has a list price of $589, and in recovery operations, and the efficiency of the variable cost of manufacturing the unit is $340. recovery is estimated at 71%. What must the (a) What could the company's fixed cost per average selling price per pound be for the pre- year be in order for Banner to break even cious metals that are recovered and sold in order with sales of 9000 units per year? for the company to break even at its MARR of (b) If Banner's fixed cost is actually $730,000 15% per year? per year, what is the profit at a sales level of 7000 units per year! Problems 13.4 through 13.7 are based on the following information. Handheld fiber-optic meters with white light po- larization interferometry are useful for measuring Hambry Enterprises produces a component for recycling temperature, press re, and strain in electrically uranium used as a nuclear fuel in power plant generators noisy environments. The fixed costs associated in France and the United States. Use the following cost with manufacturing are $800,000 per year. If a and revenue figures, quoted in U.S. dollars per hundred- base unit sells for $2950 and its variable cost is weight (ewt), recorded for this year to calculate the an- $2075, (a) how many units must be sold each year sowers for each plant. for breakeven and (b) what will the profit be for sales of 3000 units per year? Fixed Cost Revenue, Cast million per cut 5 pick cut A metallurgical engineer has estimated that the France 3.50 8 500 3,900 capital investment cost for recovering valuable United States 2 65 12 900 9,900\f\f\f\f\f