Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve this 1. NCC Corporation is considering building a new facility in Texas. To raise money for the capital projects, the corporation plans the following

solve this

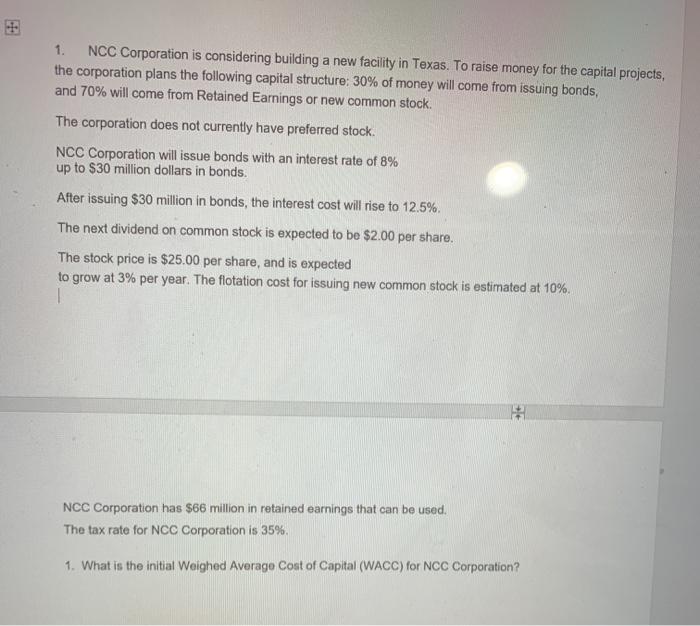

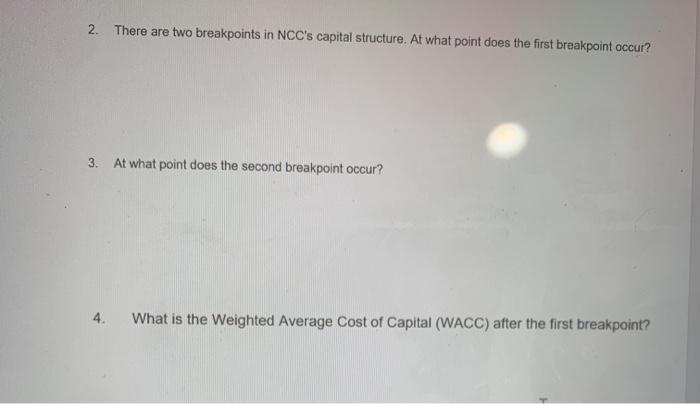

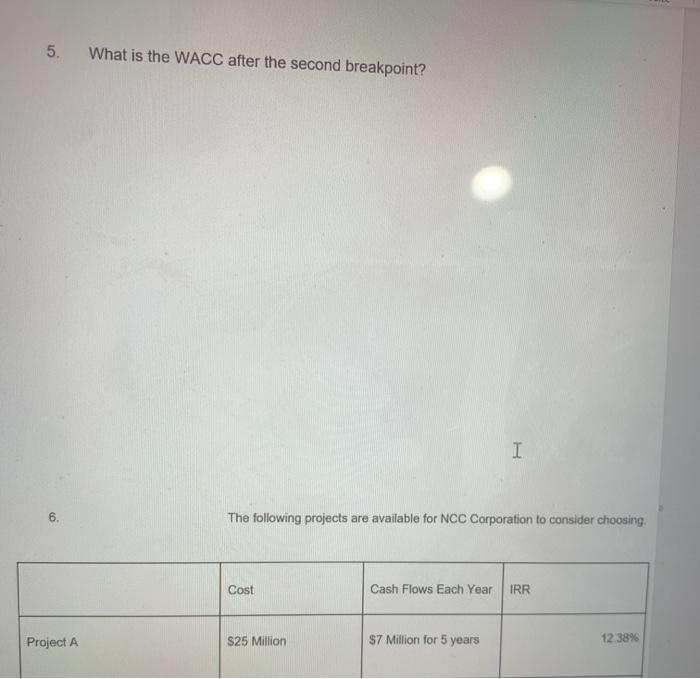

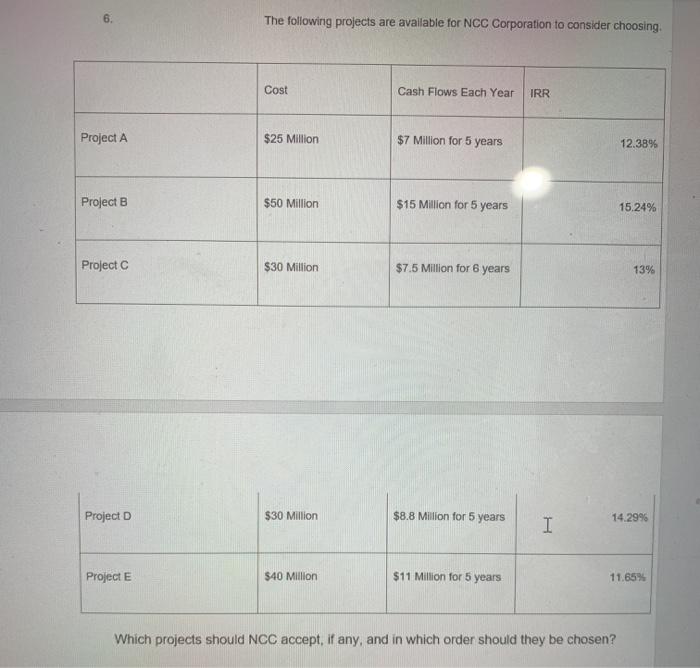

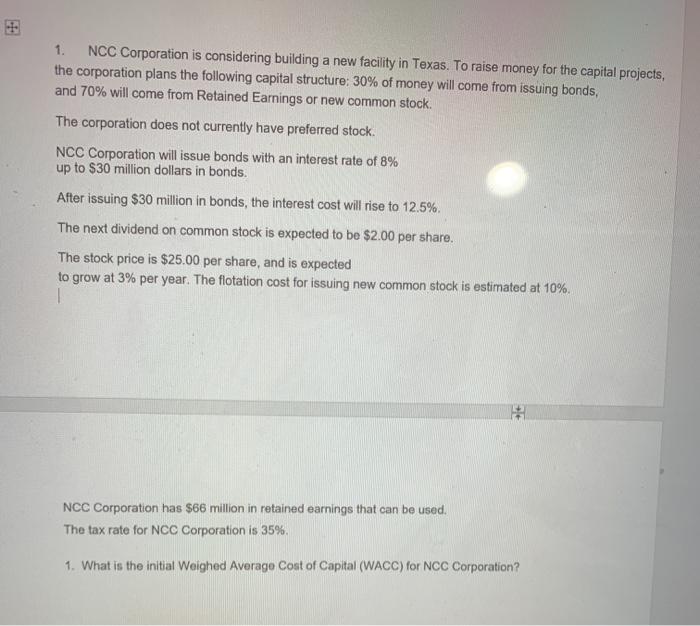

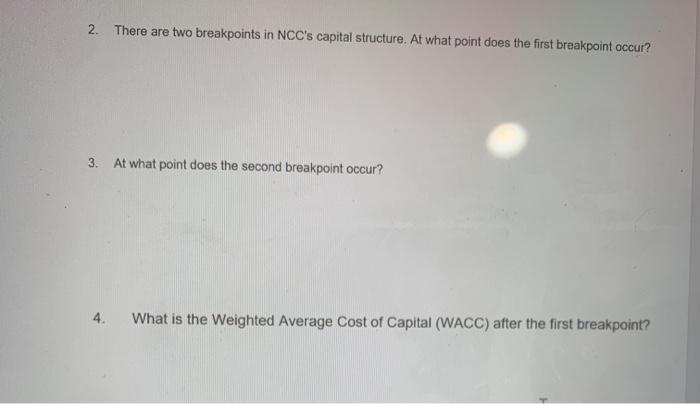

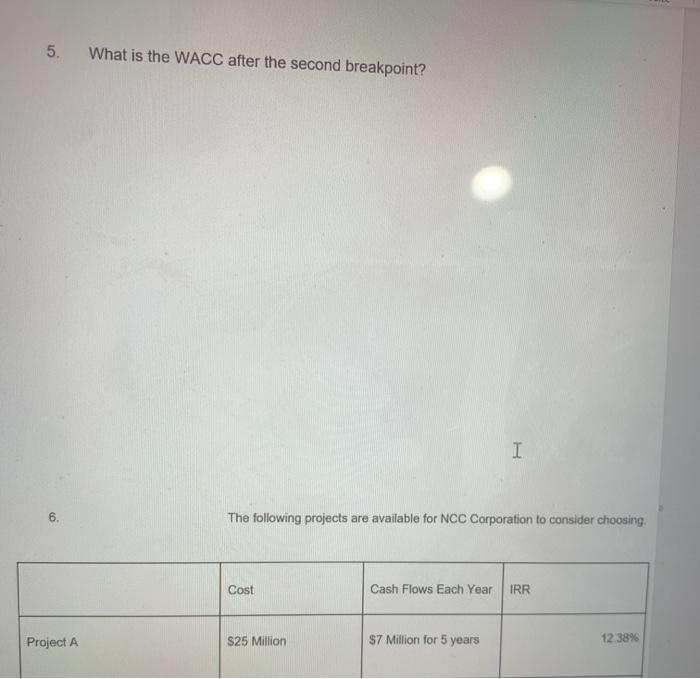

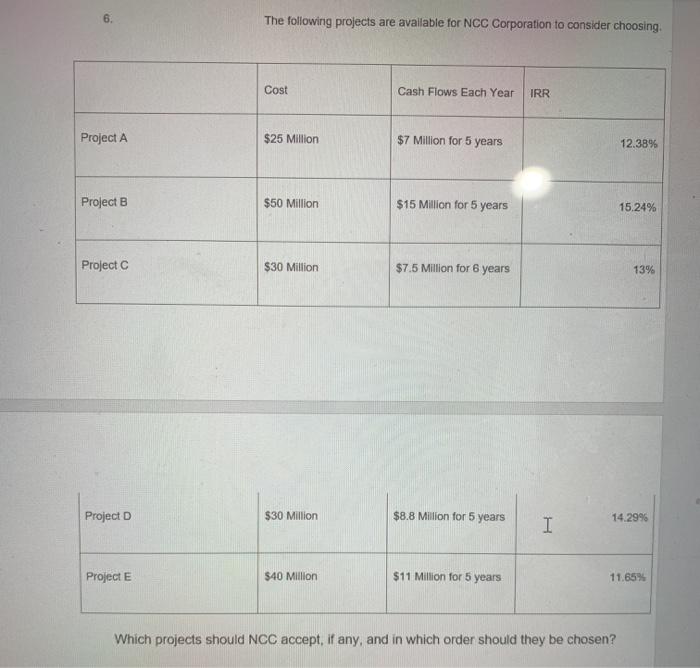

1. NCC Corporation is considering building a new facility in Texas. To raise money for the capital projects, the corporation plans the following capital structure: 30% of money will come from issuing bonds, and 70% will come from Retained Earnings or new common stock The corporation does not currently have preferred stock. NCC Corporation will issue bonds with an interest rate of 8% up to $30 million dollars in bonds, After issuing $30 million in bonds, the interest cost will rise to 12.5%. The next dividend on common stock is expected to be $2.00 per share. The stock price is $25.00 per share, and is expected to grow at 3% per year. The flotation cost for issuing new common stock is estimated at 10%. # NCC Corporation has $66 million in retained earnings that can be used. The tax rate for NCC Corporation is 35%. 1. What is the initial Weighed Average Cost of Capital (WACC) for NCC Corporation? 2. There are two breakpoints in NCC's capital structure. At what point does the first breakpoint occur? 3. At what point does the second breakpoint occur? 4. What is the Weighted Average Cost of Capital (WACC) after the first breakpoint? 5. What is the WACC after the second breakpoint? I 6. The following projects are available for NCC Corporation to consider choosing Cost Cash Flows Each Year IRR Project A S25 Million $7 Million for 5 years 12 3896 6. The following projects are available for NCC Corporation to consider choosing Cost Cash Flows Each Year IRR Project A $25 Million $7 Million for 5 years 12.38% Project B $50 Million $15 Million for 5 years 15.24% Project C $30 Million $7.5 Million for 6 years 13% Project D $30 Million $8.8 Million for 5 years 14.2996 I Project E $40 Million $11 Million for 5 years 11.65% Which projects should NCC accept, if any, and in which order should they be chosen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started