Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve this 4 question with using formula and Exhibit - 1 Question I (2 points) Refer to Exhibit 1. What is the firm's total assets

Solve this question with using formula and Exhibit

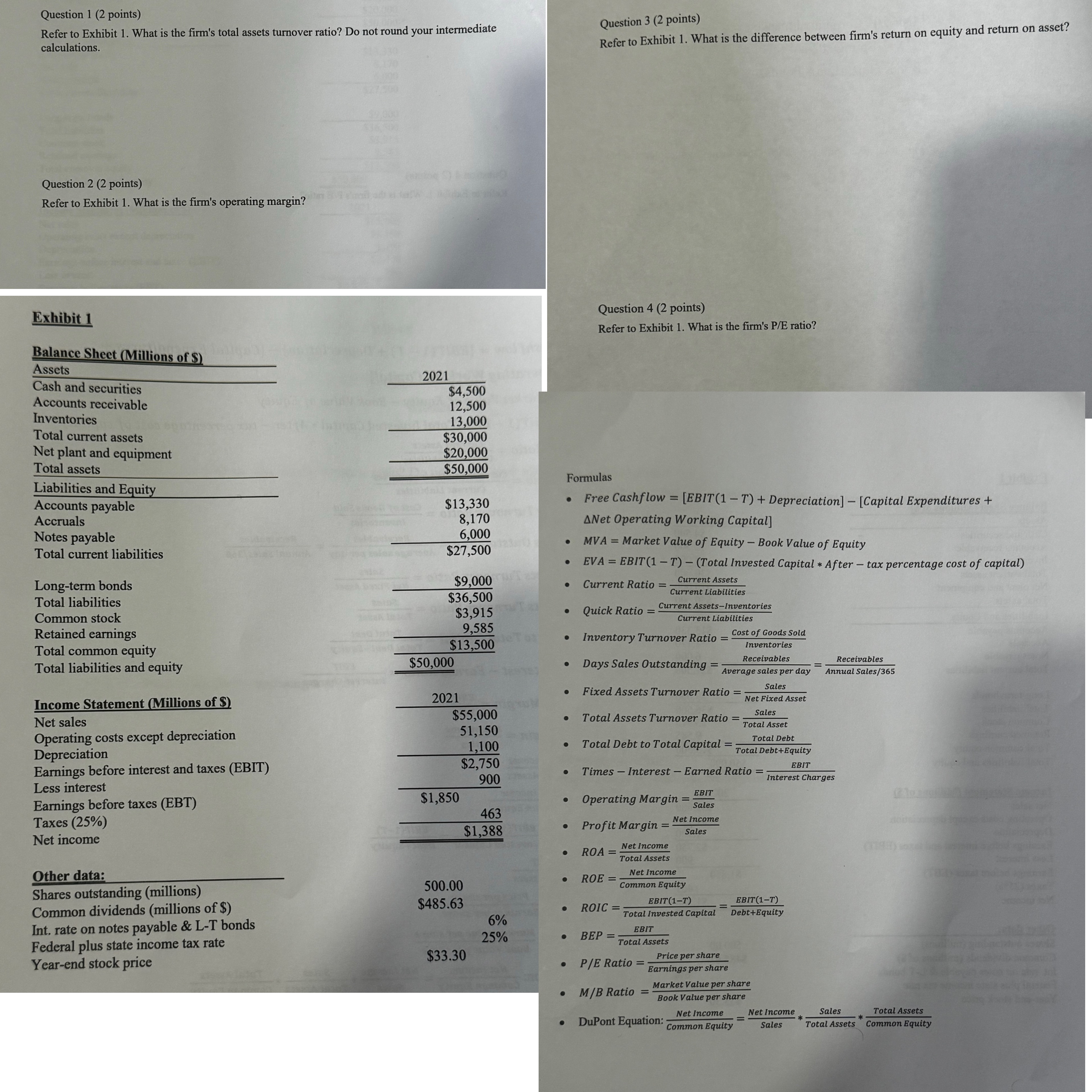

Question I (2 points) Refer to Exhibit 1. What is the firm's total assets turnover ratio? Do not round your intermediate calculations. Question 2 (2 points) Refer to Exhibit 1. What is the firm's operating margin? Exhibit 1 Balance Sheet illions of Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of S) Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes (25%) Net income Other data: Shares outstanding (millions) Common dividends (millions of $) Int. rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 2021 $4,500 12,500 13 ooo $30,000 $20 ooo $50,000 $13,330 8,170 6,000 $27,500 $9,000 $36,500 $3,915 9,585 $13,500 $50,000 2021 $55,000 51,150 1,100 $2,750 900 $1,850 463 $1,388 500.00 $485.63 6% $33.30 Question 3 (2 points) Refer to Exhibit 1. What is the difference between firm's return on equity and return on asset? Question 4 (2 points) Refer to Exhibit 1. What is the firm's PIE ratio? Formulas Free Cashflow = [EBIT(I T) + Depreciation] [Capital Expenditures + ANet Operating Working Capital] MVA = Market Value of Equity Book Value of Equity EVA = EBIT(I T) (Total Invested Capital * After tax percentage cost of capital) Current Assets Current Ratio = Current Liabilities Current Assetsinventories Quick Ratio = Current Liabilities Inventory Turnover Ratio = Cost of Goods Sold Days Sales Outstanding = Inventories Receivables Average sales per day Fixed Assets Turnover Ratio = Sales Net Fixed Asset Total Assets Turnover Ratio = Sales Total Asset Total Debt Total Debt to Total Capital = Total Debt+Equity Times Interest Earned Ratio = EBIT Receivables Annual Sales/365 Interest Charges EBIT Operating Margin = Sales Net Income Profit Margin = Sales Net Income ROA = Total Assets Net Income ROE = Common Equity EBIT(I-T) ROIC = EBIT(I-T) Total Invested Capital Debt+Equity EBIT BEP = Total Assets Price per share P/E Ratio = Earnings per share Market Value per share M/B Ratio = Book Value per share Net Income Net Income Sales Total Assets DuPont Equation: Common Equity Sales Total Assets Common Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started