Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve this one i am uploading same question for the third time 1. Suppose you are working as a treasurer in Citibank and your bank

solve this one i am uploading same question for the third time

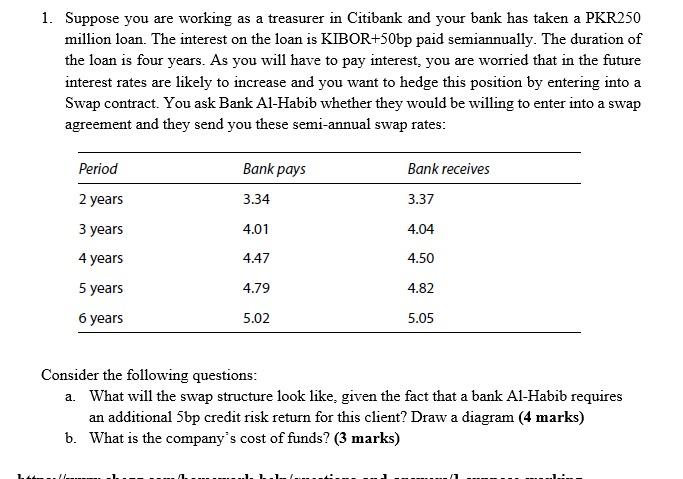

1. Suppose you are working as a treasurer in Citibank and your bank has taken a PKR250 million loan. The interest on the loan is KIBOR+50bp paid semiannually. The duration of the loan is four years. As you will have to pay interest, you are worried that in the future interest rates are likely to increase and you want to hedge this position by entering into a Swap contract. You ask Bank Al-Habib whether they would be willing to enter into a swap agreement and they send you these semi-annual swap rates: Period Bank pays Bank receives 2 years 3.34 3.37 4.01 4.04 4.47 4.50 3 years 4 years 5 years 6 years 4.79 4.82 5.02 5.05 Consider the following questions: a. What will the swap structure look like, given the fact that a bank Al-Habib requires an additional 5bp credit risk return for this client? Draw a diagram (4 marks) b. What is the company's cost of funds? (3 marks) 1. Suppose you are working as a treasurer in Citibank and your bank has taken a PKR250 million loan. The interest on the loan is KIBOR+50bp paid semiannually. The duration of the loan is four years. As you will have to pay interest, you are worried that in the future interest rates are likely to increase and you want to hedge this position by entering into a Swap contract. You ask Bank Al-Habib whether they would be willing to enter into a swap agreement and they send you these semi-annual swap rates: Period Bank pays Bank receives 2 years 3.34 3.37 4.01 4.04 4.47 4.50 3 years 4 years 5 years 6 years 4.79 4.82 5.02 5.05 Consider the following questions: a. What will the swap structure look like, given the fact that a bank Al-Habib requires an additional 5bp credit risk return for this client? Draw a diagram (4 marks) b. What is the company's cost of fundsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started