solve this !!!please i have to submit this at 6 pm

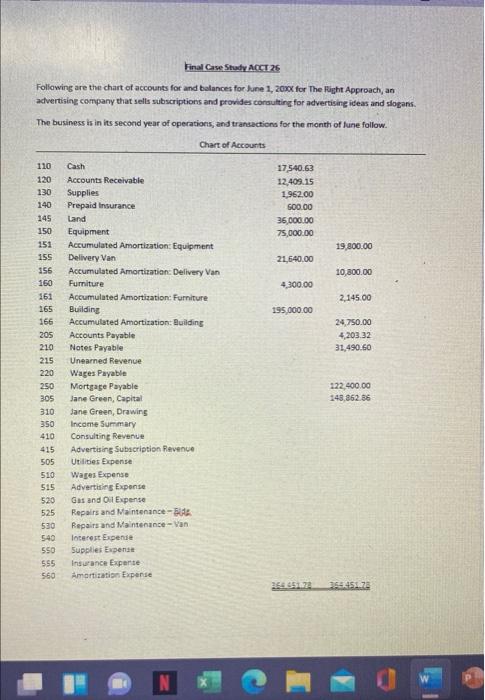

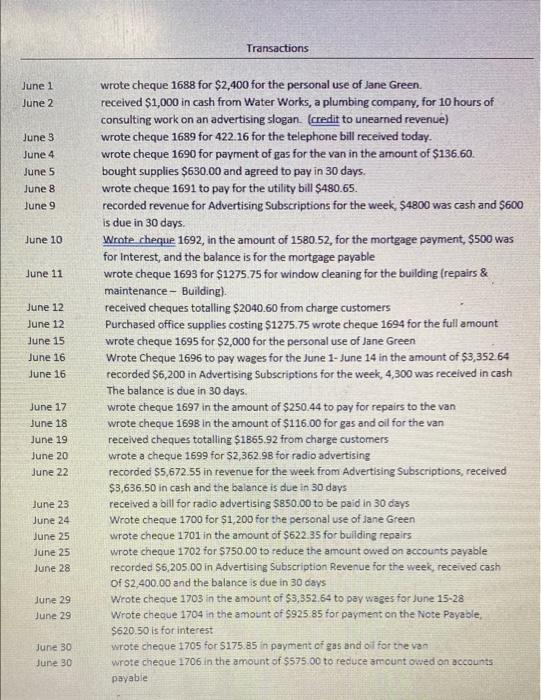

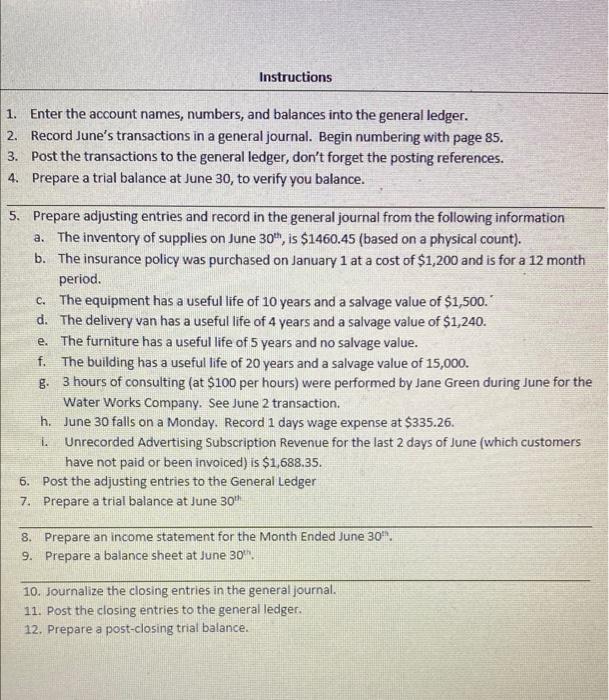

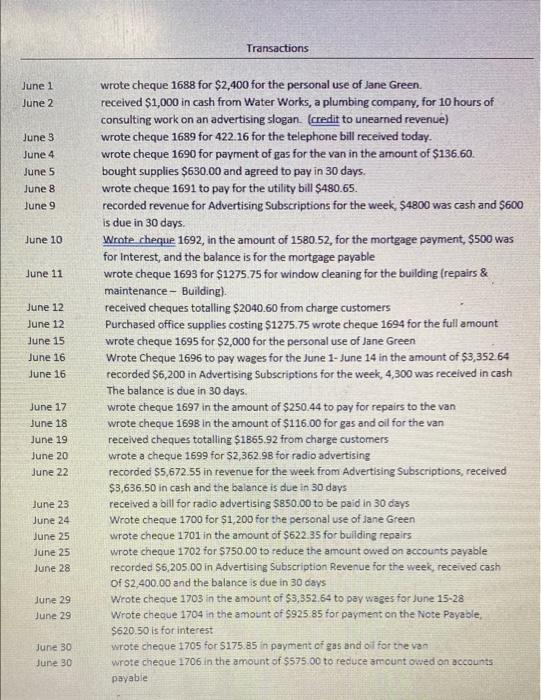

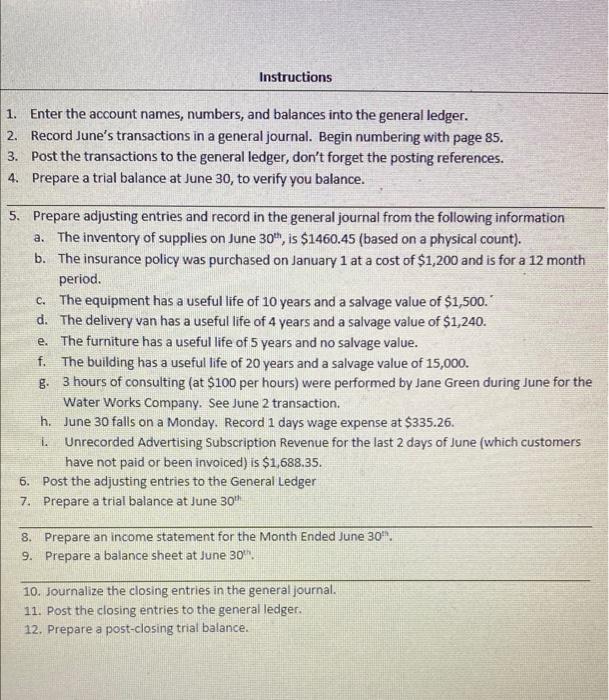

Final Case Study ACC 26 Following are the chart of accounts for and balances for June 1, 20XX for The Right Approach, an advertising company that sells subscriptions and provides consulting for advertising ideas and slogans. The business is in its second year of operations, and transactions for the month of June follow. Chart of Accounts 110 120 130 140 145 17540.63 12,409.15 1,962.00 500.00 36000.00 75,000.00 151 155 19,800.00 21.640.00 156 10,800.00 4,300.00 2,145.00 195,000.00 24,750.00 4,203.32 31,490.50 Cash Accounts Receivable Supplies Prepaid Insurance Land Equipment Accumulated Amortization Equipment Delivery Van Accumulated Amortization Delivery Van Furniture Accumulated Amortization Furniture Building Accumulated Amortization Building Accounts Payable Notes Payable Unearned Revenue Wages Payable Mortgage Payable Jane Green Capital Jane Green, Drawing Income Summary Consulting Revenue Advertising Subscription Revenue Utilities Expense Wages Expense Advertising Expense Gas and Oil Expense Repairs and Maintenance - Repairs and Maintenance - Van Interest Expense Supplies Expense Insurance Experte Amortization Expanse 160 161 165 166 205 210 215 220 250 305 310 350 410 415 505 510 515 520 525 530 540 550 555 560 122,400.00 148,062.86 25435 355 45678 Transactions June 1 June 2 June 3 June 4 June 5 June 8 June 9 June 10 June 11 June 12 June 12 June 15 June 16 June 16 wrote cheque 1688 for $2,400 for the personal use of Jane Green received $1,000 in cash from Water Works, a plumbing company, for 10 hours of consulting work on an advertising slogan (credit to unearned revenue) wrote cheque 1689 for 422.16 for the telephone bill received today. wrote cheque 1690 for payment of gas for the van in the amount of $136.60. bought supplies $630.00 and agreed to pay in 30 days. wrote cheque 1691 to pay for the utility bill $480.65. recorded revenue for Advertising Subscriptions for the week $4800 was cash and $600 is due in 30 days Wrote cheque 1692, in the amount of 1580.52, for the mortgage payment, $500 was for Interest, and the balance is for the mortgage payable wrote cheque 1693 for $1275.75 for window cleaning for the building (repairs & maintenance - Building) received cheques totalling $2040.60 from charge customers Purchased office supplies costing $1275.75 wrote cheque 1694 for the full amount wrote cheque 1695 for $2,000 for the personal use of Jane Green Wrote Cheque 1696 to pay wages for the June 1- June 14 in the amount of $3,352.64 recorded 56,200 in Advertising Subscriptions for the week. 4,300 was received in cash The balance is due in 30 days. wrote cheque 1697 in the amount of $250.44 to pay for repairs to the van wrote cheque 1698 in the amount of $116.00 for gas and oil for the van received cheques totalling $1865.92 from charge customers wrote a cheque 1599 for S2,362 98 for radio advertising recorded 55,672.55 in revenue for the week from Advertising Subscriptions, received $3,636.50 in cash and the balance is due in 30 days received a bill for radio advertising $850.00 to be paid in 30 days Wrote cheque 1700 for $1,200 for the personal use of Jane Green wrote cheque 1701 in the amount of $622.35 for building repairs wrote cheque 1702 for $750.00 to reduce the amount owed on accounts payable recorded 55,205 00 in Advertising Subscription Revenue for the week, received cash of S2,400.00 and the balance is due in 30 days Wrote cheque 1703 in the amount of $3,352.64 to pay wages for June 15-28 Wrote cheque 1704 in the amount of $925 85 for payment on the Note Payable, $620.50 is for interest wrote cheque 1705 for $175.85 in payment of gas and out for the van wrote cheque 1706 in the amount of $575.00 to reduce amount owed on accounts payable June 17 June 18 June 19 June 20 June 22 June 23 June 24 June 25 June 25 June 28 June 29 June 29 June 30 June 30 Instructions 1. Enter the account names, numbers, and balances into the general ledger. 2. Record June's transactions in a general journal. Begin numbering with page 85. 3. Post the transactions to the general ledger, don't forget the posting references. 4. Prepare a trial balance at June 30, to verify you balance. 5. Prepare adjusting entries and record in the general journal from the following information a. The inventory of supplies on June 30th, is $1460.45 (based on a physical count). b. The insurance policy was purchased on January 1 at a cost of $1,200 and is for a 12 month period. C. The equipment has a useful life of 10 years and a salvage value of $1,500." d. The delivery van has a useful life of 4 years and a salvage value of $1,240. e. The furniture has a useful life of 5 years and no salvage value. f. The building has a useful life of 20 years and a salvage value of 15,000. g. 3 hours of consulting (at $100 per hours) were performed by Jane Green during June for the Water Works Company. See June 2 transaction. h. June 30 falls on a Monday. Record 1 days wage expense at $335.26. 1 Unrecorded Advertising Subscription Revenue for the last 2 days of June (which customers have not paid or been invoiced) is $1,688.35. 6. Post the adjusting entries to the General Ledger 7. Prepare a trial balance at June 30 8. Prepare an income statement for the Month Ended June 30. 9. Prepare a balance sheet at June 30 10. Journalize the closing entries in the general journal. 11. Post the closing entries to the general ledger. 12. Prepare a post-closing trial balance. Final Case Study ACC 26 Following are the chart of accounts for and balances for June 1, 20XX for The Right Approach, an advertising company that sells subscriptions and provides consulting for advertising ideas and slogans. The business is in its second year of operations, and transactions for the month of June follow. Chart of Accounts 110 120 130 140 145 17540.63 12,409.15 1,962.00 500.00 36000.00 75,000.00 151 155 19,800.00 21.640.00 156 10,800.00 4,300.00 2,145.00 195,000.00 24,750.00 4,203.32 31,490.50 Cash Accounts Receivable Supplies Prepaid Insurance Land Equipment Accumulated Amortization Equipment Delivery Van Accumulated Amortization Delivery Van Furniture Accumulated Amortization Furniture Building Accumulated Amortization Building Accounts Payable Notes Payable Unearned Revenue Wages Payable Mortgage Payable Jane Green Capital Jane Green, Drawing Income Summary Consulting Revenue Advertising Subscription Revenue Utilities Expense Wages Expense Advertising Expense Gas and Oil Expense Repairs and Maintenance - Repairs and Maintenance - Van Interest Expense Supplies Expense Insurance Experte Amortization Expanse 160 161 165 166 205 210 215 220 250 305 310 350 410 415 505 510 515 520 525 530 540 550 555 560 122,400.00 148,062.86 25435 355 45678 Transactions June 1 June 2 June 3 June 4 June 5 June 8 June 9 June 10 June 11 June 12 June 12 June 15 June 16 June 16 wrote cheque 1688 for $2,400 for the personal use of Jane Green received $1,000 in cash from Water Works, a plumbing company, for 10 hours of consulting work on an advertising slogan (credit to unearned revenue) wrote cheque 1689 for 422.16 for the telephone bill received today. wrote cheque 1690 for payment of gas for the van in the amount of $136.60. bought supplies $630.00 and agreed to pay in 30 days. wrote cheque 1691 to pay for the utility bill $480.65. recorded revenue for Advertising Subscriptions for the week $4800 was cash and $600 is due in 30 days Wrote cheque 1692, in the amount of 1580.52, for the mortgage payment, $500 was for Interest, and the balance is for the mortgage payable wrote cheque 1693 for $1275.75 for window cleaning for the building (repairs & maintenance - Building) received cheques totalling $2040.60 from charge customers Purchased office supplies costing $1275.75 wrote cheque 1694 for the full amount wrote cheque 1695 for $2,000 for the personal use of Jane Green Wrote Cheque 1696 to pay wages for the June 1- June 14 in the amount of $3,352.64 recorded 56,200 in Advertising Subscriptions for the week. 4,300 was received in cash The balance is due in 30 days. wrote cheque 1697 in the amount of $250.44 to pay for repairs to the van wrote cheque 1698 in the amount of $116.00 for gas and oil for the van received cheques totalling $1865.92 from charge customers wrote a cheque 1599 for S2,362 98 for radio advertising recorded 55,672.55 in revenue for the week from Advertising Subscriptions, received $3,636.50 in cash and the balance is due in 30 days received a bill for radio advertising $850.00 to be paid in 30 days Wrote cheque 1700 for $1,200 for the personal use of Jane Green wrote cheque 1701 in the amount of $622.35 for building repairs wrote cheque 1702 for $750.00 to reduce the amount owed on accounts payable recorded 55,205 00 in Advertising Subscription Revenue for the week, received cash of S2,400.00 and the balance is due in 30 days Wrote cheque 1703 in the amount of $3,352.64 to pay wages for June 15-28 Wrote cheque 1704 in the amount of $925 85 for payment on the Note Payable, $620.50 is for interest wrote cheque 1705 for $175.85 in payment of gas and out for the van wrote cheque 1706 in the amount of $575.00 to reduce amount owed on accounts payable June 17 June 18 June 19 June 20 June 22 June 23 June 24 June 25 June 25 June 28 June 29 June 29 June 30 June 30 Instructions 1. Enter the account names, numbers, and balances into the general ledger. 2. Record June's transactions in a general journal. Begin numbering with page 85. 3. Post the transactions to the general ledger, don't forget the posting references. 4. Prepare a trial balance at June 30, to verify you balance. 5. Prepare adjusting entries and record in the general journal from the following information a. The inventory of supplies on June 30th, is $1460.45 (based on a physical count). b. The insurance policy was purchased on January 1 at a cost of $1,200 and is for a 12 month period. C. The equipment has a useful life of 10 years and a salvage value of $1,500." d. The delivery van has a useful life of 4 years and a salvage value of $1,240. e. The furniture has a useful life of 5 years and no salvage value. f. The building has a useful life of 20 years and a salvage value of 15,000. g. 3 hours of consulting (at $100 per hours) were performed by Jane Green during June for the Water Works Company. See June 2 transaction. h. June 30 falls on a Monday. Record 1 days wage expense at $335.26. 1 Unrecorded Advertising Subscription Revenue for the last 2 days of June (which customers have not paid or been invoiced) is $1,688.35. 6. Post the adjusting entries to the General Ledger 7. Prepare a trial balance at June 30 8. Prepare an income statement for the Month Ended June 30. 9. Prepare a balance sheet at June 30 10. Journalize the closing entries in the general journal. 11. Post the closing entries to the general ledger. 12. Prepare a post-closing trial balance