Answered step by step

Verified Expert Solution

Question

1 Approved Answer

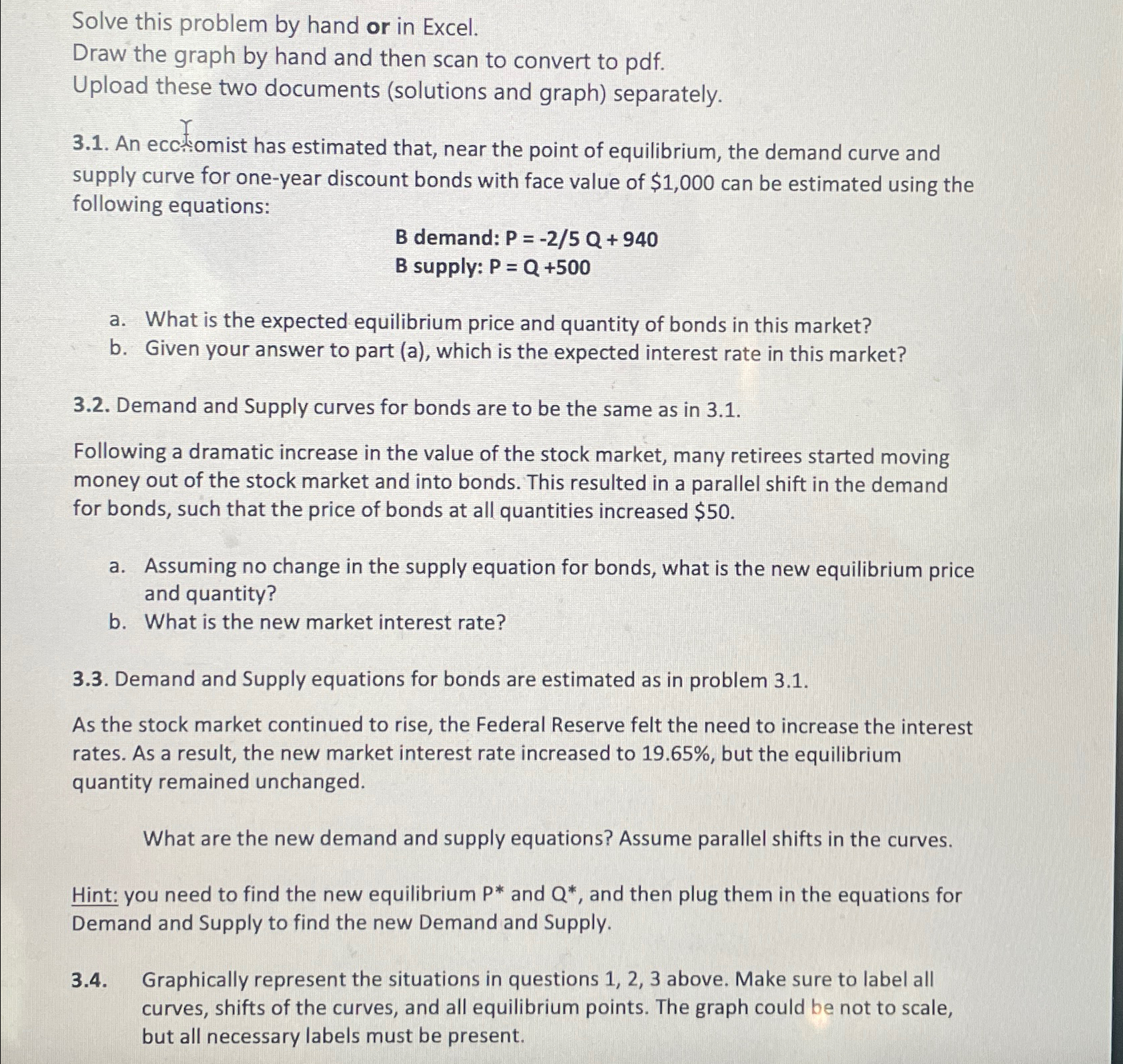

Solve this problem by hand or in Excel. Draw the graph by hand and then scan to convert to pdf . Upload these two documents

Solve this problem by hand or in Excel.

Draw the graph by hand and then scan to convert to pdf

Upload these two documents solutions and graph separately.

An ecciomist has estimated that, near the point of equilibrium, the demand curve and supply curve for oneyear discount bonds with face value of $ can be estimated using the following equations:

B demand:

B supply:

a What is the expected equilibrium price and quantity of bonds in this market?

b Given your answer to part a which is the expected interest rate in this market?

Demand and Supply curves for bonds are to be the same as in

Following a dramatic increase in the value of the stock market, many retirees started moving money out of the stock market and into bonds. This resulted in a parallel shift in the demand for bonds, such that the price of bonds at all quantities increased $

a Assuming no change in the supply equation for bonds, what is the new equilibrium price and quantity?

b What is the new market interest rate?

Demand and Supply equations for bonds are estimated as in problem

As the stock market continued to rise, the Federal Reserve felt the need to increase the interest rates. As a result, the new market interest rate increased to but the equilibrium quantity remained unchanged.

What are the new demand and supply equations? Assume parallel shifts in the curves.

Hint: you need to find the new equilibrium and and then plug them in the equations for Demand and Supply to find the new Demand and Supply.

Graphically represent the situations in questions above. Make sure to label all curves, shifts of the curves, and all equilibrium points. The graph could be not to scale, but all necessary labels must be present.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started