Question

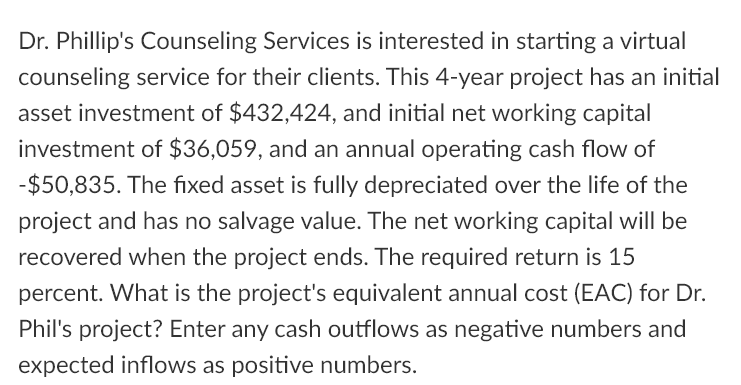

solve this problemDr. Phillip's Counseling Services is interested in starting a virtual counseling service for their clients. This 4-year project has an initial asset investment

solve this problemDr. Phillip's Counseling Services is interested in starting a virtual\ counseling service for their clients. This 4-year project has an initial\ asset investment of

$432,424, and initial net working capital\ investment of

$36,059, and an annul operating cash flow of\

-$50,835. The fixed asset is fully depreciated over the life of the\ project and has no salvage value. The net working capital will be\ recovered when the project ends. The required return is 15\ percent. What is the project's equivalent annual cost (EAC) for Dr.\ Phil's project? Enter any cash outflows as negative numbers and\ expected inflows as positive numbers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started