Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve this question in excel, using the project management skills 3) Stresla Truck Company is a small company that manufactures and sells electric pickup trucks.

Solve this question in excel, using the project management skills

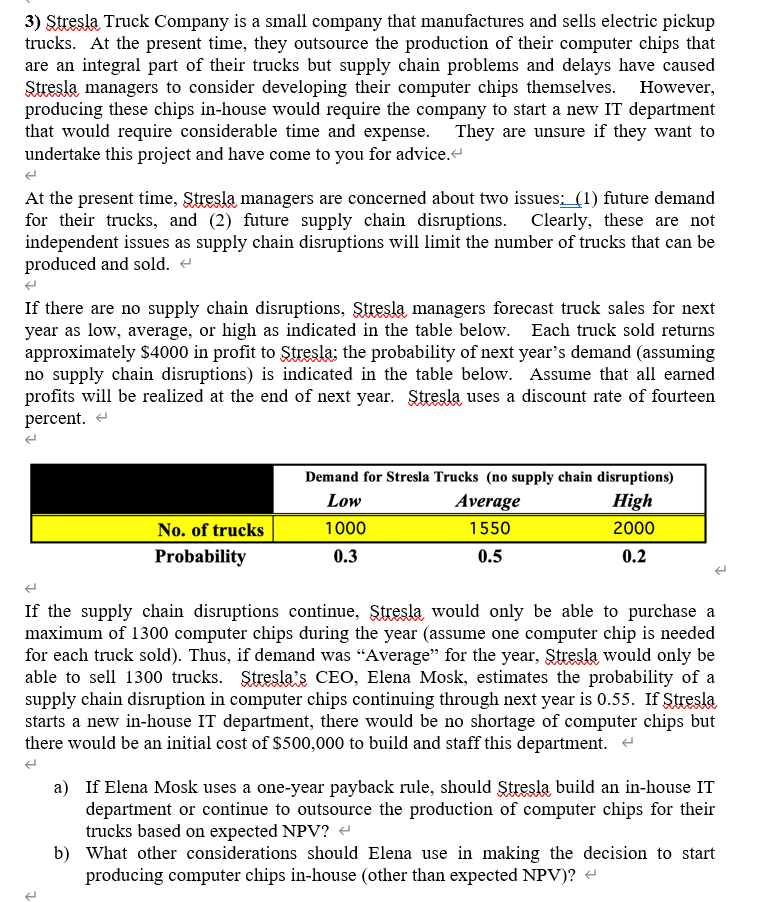

3) Stresla Truck Company is a small company that manufactures and sells electric pickup trucks. At the present time, they outsource the production of their computer chips that are an integral part of their trucks but supply chain problems and delays have caused Stresla managers to consider developing their computer chips themselves. However, producing these chips in-house would require the company to start a new IT department that would require considerable time and expense. They are unsure if they want to undertake this project and have come to you for advice. At the present time, Stresla managers are concerned about two issues: (1) future demand for their trucks, and (2) future supply chain disruptions. Clearly, these are not independent issues as supply chain disruptions will limit the number of trucks that can be produced and sold. If there are no supply chain disruptions, Stresla managers forecast truck sales for next year as low, average, or high as indicated in the table below. Each truck sold returns approximately $4000 in profit to Stresla; the probability of next year's demand (assuming no supply chain disruptions) is indicated in the table below. Assume that all earned profits will be realized at the end of next year. Stresla uses a discount rate of fourteen percent. If the supply chain disruptions continue, Stresla would only be able to purchase a maximum of 1300 computer chips during the year (assume one computer chip is needed for each truck sold). Thus, if demand was "Average" for the year, Stresla would only be able to sell 1300 trucks. Stresla's CEO, Elena Mosk, estimates the probability of a supply chain disruption in computer chips continuing through next year is 0.55 . If Stresla starts a new in-house IT department, there would be no shortage of computer chips but there would be an initial cost of $500,000 to build and staff this department. a) If Elena Mosk uses a one-year payback rule, should Stresla build an in-house IT department or continue to outsource the production of computer chips for their trucks based on expected NPV? b) What other considerations should Elena use in making the decision to start producing computer chips in-house (other than expected NPV)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started