Answered step by step

Verified Expert Solution

Question

1 Approved Answer

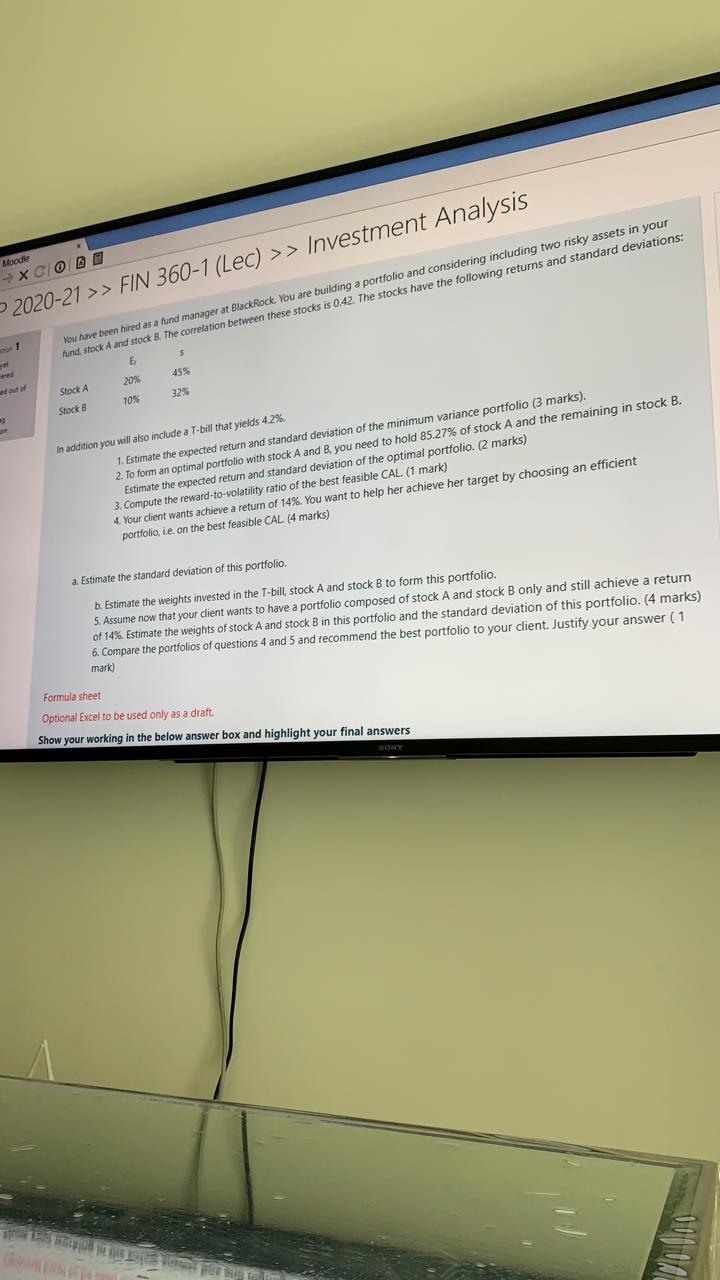

Solve this question Weedle XCIO OB - 2020-21 >> FIN 360-1 (Lec) >> Investment Analysis You have been hired as a fund manager BlackRock. You

Solve this question

Weedle XCIO OB - 2020-21 >> FIN 360-1 (Lec) >> Investment Analysis You have been hired as a fund manager BlackRock. You are building a portfolio and considering including two risky assets in your fund stock A and stock 8. The correlation between these stocks is 0.42. The stocks have the following returns and standard deviations: E Stock A 20 459 Stock 8 105 32% out of In addition you will also include a T-bill that yields 4.2% 1. Estimate the expected return and standard deviation of the minimum variance portfolio (3 marks). 2. To form an optimal portfolio with stock A and B, you need to hold 85.27% of stock A and the remaining in stock B. Estimate the expected return and standard deviation of the optimal portfolio. (2 marks) 3. Compute the reward-to-volatility ratio of the best feasible CAL (1 mark) 4. Your client wants achieve a return of 14%. You want to help her achieve her target by choosing an efficient portfolio, ie, on the best feasible CAL (4 marks) a. Estimate the standard deviation of this portfolio b. Estimate the weights invested in the T-bill, stock A and stock B to form this portfolio. 5. Assume now that your client wants to have a portfolio composed of stock A and stock B only and still achieve a return of 14%. Estimate the weights of stock A and stock B in this portfolio and the standard deviation of this portfolio. (4 marks) 6. Compare the portfolios of questions 4 and 5 and recommend the best portfolio to your client. Justify your answer (1 mark) Formula sheet Optional Excel to be used only as a draft. Show your working in the below answer box and highlight your final answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started