solve using formula equations and show work. Thanks

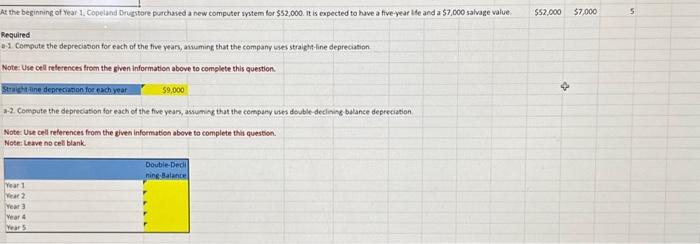

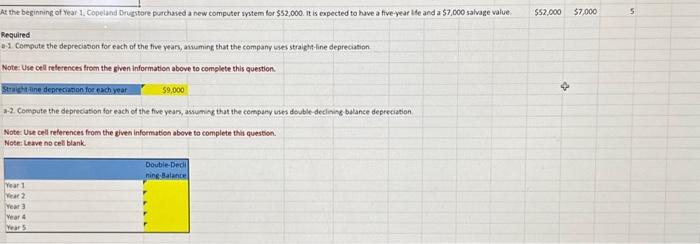

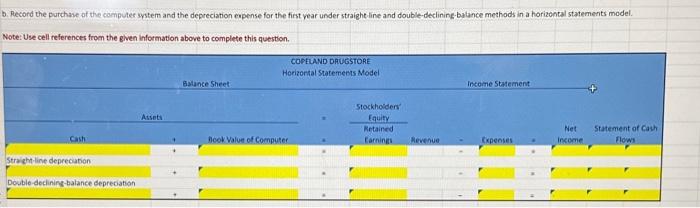

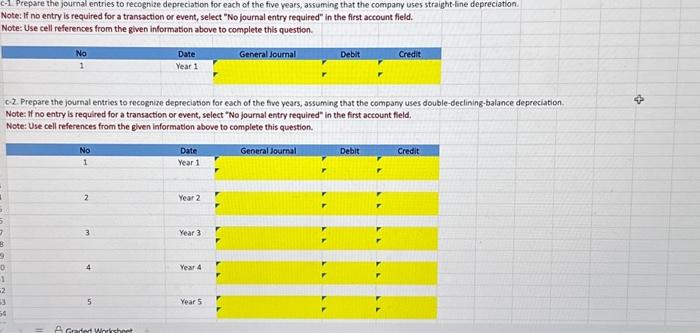

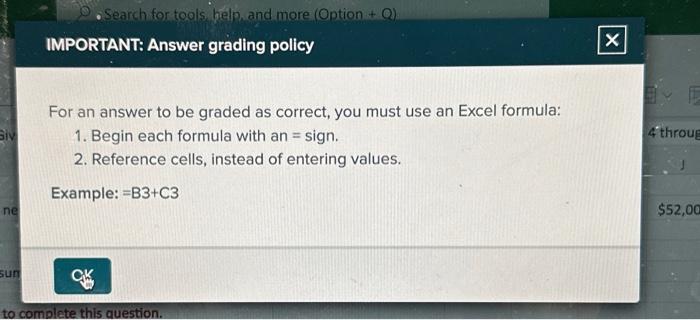

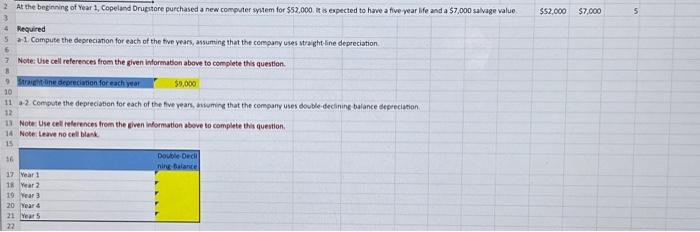

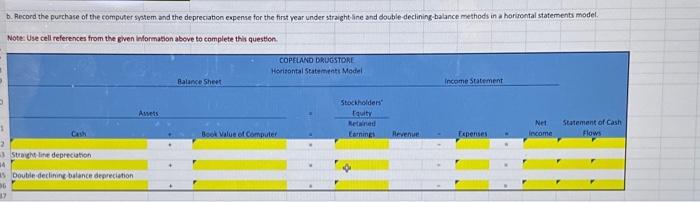

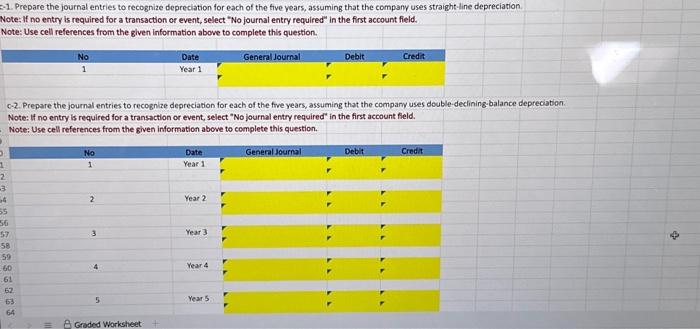

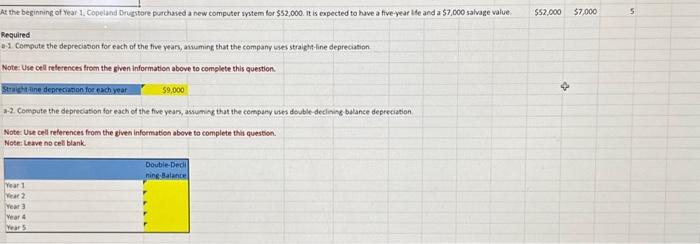

Record the purchase of the compules system and the depreciation expense for the first vear under straighe-line and double-declining-batance methods in a horizontal statements model. Note: Use cell references from the given information above to complete this question. For an answer to be graded as correct, you must use an Excel formula: 1. Begin each formula with an = sign. 2. Reference cells, instead of entering values. Example: =B3+C3 -1. Prepare the joumal entries to recognize depreciation for each of the five vears, assuming that the company uses straight-fine depreciation. Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. 0.2. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation. Note: if no entry is required for a transaction or event, select "No jocarnal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. b. Recond the purchase of the computer system and the deprecation expense for the first vear under straght line and double declining-balance methods in a horitontal statements model. Note: Use cell references from the given information above to complete this question. Required a-1. Compute the deprecisson for each of the five years, asuaming that the company uses stralgh-line deprecasion. Note: Use cell releiences from the given information above to complete this question. Note: Une cell references from the given infermation above to complete this question. Note: Leave no cell blank. 1. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. 0-2. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the compary uses double-declining balance depreciabion. Note: if no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. a-2. Conoute the depreciaben for each of the five vean, hivuming that the company uses double-declinine balance depreciapion Note Use cell relerences from the siven information above to complete this question. Note leave no cell blank. Record the purchase of the compules system and the depreciation expense for the first vear under straighe-line and double-declining-batance methods in a horizontal statements model. Note: Use cell references from the given information above to complete this question. For an answer to be graded as correct, you must use an Excel formula: 1. Begin each formula with an = sign. 2. Reference cells, instead of entering values. Example: =B3+C3 -1. Prepare the joumal entries to recognize depreciation for each of the five vears, assuming that the company uses straight-fine depreciation. Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. 0.2. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation. Note: if no entry is required for a transaction or event, select "No jocarnal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. b. Recond the purchase of the computer system and the deprecation expense for the first vear under straght line and double declining-balance methods in a horitontal statements model. Note: Use cell references from the given information above to complete this question. Required a-1. Compute the deprecisson for each of the five years, asuaming that the company uses stralgh-line deprecasion. Note: Use cell releiences from the given information above to complete this question. Note: Une cell references from the given infermation above to complete this question. Note: Leave no cell blank. 1. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. Note: If no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. 0-2. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the compary uses double-declining balance depreciabion. Note: if no entry is required for a transaction or event, select "No journal entry required" in the first account field. Note: Use cell references from the given information above to complete this question. a-2. Conoute the depreciaben for each of the five vean, hivuming that the company uses double-declinine balance depreciapion Note Use cell relerences from the siven information above to complete this question. Note leave no cell blank