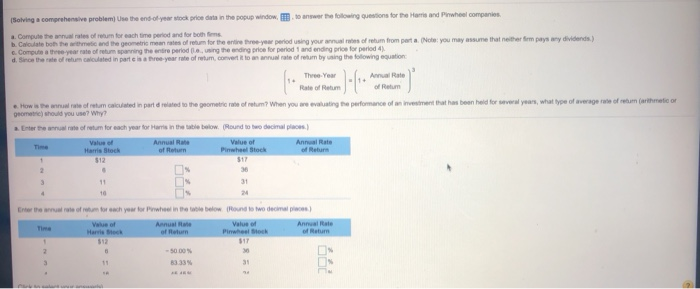

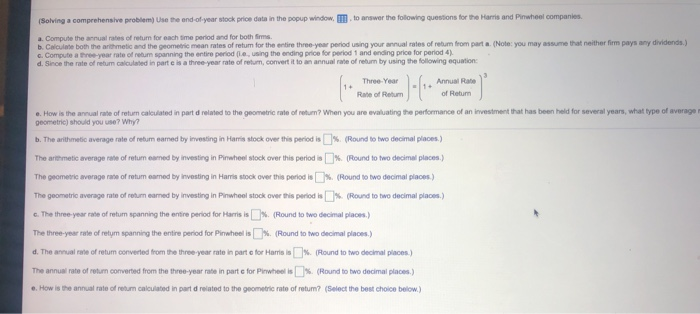

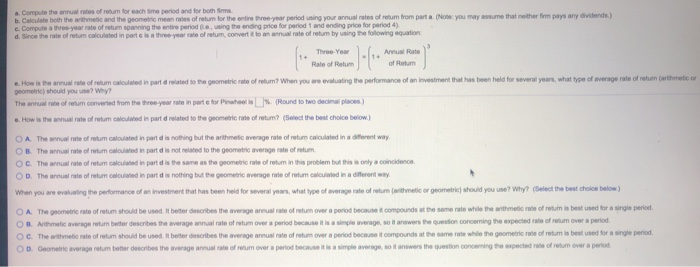

(Solving a comprehensive problem) Use the end-of-year stock price data in the popup window, to answer the folowling questions for the Harris and Pinwheel companies a. Compute the annual rates of retum for each time period and for both fms b. Caloulate both the arthmetic and the geometric mean rates of retum for the entire three-year period using your annual res of retum from part a (Note: you may assume that neither fm pays any dividends) c Compute a three-year rate of retum spanning the entre period Be, using the ending price for period 1 and ending price for period 4) d. Since the rate of rehum caloulated in part e is a three-year rate of retum, convert it to an annual rate of retum by using the folowing equation Annual Rate Three-Year 1+ Rate of Retum of Retum How is the annual rate of retum calculated in part d related to the geometric rate of retum? When you are evaluating the performance of an invesiment that has been held for several years, what type of average rate of retum (arithmetic or geometric) should you use? Why? a Enter the annual rate of retum for each year for Hams in the table below. (Round to beo decimal places ) Annual Rate of Return Annual Rate of Return Value of Pinwheel Stock Value of Time Harris Stock 1 $12 $17 36 2 31 3 1 24 10 4 Enter the annual rate of reum for each year for Pnwheel in the table below (Round to two decimal places Annual Rate of Return Value of Value of Harris Steck Annual Rate of Return Time Pinwhe Stock $12 $17 -50.00 % 30 6 1 83.33% 31 64 to answer the following questions for the Harris and Pinwheel companies (Solving a comprehensive problem) Use the ond-of-year stock price data in the popup window, T a. Compute the annual rates of retun for each tme period and for both Sms b. Calculate both the arthmetic and the geometric mean rates of retum for the entire three-year period using your annual rates of rebum from part a (Note: you may assume that neither firm pays any dividends.) c. Compute a three-year rate of returm spanning the entire period (Le, using the ending price for period 1 and ending price for period 4) d. Since the rate of retum calculated in part e is a three-year rate of return, convert it to an annual rate of returm by using the following equation: 3 Three-Year Annual Rate 1+ 1+ Rate of Retum of Retun e. How is the annual rate of retum caloulated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what type of average m geometric) should you use? Why? b. The arithmetic average rate of rebum eamed by investing in Haris stock over this period is%. (Round to two decimal places.) The arthmetic average rate of retum eamed by investing in Pinwheel stock over this period is % (Round to two decimal places) The geometric average rate of retum eamed by investing in Hamis stock over this period is%. (Round to two decimal places) The geometric average rate of return earmed by investing in Pinwheel stock over this period is% (Round to two decimal places.) eThe three-year rate of retum spanning the entire period for Hams is (Round to two decimal places) The three-year rate of retym spanning the entire period for Pinwheel is%. (Round to two decimal places.) d. The annual rate of retum converted from the three-year rate in part e for Harris is%. (Round to two deckimal places) The annual rate of retun comverted from the three-year rate in part c for Pinwheel is (Round to two decimal places) e. How is the annual rate of retun calculated in part d related to the geometric rate of retum? (Select the best choice below) a. Compute the annual rates of retum for each sme period and for both Sims b. Calculate both the arthmetic and the geometric mean rates of retum for the entire three-year period using your annual rates of retum from part a. (Note you may assume that neither fim pays any dividends) e. Compute a three-year rate of retun spanning the entire period (e, using the ending price for period 1 and ending price for period 4) d. Since the rate of retum caloulated in part e is a three-year rate of retum, convert to an annual rate of retum by using the folowing equation Three-Year Arnual Rate of Retum Rate of Retum e. How is the annual rate of relum caloulated in part d related to the geometric rate of rebum? When you are evaluating the performance of an investment that has been held for several years, what type of average rate of retum (arithmetic or geometric) shoud you use? Why The annuel rate of retum convered from the three-year rete in pert e for Pinwheel is % (Round to two decimal places) e. How is the annual rate of retum calculated in part d related to the geometric rate of retum? (Select the best choice below.) OA The annual rate of retum caloulated in part d is nothing but the arthmetic avenage rate of retum calculated in a diferent way. OB The annual rate of retum calouated in part d is not related to the geometric average rate of retum OC The annual rate of retum calcuated in part d is the same as the geometric rate of retum in this problem but this is only a coincidence OD. The annual rate of retum calculated in part d is nothing but the geometric avenage rate of retum calculated in a dferent way When you are evaluating the performance of an investment that has been held for several years, what type of average rate of return (arithmetic or geometric) should you use? Why? (Select the best cholce below) The geometric rate of retum should be used. It beter describes the average aneual rate of retum over a period because t compounds at the same rate while the anithmetic rate of retum is best used for a single period. OA OB. Arithmetic average retum beiter describes the average annual rate of retum over a period because it is a simple average, so it answers the quession conceming the expected rate of retum over a period The aithmetic rate of retum should be used It beter describes the average annual rate of retum over a period because it compounds at the same rate while the geometric rate of retum is best used for a single period OC OD. Geometric average retum better describes the average annual rate of reum over a period because it is a simple average, so it answers the question conceming the expected rate of retum over a period