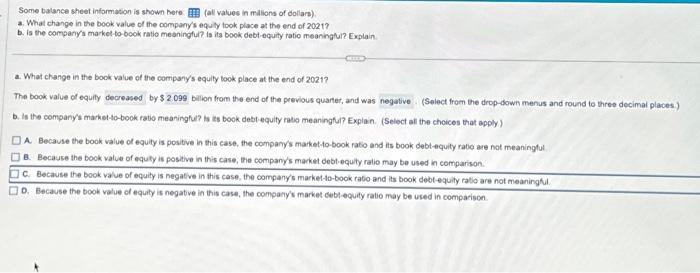

Some balance sheet informacion is shown here. (all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2021 ? b. is the company's market to-book ratio meaningtul? is its book dett-equity ratio meaninghi? Explain. a. What change in the book value of the company's equily look place at the end of 2021? The book value of equity by billion from the end of the previous quarter, and was (Select from the drop-down menus and round to three decimal places.) b. Is the company's marketto-book ratio meaninghu? is is book debt-equity ratso meaningtul? Explan. (Select at the choices that apply) A. Because the book value of equity is positive in this case, the companys market-to-book ratio and its book debt-equity rabo are not meaningtul B. Because the book value of equty is positive in this case, the company's macket debt-equity ratio may be used in comparison. C. Because the book value of equily is negative in this case, the companys market-to-book rato and its book debl-equity ratio are not meaninghil. D. Because the book value of equity is negative in this case, the company's market cebl-equity ratio may be used in compariscon. Some balance sheet informacion is shown here. (all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2021 ? b. is the company's market to-book ratio meaningtul? is its book dett-equity ratio meaninghi? Explain. a. What change in the book value of the company's equily look place at the end of 2021? The book value of equity by billion from the end of the previous quarter, and was (Select from the drop-down menus and round to three decimal places.) b. Is the company's marketto-book ratio meaninghu? is is book debt-equity ratso meaningtul? Explan. (Select at the choices that apply) A. Because the book value of equity is positive in this case, the companys market-to-book ratio and its book debt-equity rabo are not meaningtul B. Because the book value of equty is positive in this case, the company's macket debt-equity ratio may be used in comparison. C. Because the book value of equily is negative in this case, the companys market-to-book rato and its book debl-equity ratio are not meaninghil. D. Because the book value of equity is negative in this case, the company's market cebl-equity ratio may be used in compariscon