Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Some companies like Facebook Inc. have two stages of growth, a fast rate for the next few years and then a slower rate for

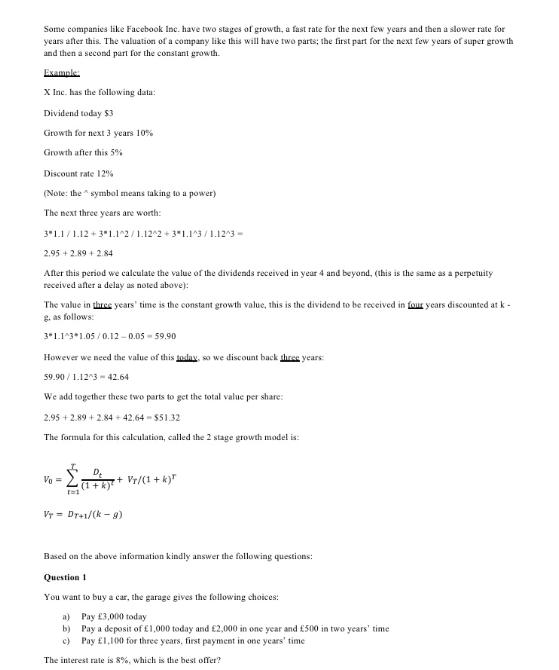

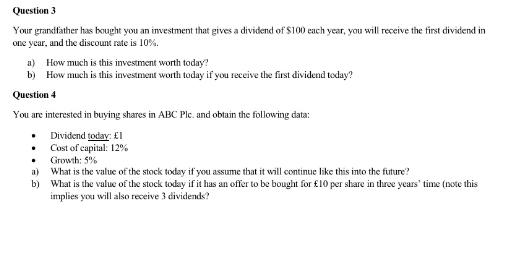

Some companies like Facebook Inc. have two stages of growth, a fast rate for the next few years and then a slower rate for years after this. The valuation of a company like this will have two parts; the first part for the next few years of super growth and then a second part for the constant growth. Example: X Inc. has the following data: Dividend today $3 Growth for next 3 years 10% Growth after this 5% Discount rate 12% (Note: the symbol means taking to a power) The next three years are worth: 31.1/1.12+3*1.1^2/1.12^2+3*1.1^3/1.12^3- 2.95 +2.89 +2.84 After this period we calculate the value of the dividends received in year 4 and beyond, (this is the same as a perpetuity received after a delay as noted above): The value in three years' time is the constant growth value, this is the dividend to be received in four years discounted at k- g. as follows: 3*1.1^3*1.05/0.12 -0.05-59.90 However we need the value of this today, so we discount back three years 59.90/1.12-3-42.64 We add together these two parts to get the total value per share: 2.95 +2.89 +2.84 +42.64-$51.32 The formula for this Vo = [1 D (1+A ion, + Vr/(1+k)" Vr Dr+1/(kg) the 2 stage growth is: Based on the above information kindly answer the following questions: Question 1 You want to buy a car, the garage gives the following choices: a) Pay 3,000 today b) Pay a deposit of 1,000 today and 2,000 in one year and 500 in two years' time c) Pay 1,100 for three years, first payment in one years' time The interest rate is 8%, which is the best offer? Question 3 Your grandfather has bought you an investment that gives a dividend of $100 each year, you will receive the first dividend in one year, and the discount rate is 10%. a) How much is this investment worth today? b) How much is this investment worth today if you receive the first dividend today? Question 4 You are interested in buying shares in ABC Plc. and obtain the following data: Dividend today: 1 Cost of capital: 12% . . a) b) Growth: 5% What is the value of the stock today if you assume that it will continue like this into the future? What is the value of the stock today if it has an offer to be bought for 10 per share in three years' time (note this implies you will also receive 3 dividends?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To determine the best offer among the given choices we need to calculate the present value of each option and compare them a Pay 3000 today The present value of this option is simply 3000 s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started