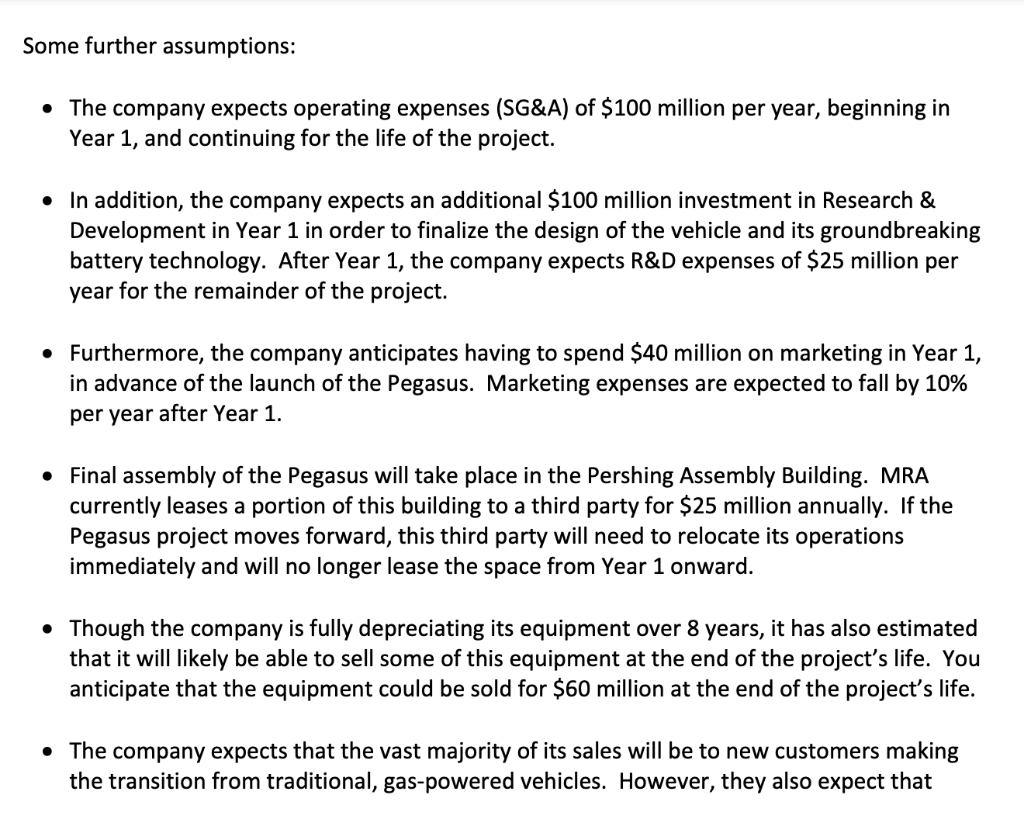

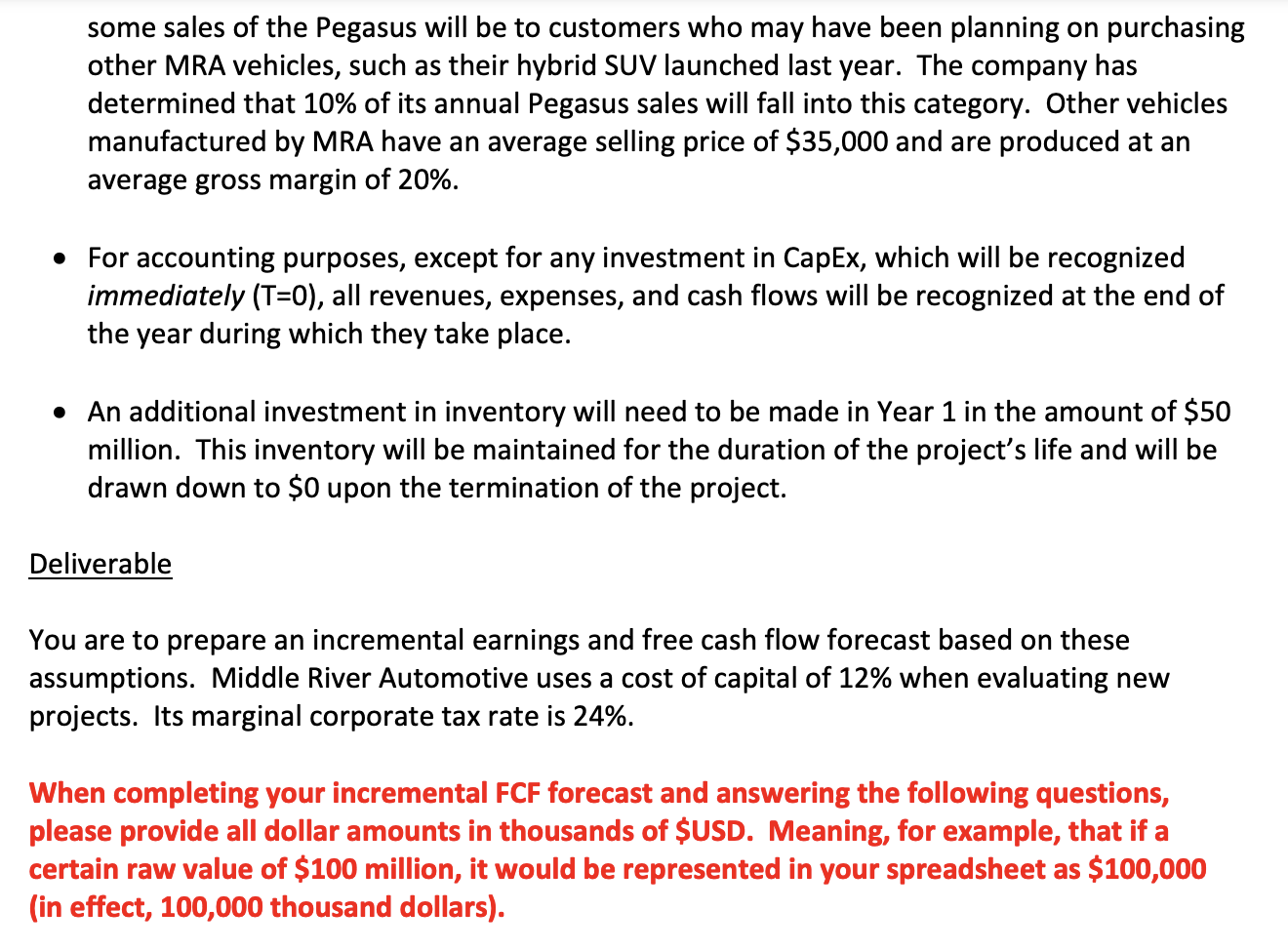

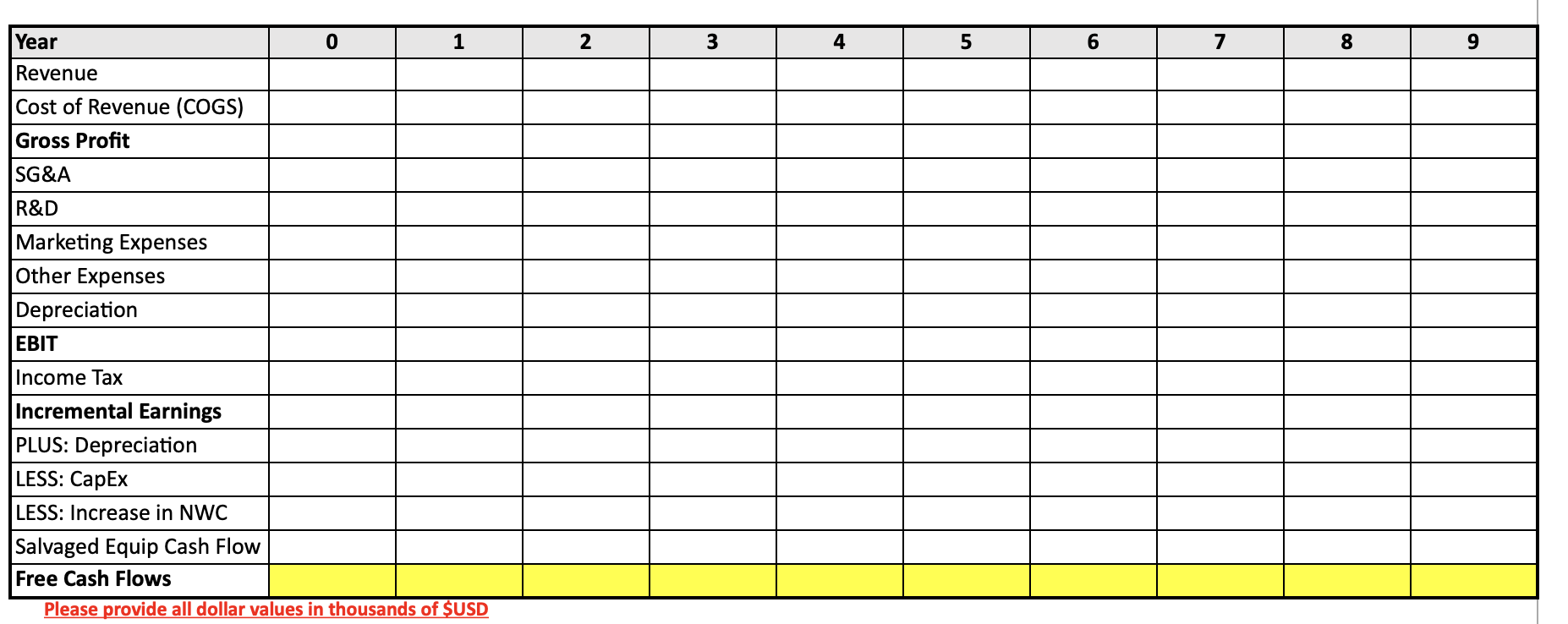

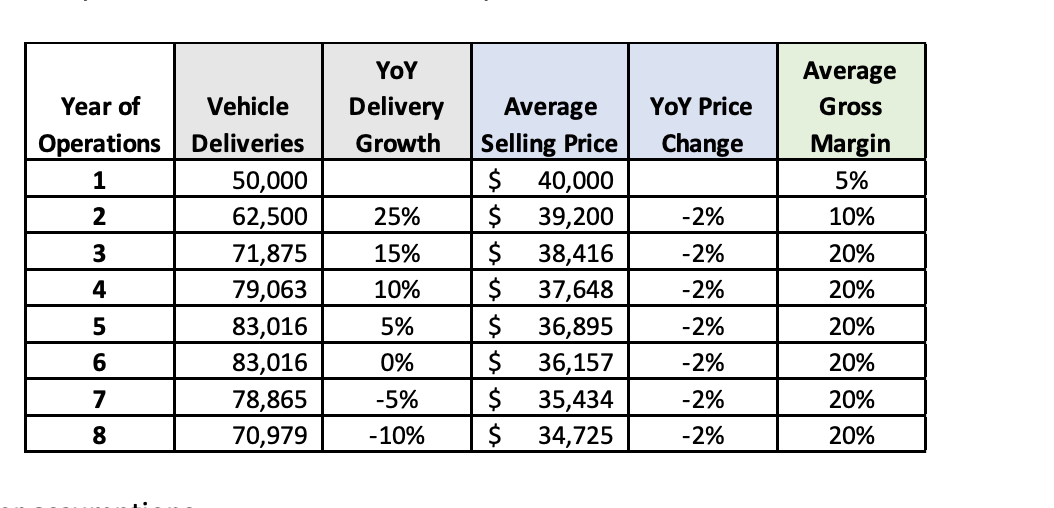

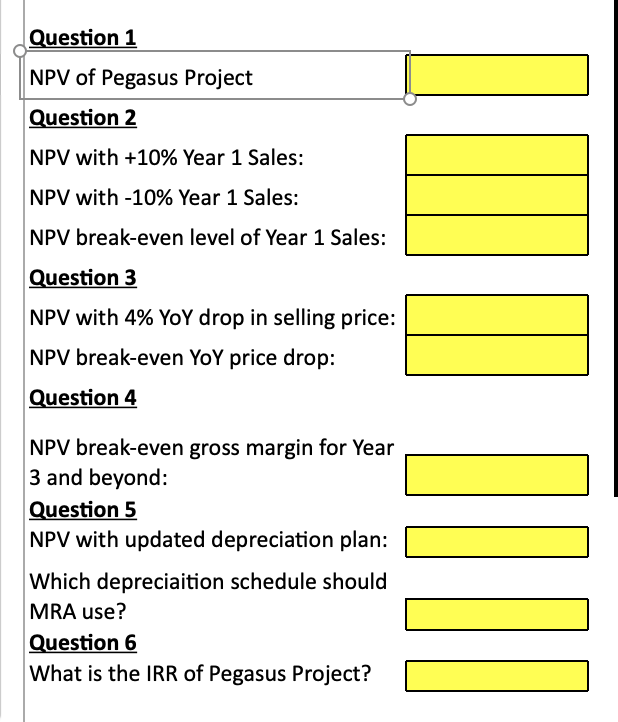

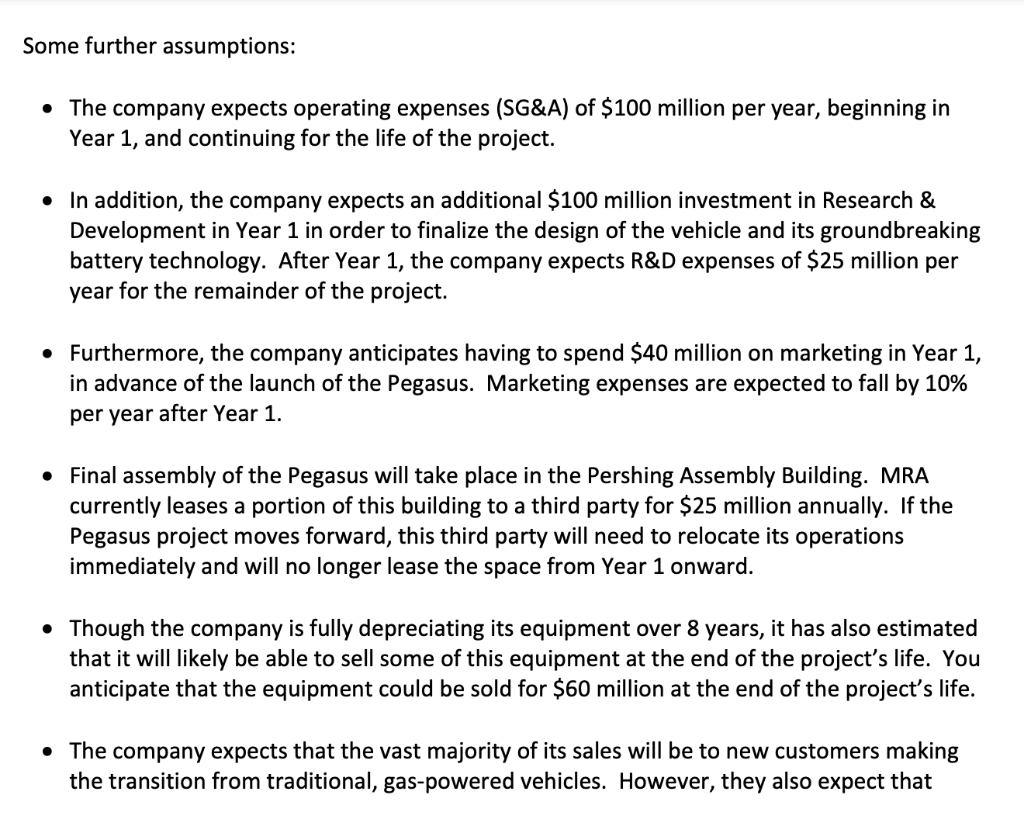

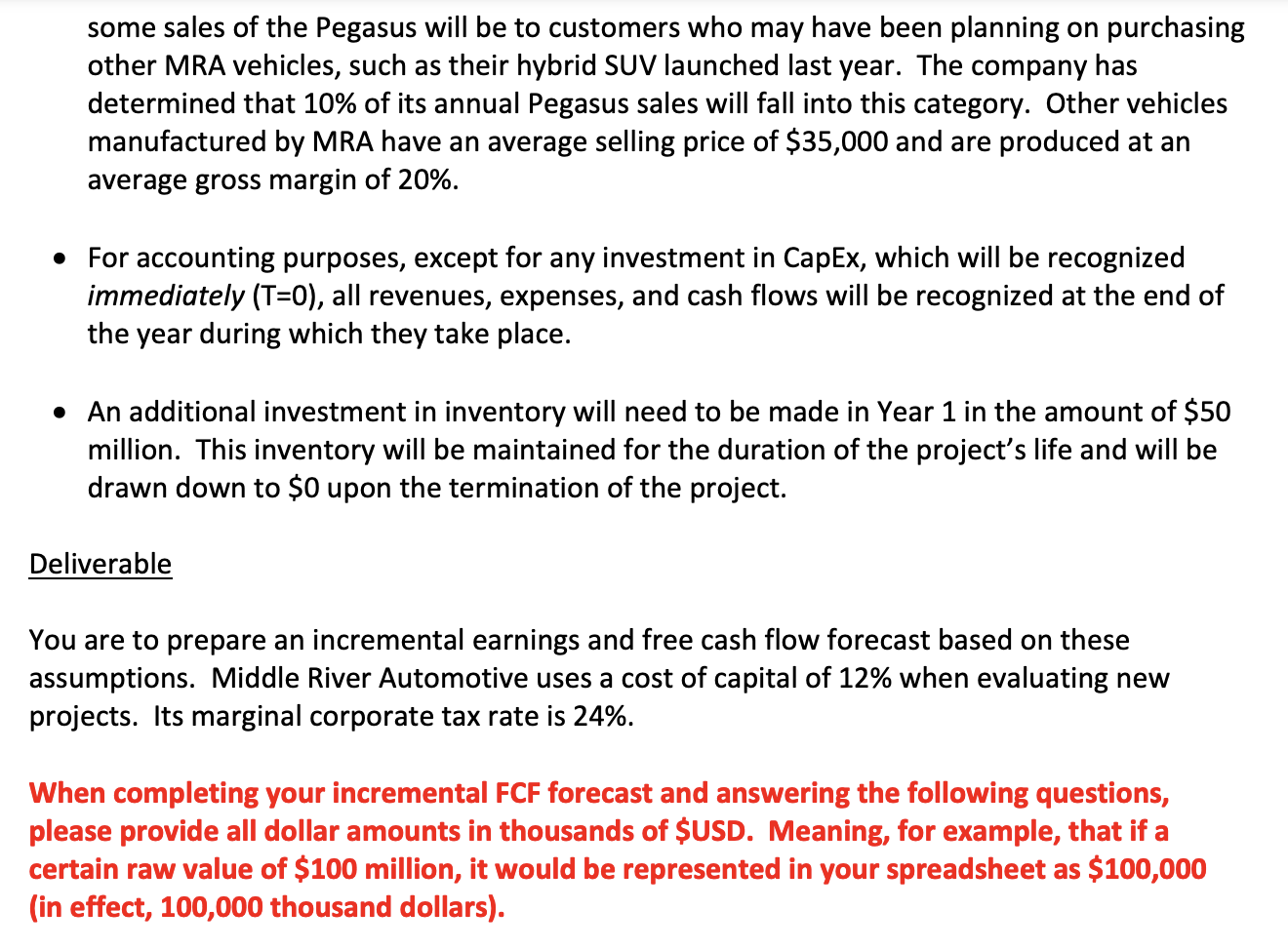

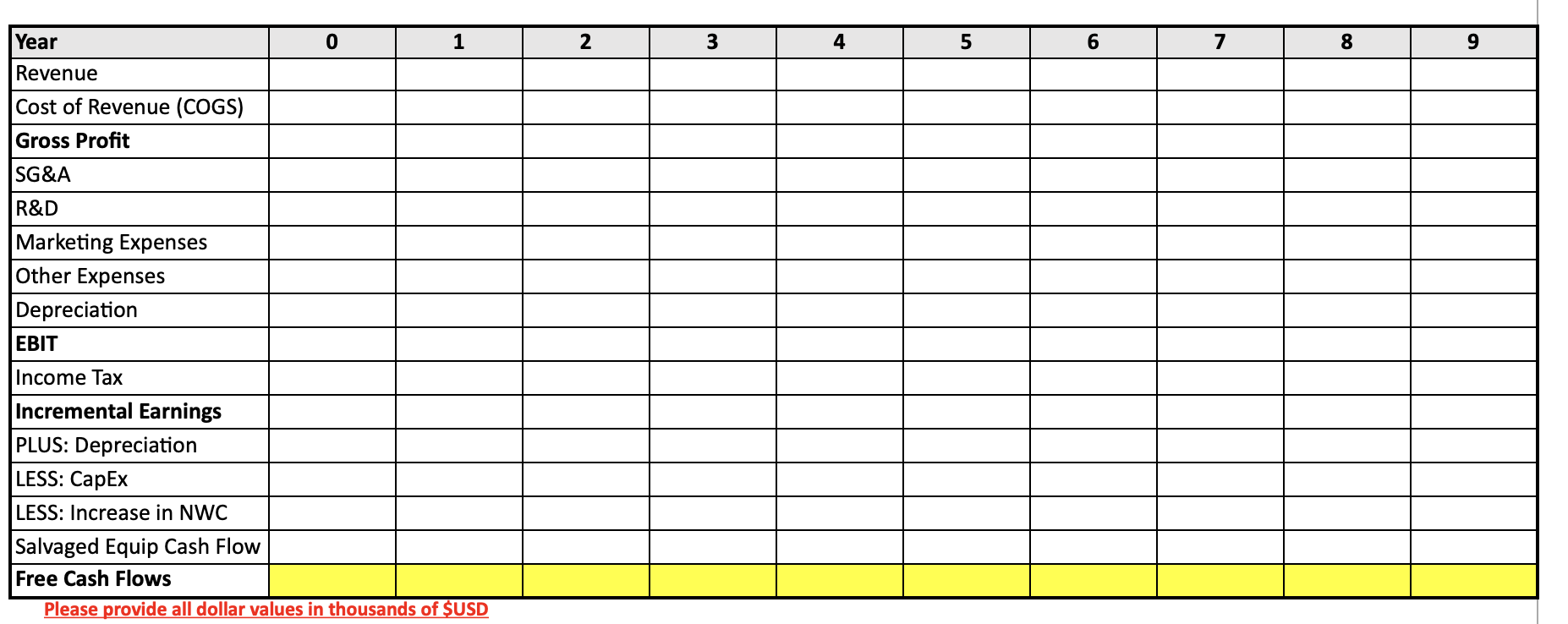

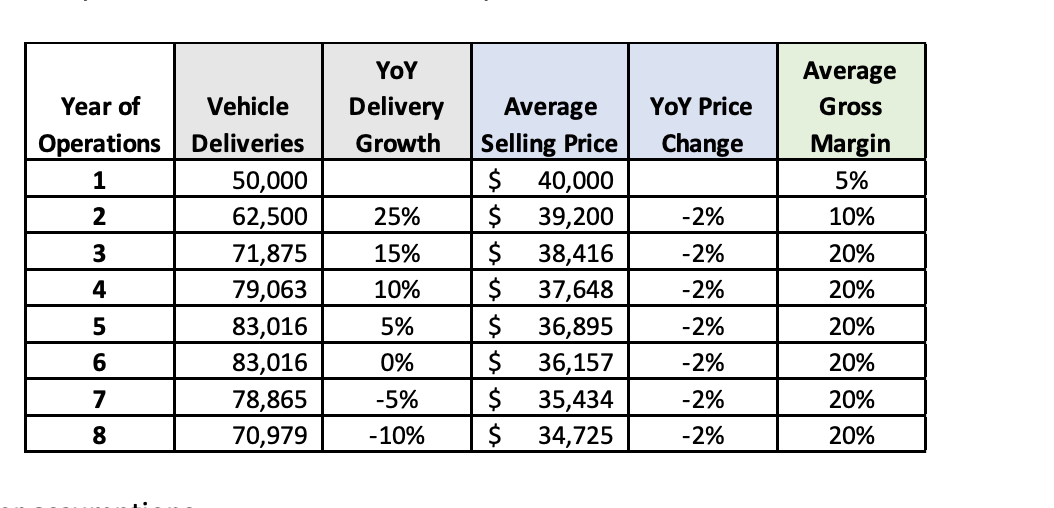

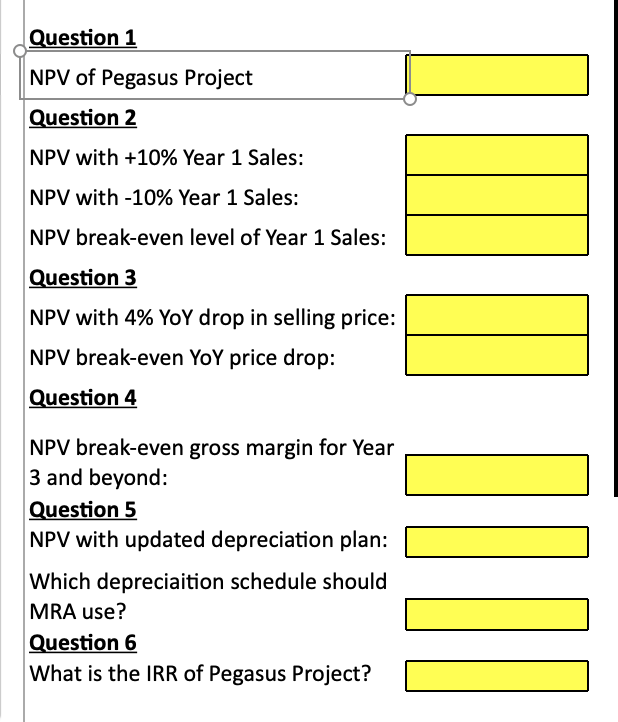

Some further assumptions: The company expects operating expenses (SG&A) of $100 million per year, beginning in Year 1, and continuing for the life of the project. In addition, the company expects an additional $100 million investment in Research & Development in Year 1 in order to finalize the design of the vehicle and its groundbreaking battery technology. After Year 1, the company expects R&D expenses of $25 million per year for the remainder of the project. Furthermore, the company anticipates having to spend $40 million on marketing in Year 1, in advance of the launch of the Pegasus. Marketing expenses are expected to fall by 10% per year after Year 1. Final assembly of the Pegasus will take place in the Pershing Assembly Building. MRA currently leases a portion of this building to a third party for $25 million annually. If the Pegasus project moves forward, this third party will need to relocate its operations immediately and will no longer lease the space from Year 1 onward. Though the company is fully depreciating its equipment over 8 years, it has also estimated that it will likely be able to sell some of this equipment at the end of the project's life. You anticipate that the equipment could be sold for $60 million at the end of the project's life. The company expects that the vast majority of its sales will be to new customers making the transition from traditional, gas-powered vehicles. However, they also expect that some sales of the Pegasus will be to customers who may have been planning on purchasing other MRA vehicles, such as their hybrid SUV launched last year. The company has determined that 10% of its annual Pegasus sales will fall into this category. Other vehicles manufactured by MRA have an average selling price of $35,000 and are produced at an average gross margin of 20%. For accounting purposes, except for any investment in CapEx, which will be recognized immediately (T=0), all revenues, expenses, and cash flows will be recognized at the end of the year during which they take place. . An additional investment in inventory will need to be made in Year 1 in the amount of $50 million. This inventory will be maintained for the duration of the oject's life and will be drawn down to $0 upon the termination of the project. Deliverable You are to prepare an incremental earnings and free cash flow forecast based on these assumptions. Middle River Automotive uses a cost of capital of 12% when evaluating new projects. Its marginal corporate tax rate is 24%. When completing your incremental FCF forecast and answering the following questions, please provide all dollar amounts in thousands of $USD. Meaning, for example, that if a certain raw value of $100 million, it would be represented in your spreadsheet as $100,000 (in effect, 100,000 thousand dollars). 0 1 2 3 4 5 6 7 8 9 Year Revenue Cost of Revenue (COGS) Gross Profit SG&A R&D Marketing Expenses Other Expenses Depreciation EBIT Income Tax Incremental Earnings PLUS: Depreciation LESS: Capex LESS: Increase in NWC Salvaged Equip Cash Flow Free Cash Flows Please provide all dollar values in thousands of SUSD YoY Delivery Growth YOY Price Change 25% Average Gross Margin 5% 10% 20% 20% Year of Vehicle Operations Deliveries 1 50,000 2 62,500 3 71,875 4 79,063 5 83,016 6 83,016 7 78,865 8 70,979 15% Average Selling Price $ 40,000 $ 39,200 $ 38,416 $ 37,648 $ 36,895 $ 36,157 $ 35,434 $ 34,725 10% 5% -2% -2% -2% -2% -2% -2% -2% 20% 0% 20% 20% -5% -10% 20% Question 1 NPV of Pegasus Project Question 2 NPV with +10% Year 1 Sales: NPV with -10% Year 1 Sales: LINT NPV break-even level of Year 1 Sales: Question 3 NPV with 4% YoY drop in selling price: NPV break-even YoY price drop: Question 4 NPV break-even gross margin for Year 3 and beyond: Question 5 NPV with updated depreciation plan: Which depreciaition schedule should MRA use? Question 6 What is the IRR of Pegasus Project? Some further assumptions: The company expects operating expenses (SG&A) of $100 million per year, beginning in Year 1, and continuing for the life of the project. In addition, the company expects an additional $100 million investment in Research & Development in Year 1 in order to finalize the design of the vehicle and its groundbreaking battery technology. After Year 1, the company expects R&D expenses of $25 million per year for the remainder of the project. Furthermore, the company anticipates having to spend $40 million on marketing in Year 1, in advance of the launch of the Pegasus. Marketing expenses are expected to fall by 10% per year after Year 1. Final assembly of the Pegasus will take place in the Pershing Assembly Building. MRA currently leases a portion of this building to a third party for $25 million annually. If the Pegasus project moves forward, this third party will need to relocate its operations immediately and will no longer lease the space from Year 1 onward. Though the company is fully depreciating its equipment over 8 years, it has also estimated that it will likely be able to sell some of this equipment at the end of the project's life. You anticipate that the equipment could be sold for $60 million at the end of the project's life. The company expects that the vast majority of its sales will be to new customers making the transition from traditional, gas-powered vehicles. However, they also expect that some sales of the Pegasus will be to customers who may have been planning on purchasing other MRA vehicles, such as their hybrid SUV launched last year. The company has determined that 10% of its annual Pegasus sales will fall into this category. Other vehicles manufactured by MRA have an average selling price of $35,000 and are produced at an average gross margin of 20%. For accounting purposes, except for any investment in CapEx, which will be recognized immediately (T=0), all revenues, expenses, and cash flows will be recognized at the end of the year during which they take place. . An additional investment in inventory will need to be made in Year 1 in the amount of $50 million. This inventory will be maintained for the duration of the oject's life and will be drawn down to $0 upon the termination of the project. Deliverable You are to prepare an incremental earnings and free cash flow forecast based on these assumptions. Middle River Automotive uses a cost of capital of 12% when evaluating new projects. Its marginal corporate tax rate is 24%. When completing your incremental FCF forecast and answering the following questions, please provide all dollar amounts in thousands of $USD. Meaning, for example, that if a certain raw value of $100 million, it would be represented in your spreadsheet as $100,000 (in effect, 100,000 thousand dollars). 0 1 2 3 4 5 6 7 8 9 Year Revenue Cost of Revenue (COGS) Gross Profit SG&A R&D Marketing Expenses Other Expenses Depreciation EBIT Income Tax Incremental Earnings PLUS: Depreciation LESS: Capex LESS: Increase in NWC Salvaged Equip Cash Flow Free Cash Flows Please provide all dollar values in thousands of SUSD YoY Delivery Growth YOY Price Change 25% Average Gross Margin 5% 10% 20% 20% Year of Vehicle Operations Deliveries 1 50,000 2 62,500 3 71,875 4 79,063 5 83,016 6 83,016 7 78,865 8 70,979 15% Average Selling Price $ 40,000 $ 39,200 $ 38,416 $ 37,648 $ 36,895 $ 36,157 $ 35,434 $ 34,725 10% 5% -2% -2% -2% -2% -2% -2% -2% 20% 0% 20% 20% -5% -10% 20% Question 1 NPV of Pegasus Project Question 2 NPV with +10% Year 1 Sales: NPV with -10% Year 1 Sales: LINT NPV break-even level of Year 1 Sales: Question 3 NPV with 4% YoY drop in selling price: NPV break-even YoY price drop: Question 4 NPV break-even gross margin for Year 3 and beyond: Question 5 NPV with updated depreciation plan: Which depreciaition schedule should MRA use? Question 6 What is the IRR of Pegasus Project