Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(some instructions to help solve above) Need your working as well. Thanks. You are a senior manager in the Risk Management Department of ABC Bank.

(some instructions to help solve above)

Need your working as well. Thanks.

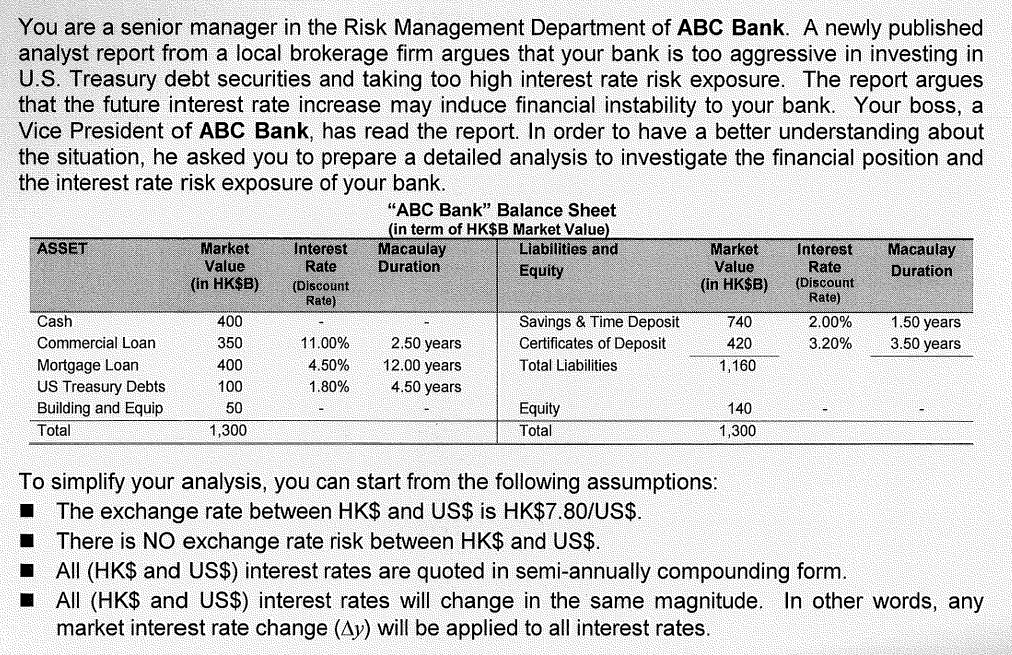

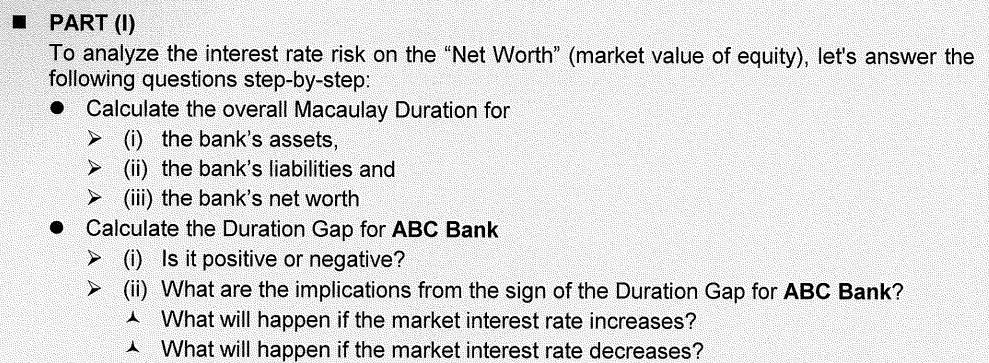

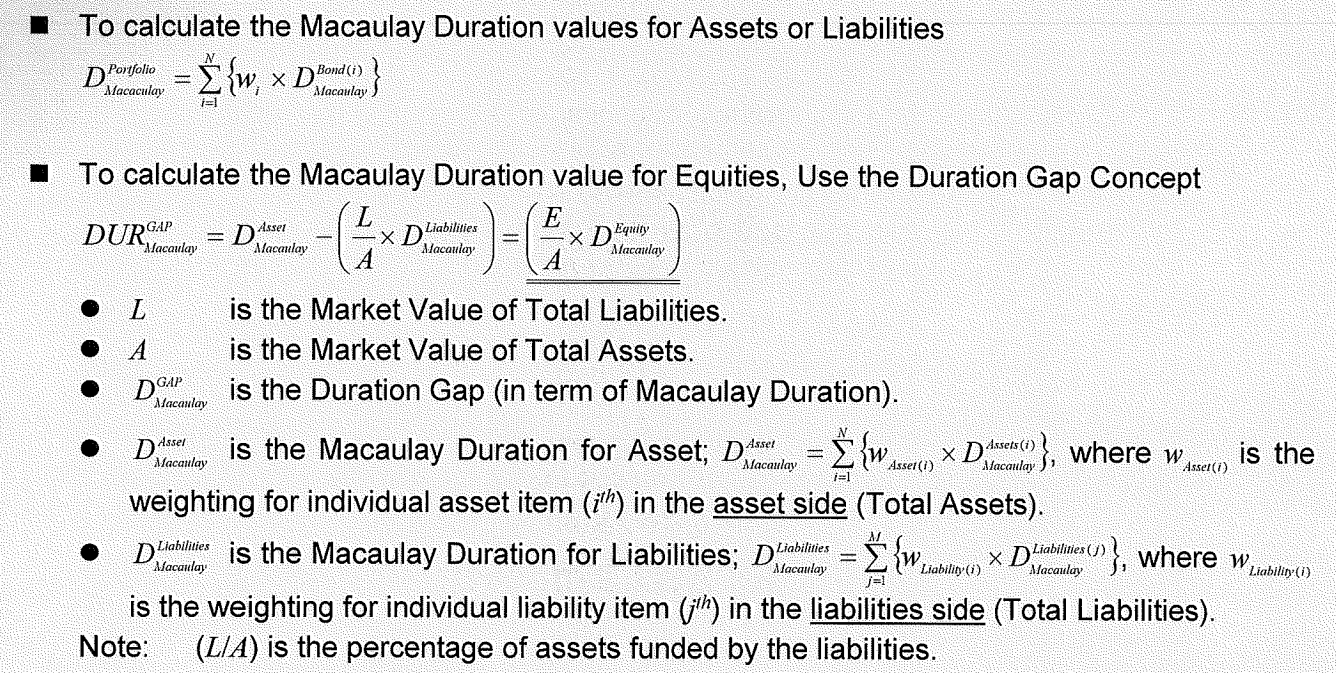

You are a senior manager in the Risk Management Department of ABC Bank. A newly published analyst report from a local brokerage firm argues that your bank is too aggressive in investing in U.S. Treasury debt securities and taking too high interest rate risk exposure. The report argues that the future interest rate increase may induce financial instability to your bank. Your boss, a Vice President of ABC Bank, has read the report. In order to have a better understanding about the situation, he asked you to prepare a detailed analysis to investigate the financial position and the interest rate risk exposure of your bank. "ABC Bank Balance Sheet ASSET Market Value (in HK$B) Interest Rate (Discount Rate) (in term of HK$B Market Value) Macaulay Liabilities and Duration Equity Market Value (in HK$B) Macaulay Duration Interest Rate (Discount Rate) 2.00% 3.20% Savings & Time Deposit Certificates of Deposit Total Liabilities 1.50 years 3.50 years Cash Commercial Loan Mortgage Loan US Treasury Debts Building and Equip Total 740 420 1,160 11.00% 4.50% 1.80% 400 350 400 100 50 1,300 2.50 years 12.00 years 4.50 years Equity Total 140 1,300 To simplify your analysis, you can start from the following assumptions: I The exchange rate between HK$ and US$ is HK$7.80/US$. There is NO exchange rate risk between HK$ and US$. All (HK$ and US$) interest rates are quoted in semi-annually compounding form. All (HK$ and US$) interest rates will change in the same magnitude. In other words, any market interest rate change (Ay) will be applied to all interest rates. I PART (0) To analyze the interest rate risk on the Net Worth" (market value of equity), let's answer the following questions step-by-step: Calculate the overall Macaulay Duration for (0) the bank's assets, > (ii) the bank's liabilities and > (iii) the bank's net worth Calculate the Duration Gap for ABC Bank > (0Is it positive or negative? > (ii) What are the implications from the sign of the Duration Gap for ABC Bank? What will happen if the market interest rate increases? What will happen if the market interest rate decreases? alacaula, I To calculate the Macaulay Duration values for Assets or Liabilities ${w, xD Bond (i) D Portfolio Macaculay DURGAP Asset Macaulay X D Liabilities Macaulay Macaulay x Dywity Macaulay To calculate the Macaulay Duration value for Equities, Use the Duration Gap Concept L E = D.4* A L is the Market Value of Total Liabilities. A is the Market Value of Total Assets. D GAP is the Duration Gap (in term of Macaulay Duration). is the Macaulay Duration for Asset; D Asset x Datasetatu}, where w is the weighting for individual asset item (ih) in the asset side (Total Assets). D? stabilities is the Macaulay Duration for Liabilities; D. }, where w, is the weighting for individual liability item (') in the liabilities side (Total Liabilities). Note: (LIA) is the percentage of assets funded by the liabilities. Macaulay D Asses Maca Macaulay Asset (1) Assel(i) i=1 Liabilities Macaulay {w, x D Liabilities (1) Macaulaj Liability ( ) Macaulay Liability (1) j=1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started