Answered step by step

Verified Expert Solution

Question

1 Approved Answer

some of these answers may not be correct please show all correct answers. thank you Analysis of Financial Statements: Debt Management Ratios Debt management ratios

some of these answers may not be correct please show all correct answers. thank you

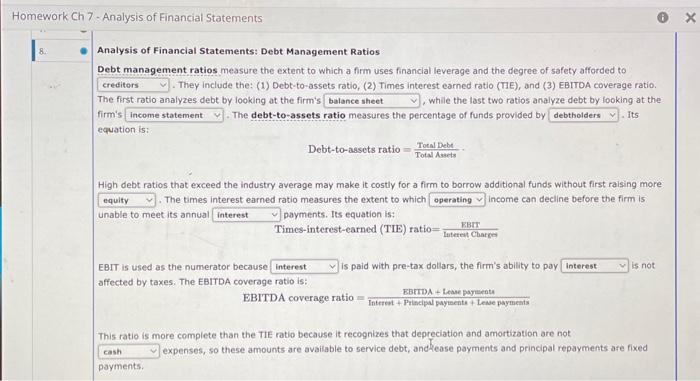

Analysis of Financial Statements: Debt Management Ratios Debt management ratios measure the extent to which a firm uses financlal leverage and the degree of safety afforded to - They include the: (1) Debt-to-assets ratio, (2) Times interest earned ratio (THE), and (3) EBITOA coverage ratio. The first ratio analyzes debt by looking at the firm's , while the last two ratios analyze debt by looking at the firm's - The debt-to-assets ratio measures the percentage of funds provided by . Its equation is: Debt-to-assetsratio=TotalAsetsTotalDebe. High debt ratios that exceed the industry average may make it costly for a firm to borrow additional funds without first raising more - The times interest earned ratio measures the extent to which income can decline before the firm is unable to meet its annual payments. Its equation is: payments.Itsequationis:Times-interest-earned(TIE)ratio=luterentClaresEBrT EBIT is used as the numerator because is paid with pre-tax dollars, the firm's ability to pay is not affected by taxes. The EBITDA coverage ratio is: This ratio is more complete than the TIE ratio because it recognizes that depreciation and amortization are not expenses, so these amounts are available to service debt, and lease payments and principal repayments afe fixed payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started