some please help me figure out what to do in the blank charts. Thank you!

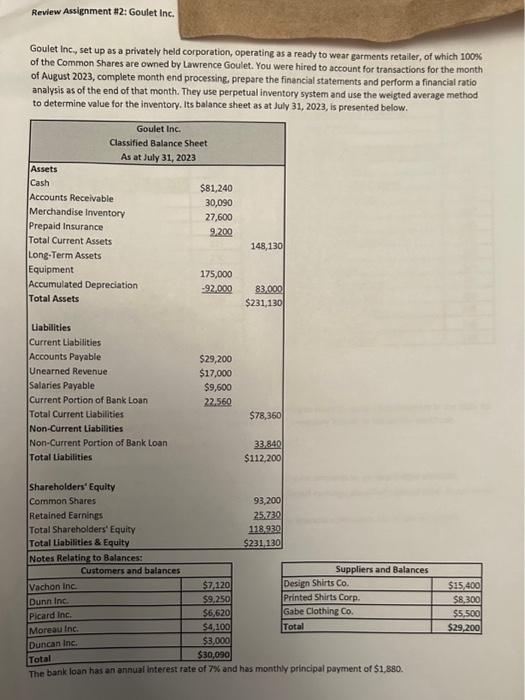

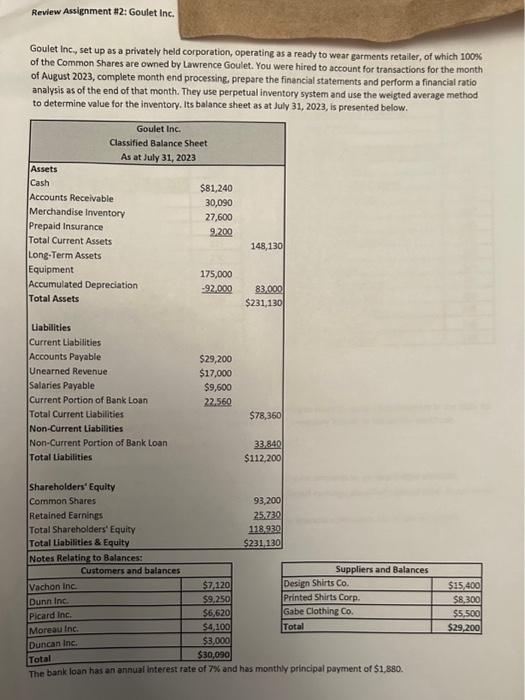

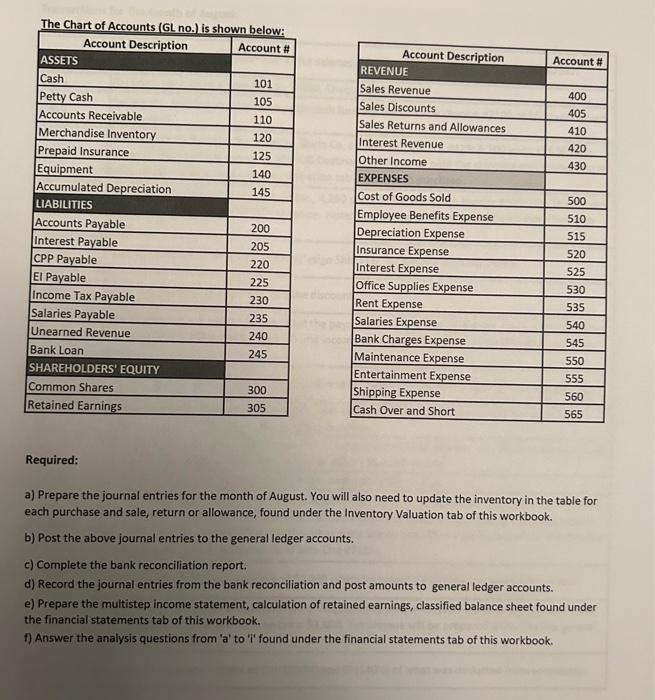

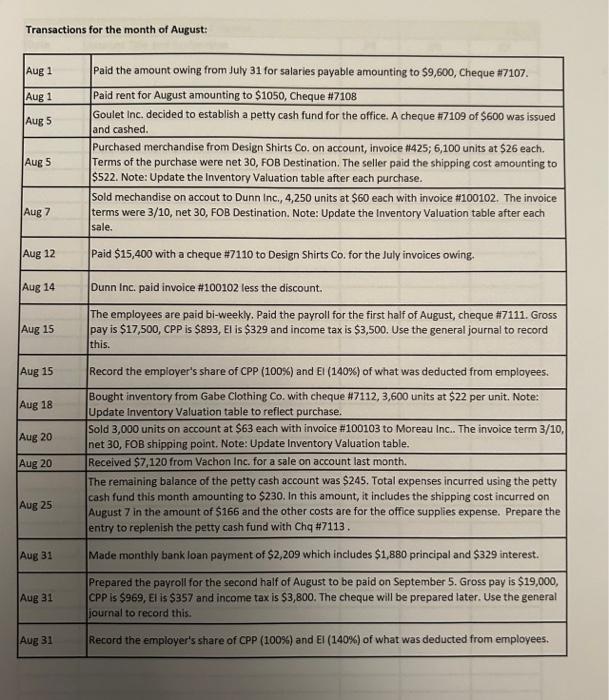

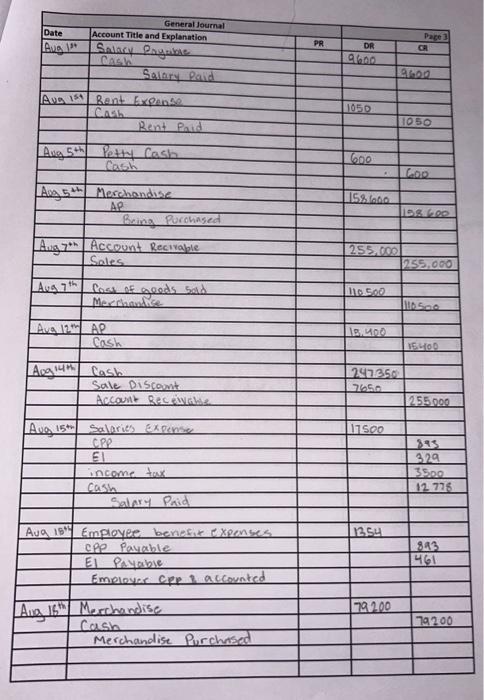

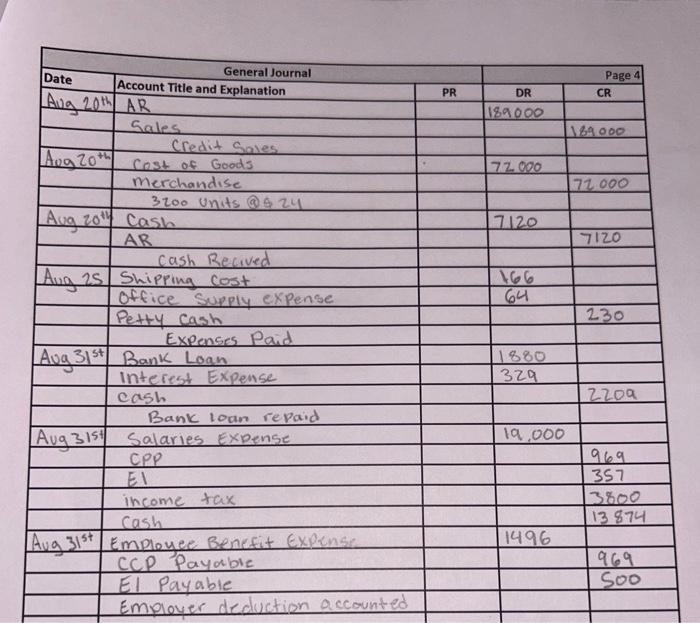

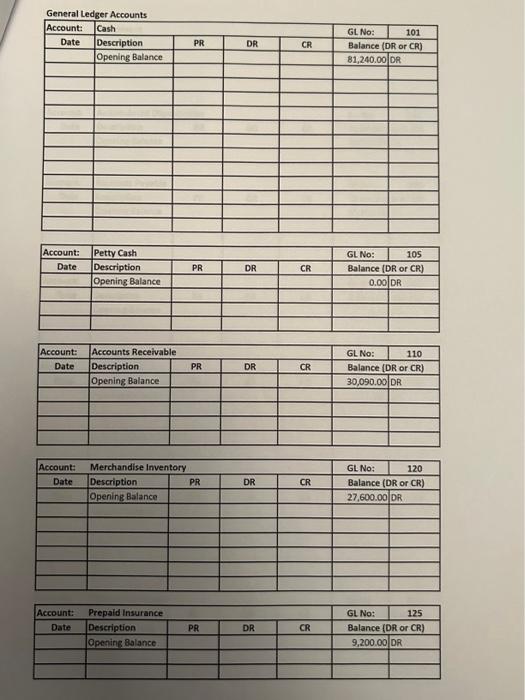

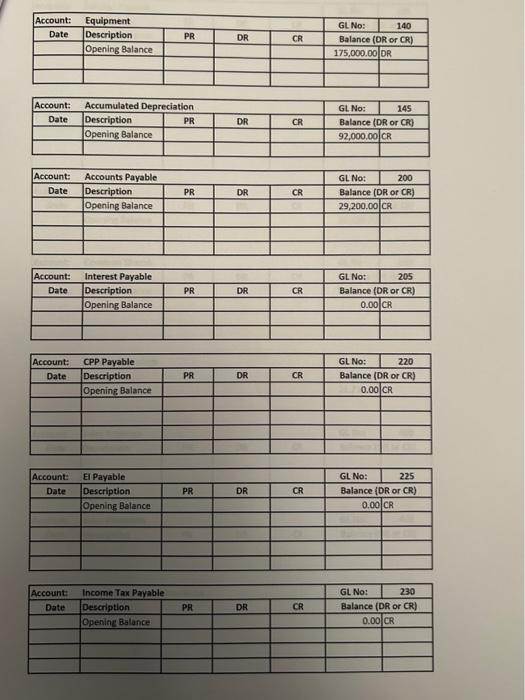

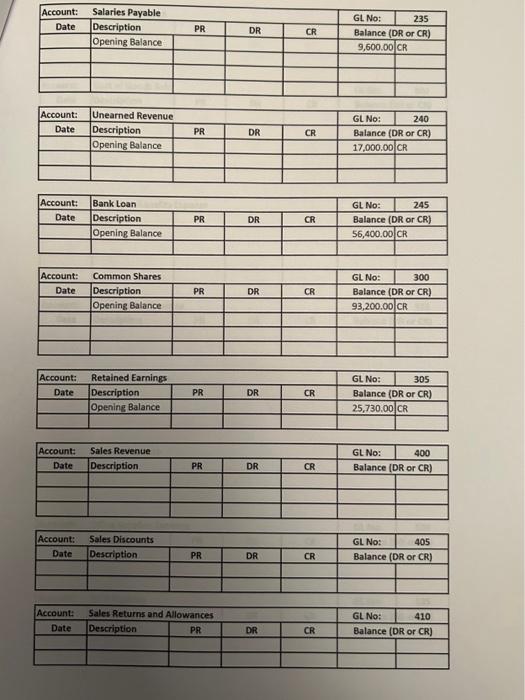

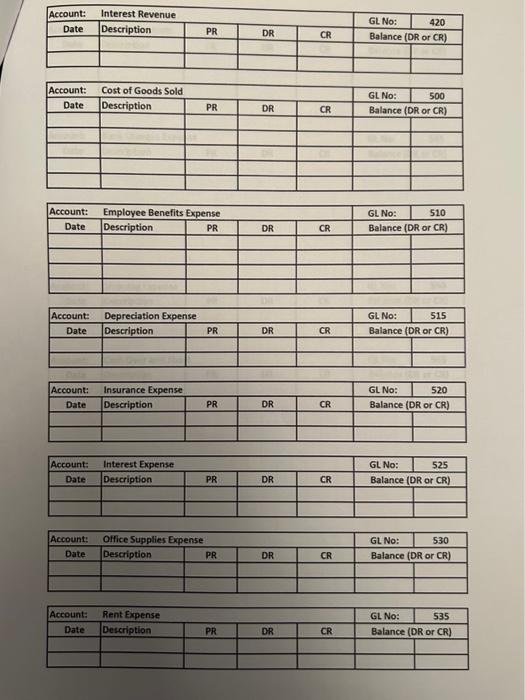

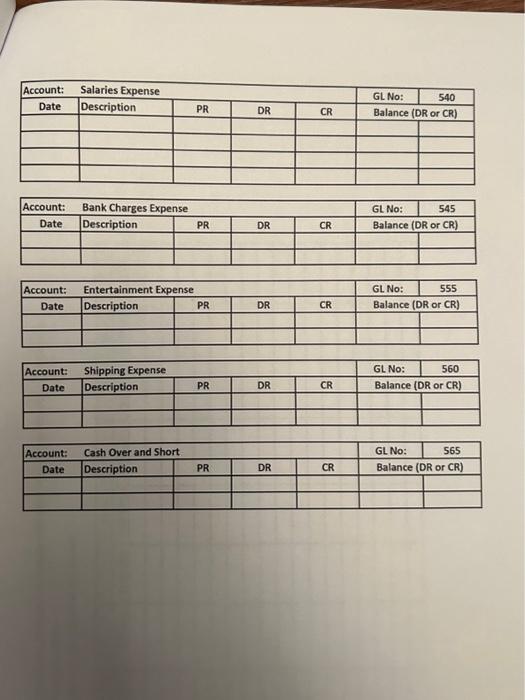

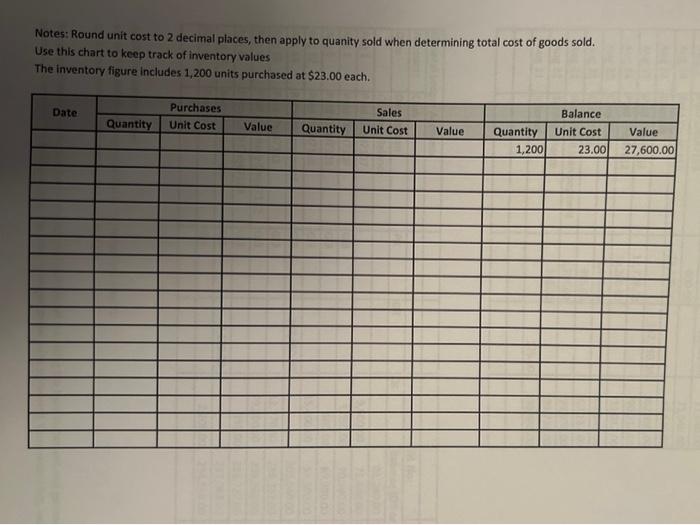

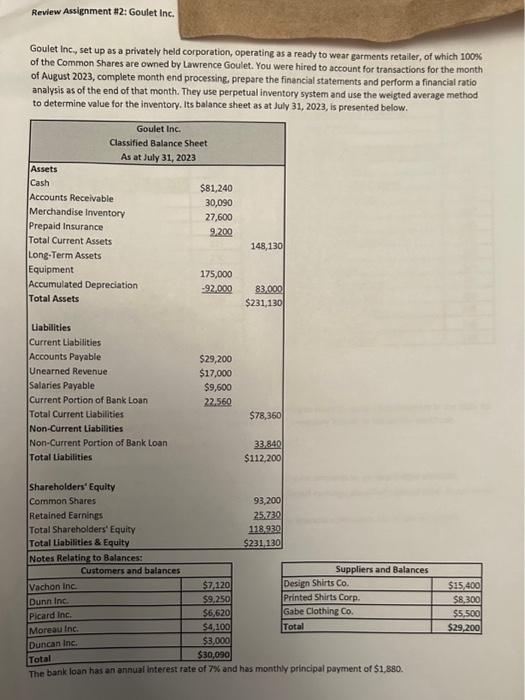

Review Assignment \#2: Goulet Inc, Goulet Inc, set up as a privately held corporation, operating as a ready to woar garments retaller, of which 10006 of the Common Shares are owned by Lawrence Goulet. You were hired to account for transactions for the month of August 2023, complete month end processing, prepare the financial statements and perform a financial ratio analysis as of the end of that month. They use perpetual inventory system and use the weigted average method to determine value for the inventory. Its balance sheet as at Julv 31,2023 , is presented below. The bank loan has an anhual lnterest rate of 7% and has monthly principal payment of $1,880. The Chart of Accounts (GI nn I ie ehnum hal..... Required: a) Prepare the journal entries for the month of August. You will also need to update the inventory in the table for each purchase and sale, return or allowance, found under the Inventory Valuation tab of this workbook. b) Post the above journal entries to the general ledger accounts. c) Complete the bank reconciliation report. d) Record the journal entries from the bank reconciliation and post amounts to general ledger accounts. e) Prepare the multistep income statement, calculation of retained earnings, classified balance sheet found under the financial statements tab of this workbook. f) Answer the analysis questions from ' a ' to 'i' found under the financial statements tab of this workbook. Transactions for the month of August: \begin{tabular}{|c|c|} \hline Aug 1 & Paid the amount owing from July 31 for salaries payable amounting to $9,600, Cheque $7107. \\ \hline Aug 1 & Paid rent for August amounting to $1050, Cheque #7108 \\ \hline Aug 5 & \begin{tabular}{l} Goulet inc. decided to establish a petty cash fund for the office. A cheque $7109 of $600 was issued \\ and cashed. \end{tabular} \\ \hline Aug 5 & \begin{tabular}{l} Purchased merchandise from Design Shirts Co. on account, invoice $425;6,100 units at $26 each. \\ Terms of the purchase were net 30 , FOB Destination. The seller paid the shipping cost amounting to \\ $522. Note: Update the Inventory Valuation table after each purchase. \end{tabular} \\ \hline Aug 7 & \begin{tabular}{l} Sold mechandise on accout to Dunn Inc., 4,250 units at $60 each with invoice #100102. The invoice \\ terms were 3/10, net 30 , FOB Destination. Note: Update the Inventory Valuation table after each \\ sale. \end{tabular} \\ \hline Aug 12 & Paid $15,400 with a cheque #7110 to Design Shirts Co. for the July invoices owing. \\ \hline Aug 14 & Dunn Inc. paid invoice #100102 less the discount. \\ \hline Aug 15 & \begin{tabular}{l} The employees are paid bi-weekly. Paid the payroll for the first half of August, cheque #7111. Gross \\ pay is $17,500, CPP is $893, El is $329 and income tax is $3,500. Use the general journal to record \\ this. \end{tabular} \\ \hline Aug 15 & Record the employer's share of CPP (100%) and EI(140%) of what was deducted from employees. \\ \hline Aug 18 & \begin{tabular}{l} Bought inventory from Gabe Clothing Co. with cheque $7112,3,600 units at $22 per unit. Note: \\ Update Inventory Valuation table to reflect purchase. \end{tabular} \\ \hline Aug 20 & \begin{tabular}{l} Sold 3,000 units on account at $63 each with invoice $100103 to Moreau inc.. The invoice term 3/10, \\ net 30 , FOB shipping point. Note: Update Inventory Valuation table. \end{tabular} \\ \hline Aug 20 & Received $7,120 from Vachon Inc. for a sale on account last month. \\ \hline Aug 25 & \begin{tabular}{l} The remaining balance of the petty cash account was $245. Total expenses incurred using the petty \\ cash fund this month amounting to $230. In this amount, it includes the shipping cost incurred on \\ August 7 in the amount of $166 and the other costs are for the office supplies expense. Prepare the \\ entry to replenish the petty cash fund with Chq $7113. \end{tabular} \\ \hline Aug 31 & Made monthly bank loan payment of $2,209 which includes $1,880 principal and $329 interest. \\ \hline Aug 31 & \begin{tabular}{l} Prepared the payroll for the second half of August to be paid on September 5 . Gross pay is $19,000, \\ CPP is $969,El is $357 and income tax is $3,800. The cheque will be prepared later. Use the general \\ journal to record this. \end{tabular} \\ \hline Aug 3 & El (140\%) of what was deducted from employees. \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} General Journal \\ Account Title and Explantion \end{tabular}} & \multicolumn{2}{|r|}{ Page 3 } \\ \hline \begin{tabular}{|l|l|} Date \\ Aug in 10 \\ \end{tabular} & Account Titie and Explanation & PR & DR & Ca \\ \hline \multirow{2}{*}{ Ang in } & \begin{tabular}{l} Salary Poynuble \\ Cash \end{tabular} & & 9600 & \\ \hline & Salary Paid & & & 9600 \\ \hline \multirow{3}{*}{ Ava 15t } & & & & \\ \hline & \begin{tabular}{l} Bent Expense \\ Cosh \end{tabular} & & 1050 & \\ \hline & Rent Paid & & & 1050 \\ \hline & & & & \\ \hline \multirow[t]{3}{*}{ Ang 5+h} & Petty Cash & & 600 & \\ \hline & Cash & & & 600 \\ \hline & & & & \\ \hline \multirow[t]{3}{*}{Aog5th} & 4 Merchandise & & 158,600 & \\ \hline & AP & & & 158.600 \\ \hline & Being Purchased & & & \\ \hline \multirow{3}{*}{ Anig 7th} & & & & \\ \hline & Hccount Recirable & & 255,000 & \\ \hline & Sales. & & & 255,000 \\ \hline \multirow[t]{3}{*}{ Aug 7th} & Cost of geads sald & & 110500 & \\ \hline & Merchandice & & & 110500 \\ \hline & & & & \\ \hline \multirow[t]{2}{*}{\begin{tabular}{|l|l} Ava 12th \\ \end{tabular}} & AP & & 18,400 & \\ \hline & Cash & & & 15400 \\ \hline \multirow{3}{*}{\begin{tabular}{|l|l|} Alog 14 \\ \end{tabular}} & Cash & & 247350 & \\ \hline & \begin{tabular}{l} Cash \\ Sale Discoont \end{tabular} & & 7650 & \\ \hline & Account Receivalse & & & 255000 \\ \hline \multirow{7}{*}{ Avog, 15+- } & & & 17500 & \\ \hline & CPPSalariesexpense & & & 893 \\ \hline & El & & & 329 \\ \hline & income tax & & & 3500 \\ \hline & cash & & & 12778 \\ \hline & Salary Paid & & & \\ \hline & & & & \\ \hline \multirow[t]{5}{*}{ Aug 1054} & Employee benefit expenses & & 1254 & \\ \hline & CPP Payable & & & 893 \\ \hline & E1 Payabie & & & 461 \\ \hline & Emplover cpe 1 accounted & & & \\ \hline & & & & \\ \hline \multirow[t]{5}{*}{Ang15+1} & Merchandise & & 79200 & \\ \hline & Cash & & & 79200 \\ \hline & Merchandise Purchased & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ General Journal } & \multicolumn{2}{|r|}{ Page 4} \\ \hline Date & Account Title and Explanation & PR & DR & CR \\ \hline \multirow{3}{*}{ Aug 20th } & AR & & 189000 & \\ \hline & Sales & & & 189000 \\ \hline & Credit Sales & & & \\ \hline \multirow[t]{3}{*}{Aog20+h} & Cost of Goods & & 72000 & \\ \hline & merchandise & & & 72,000 \\ \hline & 3200 units@24 & & & \\ \hline \multirow{3}{*}{ Aug 2014} & Cash & & 7120 & \\ \hline & AR & & & 7120 \\ \hline & Cash Recived & & & \\ \hline \multirow{4}{*}{Ang25} & Shipping cost & & 166 & \\ \hline & Office supply expense & & 64 & \\ \hline & Petty Cash & & & 230 \\ \hline & Expenses Paid & & & \\ \hline \multirow{4}{*}{Avg315+} & Bank Loan & & 1880 & \\ \hline & interest Expense & & 329 & \\ \hline & cash & & & 2209 \\ \hline & Bank loan repaid & & & \\ \hline \multirow[t]{5}{*}{ Aug 315t } & Salaries Expense & & 19.000 & \\ \hline & CPP & & & 969 \\ \hline & EI & & & 357 \\ \hline & income tax & & & 3800 \\ \hline & cash & & & 13874 \\ \hline \multirow[t]{4}{*}{ Avg 31st} & Employee Bencfit Expense & & 1496 & \\ \hline & CCP Payable & & & 969 \\ \hline & El Payable & & & 500 \\ \hline & Emplover deduction a ccounted & & & \\ \hline \end{tabular} General Ledger Accounts \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Cash & & & & GL No: & 101 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 81,240,00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline+2 & & + & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Petty Cash & & & & GL No: & 105 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Accounts Recelva & & & & GL No: & 110 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 30,090,00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Merchandise Inv & & & & GL No: & 120 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 27,600.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Prepald Insuranc & & & & GL No: & 125 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR ) } \\ \hline & Opening Balance. & & & & 9,200.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Equipment & & & +2 & GL No: & 140 \\ \hline Date & Description & PR & DR & CA & \multicolumn{2}{|c|}{ Balance (OR or CR) } \\ \hline & Opening Balance & & & & 175,000.00 & DR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & Accumulated Depreciation & \multicolumn{2}{|c|}{ GL No: } & \multicolumn{1}{c|}{ 145 } \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 92,000,00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & Accounts Payable & \multicolumn{4}{l|}{ GL No: } & 200 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 29,200,00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Interest Payable & + & & + & GL No: & 205 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (OR or CR ) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & CPP Payable & & & & GL No: & 220 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & + \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & El Payable & & & & GL No: & 225 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR ) } \\ \hline & Opening Balance & & & & 0,00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Income Tax Paya & & & & GL No: & 230 \\ \hline Date & Description & PH & DR. & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 0.0 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{4}{l|}{ Salaries Payable } \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 9,600.00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & Unearned Revenue & \multicolumn{4}{l|}{ GL No: } & 240 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 17,000,00 & CR \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Bank Loan & & & & GL No: & 245 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 56,400,00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Common Shares & & & & GL No: & 300 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 93,200.00 & CR \\ \hline & & & & - & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{3}{l|}{ Retained Earnings } & \multicolumn{2}{l|}{ GL No: } & 305 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & Opening Balance & & & & 25,730,00 & CR \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Sales Revenu & & & & GL No: & 400 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & Sales Discounts & \multicolumn{3}{|c|}{ GL No: } & 405 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{1}{|l|}{ Sales Returns and Allowances } & GL No: & 410 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: Interest Revenue & \multicolumn{3}{l|}{} & GL No: & 420 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Account: & Cost of Good & & & & GL No: & 500 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & + & \\ \hline+2 & 16 & + & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{1}{|l|}{ Depreciation Expense } & GL No: & 515 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|l|}{ Insurance Expense } & GL No: & 520 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: Interest Expense & \multicolumn{4}{l|}{} & GL No: & 525 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|l|}{ Office Supplies Expense } & GL No: & 530 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|l|}{ Rent Expense } & GL No: & 535 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|l|} \hline Account: & \multicolumn{1}{l|}{ Salaries Expense } & \multicolumn{4}{l|}{ GL No: } & 540 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{l|}{ Bank Charges Expense } & GL No: & 545 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & \multicolumn{2}{|l|}{ Entertainment Expense } & \multicolumn{2}{|c|}{ GL. No: } & 555 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|c|c|c|} \hline Account: & Shipping Expense & \multicolumn{2}{|c|}{ GL No: } & 560 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|l|l|c|} \hline Account: & \multicolumn{2}{|l|}{ Cash Over and Short } & GL No: & S65 \\ \hline Date & Description & PR & DR & CR & \multicolumn{2}{|c|}{ Balance (DR or CR) } \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Notes: Round unit cost to 2 decimal places, then apply to quanity sold when determining total cost of goods sold. Use this chart to keep track of inventory values The inventory figure includes 1,200 units purchased at $23.00 each