Question

Some recent financial statements for Brewer, Inc., follow. BREWER, INC. Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities

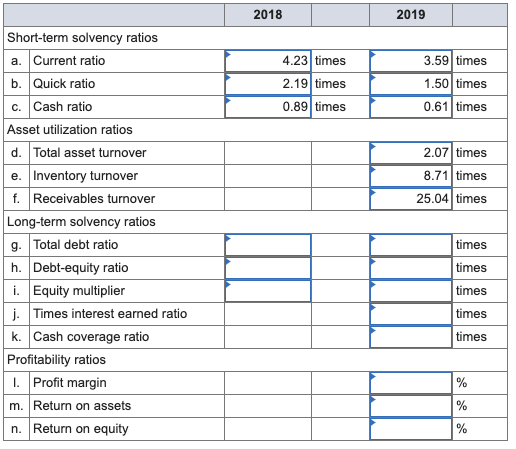

Some recent financial statements for Brewer, Inc., follow. BREWER, INC. Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners Equity Current assets Current liabilities Cash $ 5,298 $ 6,827 Accounts payable $ 3,754 $ 6,986 Accounts receivable 7,707 9,977 Notes payable 2,045 4,055 Inventory 12,150 23,456 Other 152 179 Total $ 25,155 $ 40,260 Total $ 5,951 $ 11,220 Long-term debt $ 22,700 $ 19,000 Owners equity Common stock and paid-in surplus $ 43,000 $ 43,000 Fixed assets Accumulated retained earnings 28,805 47,189 Net plant and equipment $ 75,301 $ 80,149 Total $ 71,805 $ 90,189 Total assets $ 100,456 $ 120,409 Total liabilities and owners equity $ 100,456 $ 120,409 BREWER, INC. 2019 Income Statement Sales $ 249,854 Cost of goods sold 204,317 Depreciation 8,730 EBIT $ 36,807 Interest paid 3,311 Taxable income $ 33,496 Taxes 7,034 Net income $ 26,462 Dividends $ 8,078 Retained earnings 18,384 Find the following financial ratios for Brewer, Inc. (use year-end figures rather than average values where appropriate): (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter the profit margin, return on assets, and return on equity as a percent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started