Answered step by step

Verified Expert Solution

Question

1 Approved Answer

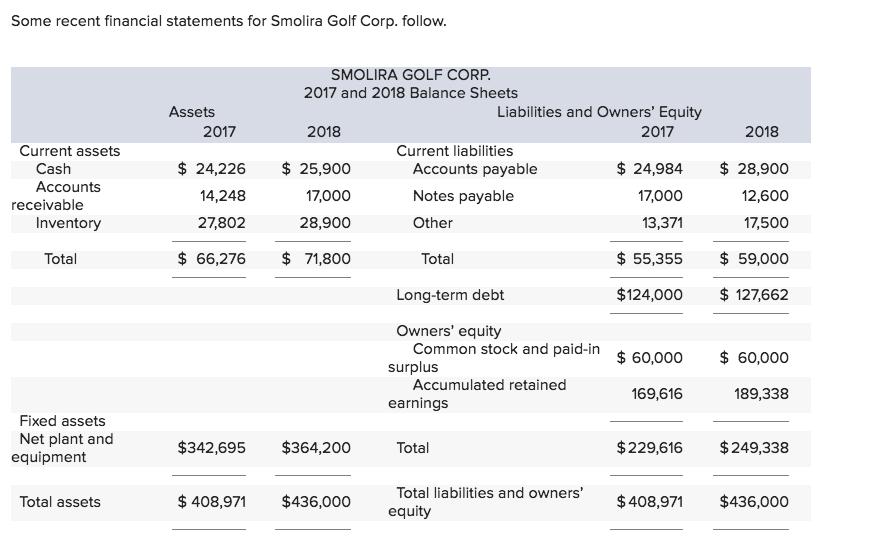

Some recent financial statements for Smolira Golf Corp. follow. Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets

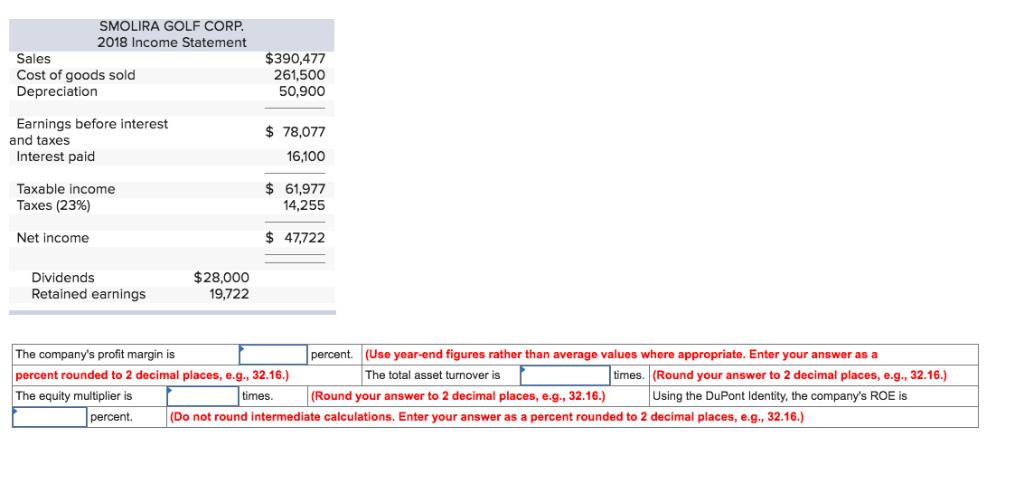

Some recent financial statements for Smolira Golf Corp. follow. Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Assets 2017 2018 $ 24,226 $ 25,900 14,248 17,000 27,802 28,900 $ 66,276 $ 71,800 $342,695 SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets $ 408,971 $364,200 $436,000 Current liabilities Liabilities and Owners' Equity 2017 Accounts payable Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in Accumulated retained surplus earnings Total Total liabilities and owners' equity $ 24,984 17,000 13,371 $ 55,355 $124,000 $ 60,000 169,616 $229,616 $ 408,971 2018 $ 28,900 12,600 17,500 $ 59,000 $ 127,662 $ 60,000 189,338 $249,338 $436,000 SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (23%) Net income Dividends Retained earnings $28,000 19,722 $390,477 261,500 50,900 $ 78,077 16,100 $61,977 14,255 $ 47,722 The company's profit margin is percent rounded to 2 decimal places, e.g., 32.16.) The equity multiplier is percent. times percent. (Use year-end figures rather than average values where appropriate. Enter your answer as a The total asset turnover is times. (Round your answer to 2 decimal places, e.g., 32.16.) Using the DuPont Identity, the company's ROE is (Round your answer to 2 decimal places, e.g., 32.16.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Step by Step Solution

★★★★★

3.46 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Profit margin Net income Sales 47722 390477 1222 Total as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started