Answered step by step

Verified Expert Solution

Question

1 Approved Answer

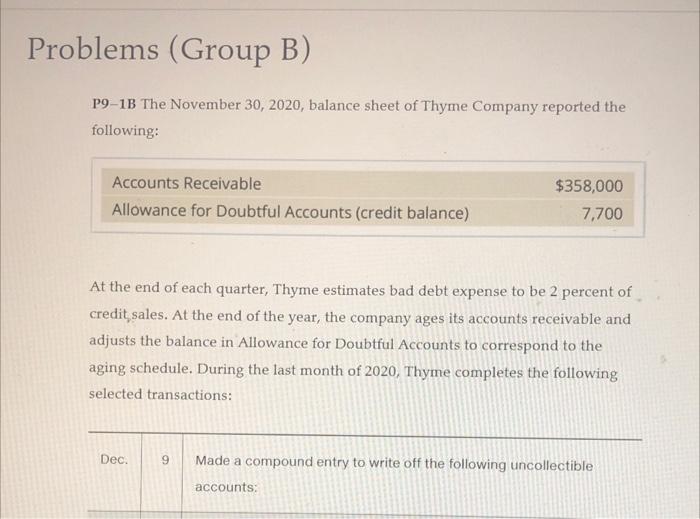

someone help me please, i need help for this assignment Problems (Group B) P9-10 The November 30, 2020, balance sheet of Thyme Company reported the

someone help me please, i need help for this assignment

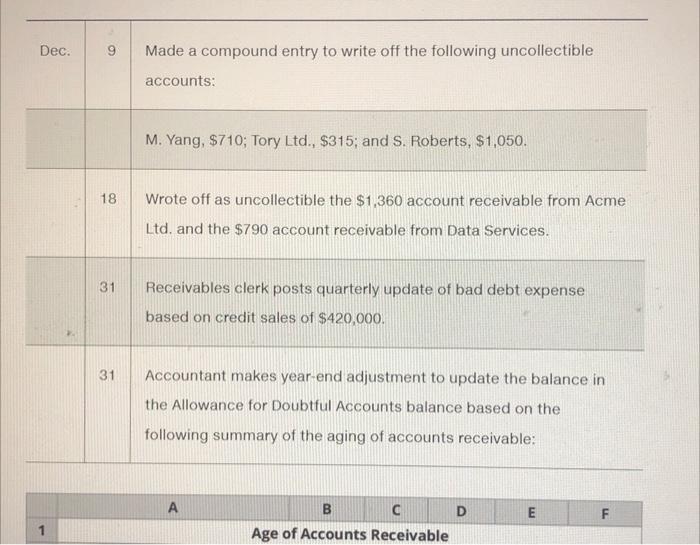

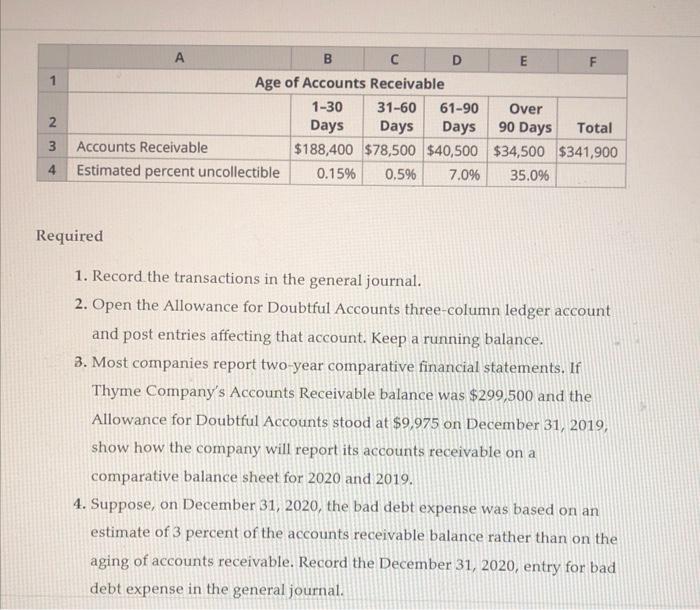

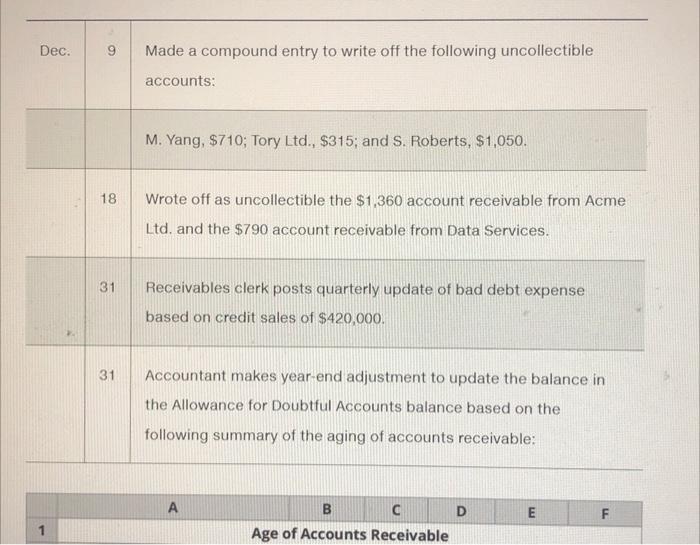

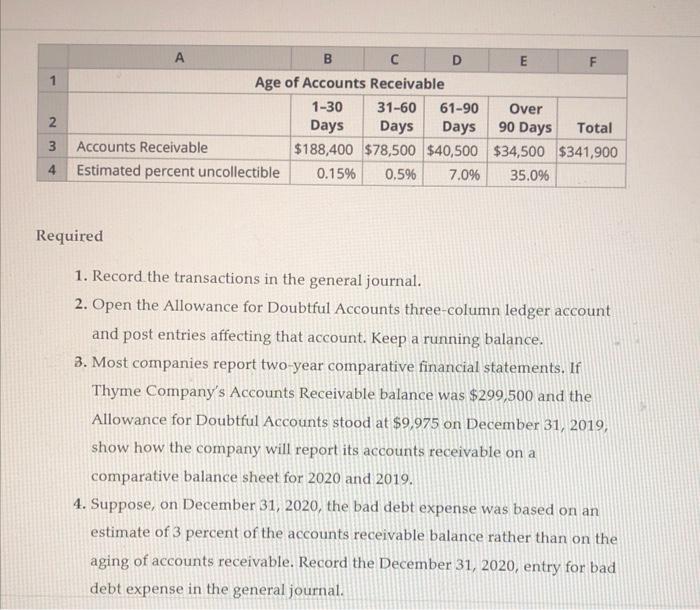

Problems (Group B) P9-10 The November 30, 2020, balance sheet of Thyme Company reported the following: $358,000 Accounts Receivable Allowance for Doubtful Accounts (credit balance) 7,700 At the end of each quarter, Thyme estimates bad debt expense to be 2 percent of credit, sales. At the end of the year, the company ages its accounts receivable and adjusts the balance in Allowance for Doubtful Accounts to correspond to the aging schedule. During the last month of 2020, Thyme completes the following selected transactions: Dec. 9 Made a compound entry to write off the following uncollectible accounts: Dec. 9 Made a compound entry to write off the following uncollectible accounts: M. Yang, $710; Tory Ltd., $315; and S. Roberts, $1,050. 18 Wrote off as uncollectible the $1,360 account receivable from Acme Ltd. and the $790 account receivable from Data Services. 31 Receivables clerk posts quarterly update of bad debt expense based on credit sales of $420,000. 31 Accountant makes year-end adjustment to update the balance in the Allowance for Doubtful Accounts balance based on the following summary of the aging of accounts receivable: A B D E F F 1 Age of Accounts Receivable A B D E F 1 Age of Accounts Receivable 1-30 31-60 61-90 Over 2 Days Days Days 90 Days Total 3 Accounts Receivable $188,400 $78,500 $40,500 $34,500 $341,900 4 Estimated percent uncollectible 0.15% 0.596 7.0% 35.096 Required 1. Record the transactions in the general journal. 2. Open the Allowance for Doubtful Accounts three-column ledger account and post entries affecting that account. Keep a running balance. 3. Most companies report two-year comparative financial statements. If Thyme Company's Accounts Receivable balance was $299,500 and the Allowance for Doubtful Accounts stood at $9,975 on December 31, 2019, show how the company will report its accounts receivable on a comparative balance sheet for 2020 and 2019. 4. Suppose, on December 31, 2020, the bad debt expense was based on an estimate of 3 percent of the accounts receivable balance rather than on the aging of accounts receivable. Record the December 31, 2020, entry for bad debt expense in the general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started