Someone please answer this question

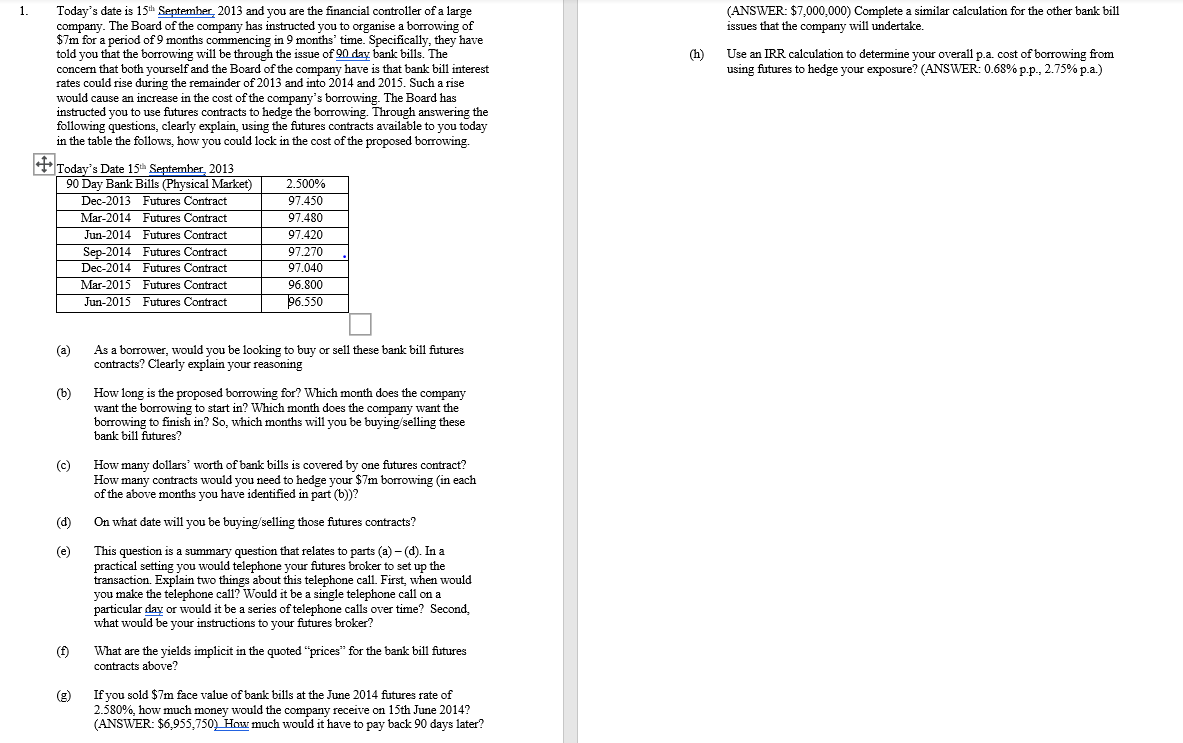

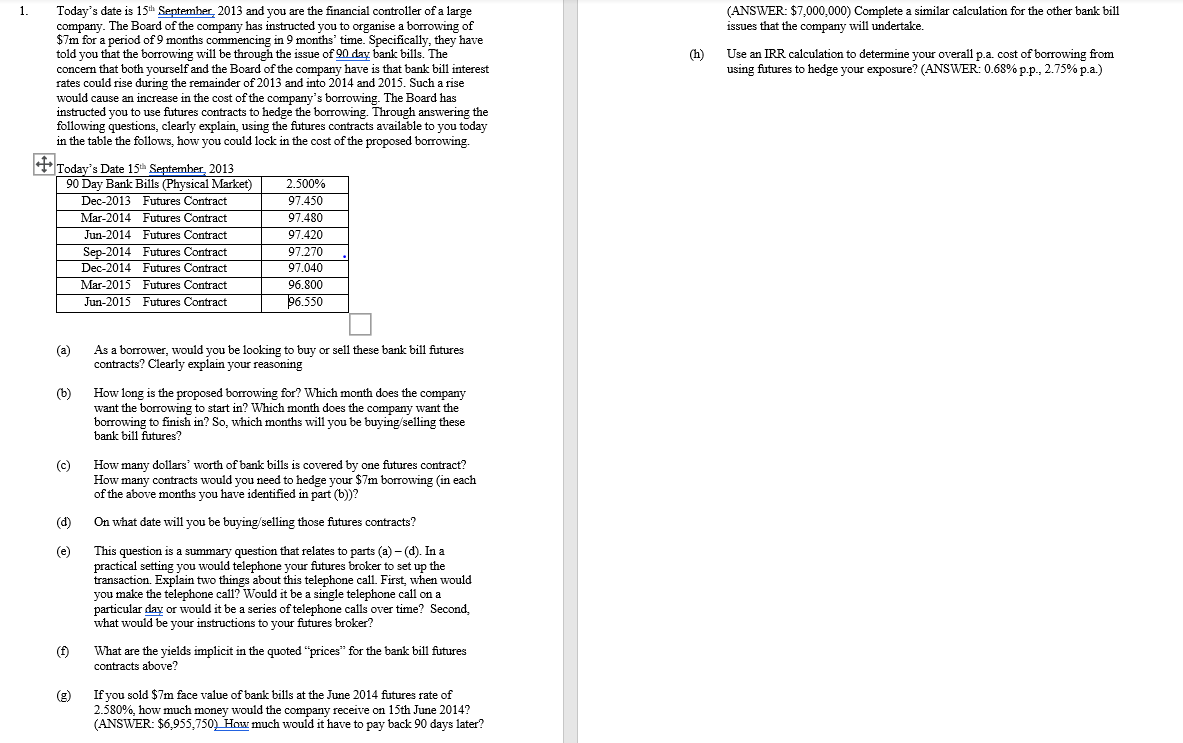

1. Today's date is 15th September 2013 and you are the financial controller of a large (ANSWER: $7,000,000 ) Complete a similar calculation for the other bank bill company. The Board of the company has instructed you to organise a borrowing of issues that the company will undertake. $7m for a period of 9 months commencing in 9 months' time. Specifically, they have told you that the borrowing will be through the issue of 90 day bank bills. The (h) Use an IRR calculation to determine your overall p.a. cost of borrowing from concern that both yourself and the Board of the company have is that bank bill interest using futures to hedge your exposure? (ANSWER: 0.68% p.p., 2.75% p.a.) rates could rise during the remainder of 2013 and into 2014 and 2015 . Such a rise would cause an increase in the cost of the company's borrowing. The Board has instructed you to use futures contracts to hedge the borrowing. Through answering the following questions, clearly explain, using the futures contracts available to you today in the table the follows, how you could lock in the cost of the proposed borrowing. + (a) As a borrower, would you be looking to buy or sell these bank bill futures contracts? Clearly explain your reasoning (b) How long is the proposed borrowing for? Which month does the company want the borrowing to start in? Which month does the company want the borrowing to finish in? So, which months will you be buying/selling these bank bill futures? (c) How many dollars' worth of bank bills is covered by one futures contract? How many contracts would you need to hedge your $7m borrowing (in each of the above months you have identified in part (b))? (d) On what date will you be buying/selling those futures contracts? (e) This question is a summary question that relates to parts (a) - (d). In a practical setting you would telephone your futures broker to set up the transaction. Explain two things about this telephone call. First, when would you make the telephone call? Would it be a single telephone call on a particular day or would it be a series of telephone calls over time? Second, what would be your instructions to your futures broker? (f) What are the yields implicit in the quoted "prices" for the bank bill futures contracts above? (g) If you sold $7m face value of bank bills at the June 2014 futures rate of 2.580%, how much money would the company receive on 15 th June 2014 ? (ANSWER: $6,955,750 ) How much would it have to pay back 90 days later