Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sometime, in the case of retirement or death of a partner, remaining partners may decide a re-adjust their capitals. The capital required by each partner

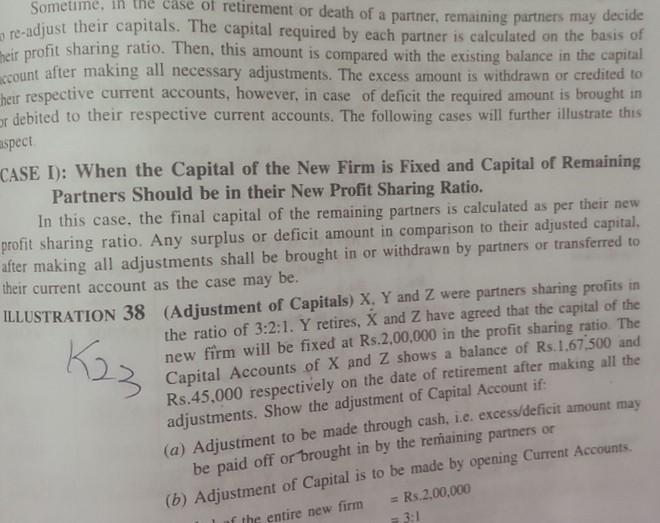

Sometime, in the case of retirement or death of a partner, remaining partners may decide a re-adjust their capitals. The capital required by each partner is calculated on the basis of Their profit sharing ratio. Then, this amount is compared with the existing balance in the capital account after making all necessary adjustments. The excess amount is withdrawn or credited to heur respective current accounts, however, in case of deficit the required amount is brought in Or debited to their respective current accounts. The following cases will further illustrate this aspect CASE 1): When the Capital of the New Firm is Fixed and Capital of Remaining Partners Should be in their New Profit Sharing Ratio. In this case, the final capital of the remaining partners is calculated as per their new profit sharing ratio. Any surplus or deficit amount in comparison to their adjusted capital, after making all adjustments shall be brought in or withdrawn by partners or transferred to their current account as the case may be. ILLUSTRATION 38 (Adjustment of Capitals) X, Y and Z were partners sharing profits in the ratio of 3:2:1. Y retires, X and Z have agreed that the capital of the new firm will be fixed at Rs.2,00,000 in the profit sharing ratio. The Capital Accounts of X and Z shows a balance of Rs.1.67.500 and Rs.45,000 respectively on the date of retirement after making all the K23 adjustments. Show the adjustment of Capital Account if: (a) Adjustment to be made through cash, i.e. excess/deficit amount may be paid off or brought in by the remaining partners or (6) Adjustment of Capital is to be made by opening Current Accounts of the entire new firm = Rs. 2,00,000 3:1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started