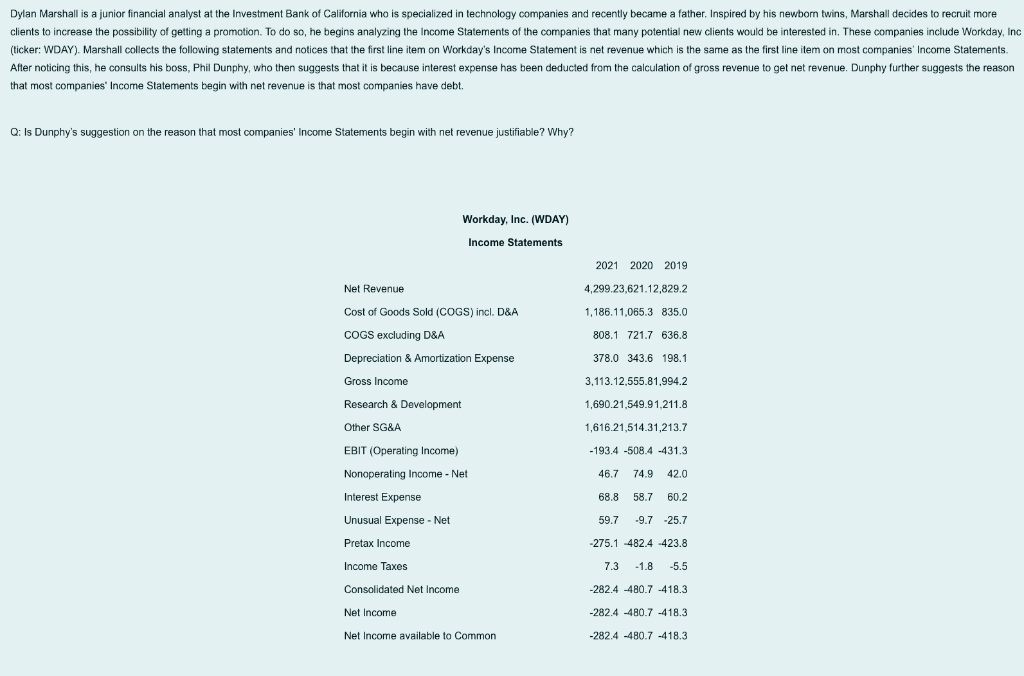

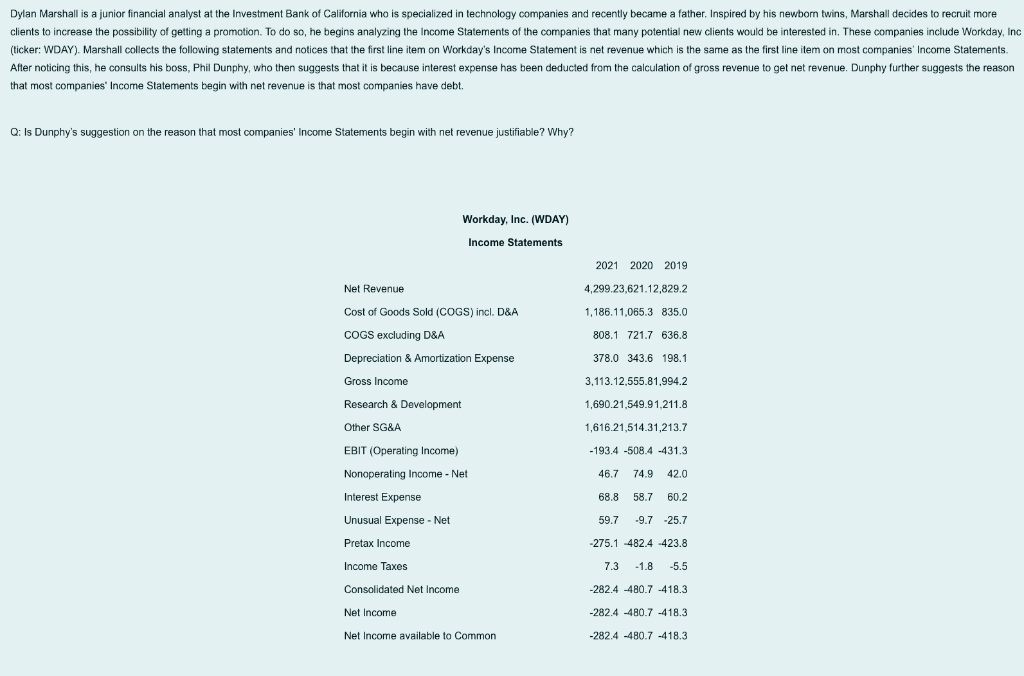

Sonia Ramirez is a senior financial analyst in the Investment Bank of California. She manages the stock portfolios of twenty clients and communicates with them on a weekly basis. Recently, she sent the semi-annual investment reports to each of her clients. After reading the report, one of her clients became interested in the reason why the numerator of adjusted returns on assets (Adj ROA) and returns on equities (ROE) are different. Specifically, the client wanted to know the reason that we add after-tax interest expense to net income when calculating Adj ROA and yet only use net income when calculating ROE. Ramirez explains that it is because the operating cash conversion cycle using total assets needs to include the time required to pay off interest expense, but the operating cash conversion cycle using only equity financing does not need to consider creditors. Q. Is Ramirez's explanation to the reason that the denominator of Adj ROA and ROE are different justifiable? Why? Dylan Marshall is a junior financial analyst at the Investment Bank of California who is specialized in technology companies and recently became a father. Inspired by his newborn twins, Marshall decides to recruit more clients to increase the possibility of getting a promotion. To do so, he begins analyzing the Income Statements of the companies that many potential new clients would be interested in. These companies include Workday, Inc (ticker: WDAY). Marshall collects the following statements and notices that the first line item on Workday's Income Statement is net revenue which is the same as the first line item on most companies' Income Statements. After noticing this, he consults his boss, Phil Dunphy, who then suggests that it is because interest expense has been deducted from the calculation of gross revenue to get net revenue. Dunphy further suggests the reason that most companies' Income Statements begin with net revenue is that most companies have debt. Q: Is Dunphy's suggestion on the reason that most companies' Income Statements begin with net revenue justifiable? Why? Workday, Inc. (WDAY) Income Statements 2021 2020 2019 Net Revenue 4,299.23,621.12,829.2 1,186.11,065.3 835.0 808.1 721.7 636.8 Cost of Goods Sold (COGS) incl. D&A COGS excluding D&A Depreciation & Amortization Expense Gross Income Research & Development 378.0 343.6 198.1 3,113.12.555.81,994.2 1,690.21,549.91.211.8 Other SG&A 1,616.21,514.31,213.7 -193.4 -508.4 -431.3 EBIT (Operating Income) Nonoperating Income - Net 46.7 74.9 42.0 68.8 58.7 60.2 Interest Expense Unusual Expense - Net 59.7 -9.7 25.7 Pretax Income -275.1 -482.4 -423.8 Income Taxes 7.3 -1.8 -5.5 Consolidated Net Income -282.4 -480.7 -418.3 Net Income -282.4 -480.7 -418.3 Net Income available to Common -282.4 -480.7 -418.3 Tony Soprano recently joined the research department of the Investment Bank of Quebec as a financial analyst. His first task involves predicting predict future aggregate economic conditions. He notices that manufacturers' orders for defense capital goods such as small arms and navigation equipment increased more than expected and shipments rose solidly over the past year. Soprano believes this is a strong indication that business spending has been persistently increasing and thus suggests a positive view on the future aggregate economy condition. Q: Should Soprano predict future aggregate economic conditions using manufacturers' orders for defense capital goods? Why? Sonia Ramirez is a senior financial analyst in the Investment Bank of California. She manages the stock portfolios of twenty clients and communicates with them on a weekly basis. Recently, she sent the semi-annual investment reports to each of her clients. After reading the report, one of her clients became interested in the reason why the numerator of adjusted returns on assets (Adj ROA) and returns on equities (ROE) are different. Specifically, the client wanted to know the reason that we add after-tax interest expense to net income when calculating Adj ROA and yet only use net income when calculating ROE. Ramirez explains that it is because the operating cash conversion cycle using total assets needs to include the time required to pay off interest expense, but the operating cash conversion cycle using only equity financing does not need to consider creditors. Q. Is Ramirez's explanation to the reason that the denominator of Adj ROA and ROE are different justifiable? Why? Dylan Marshall is a junior financial analyst at the Investment Bank of California who is specialized in technology companies and recently became a father. Inspired by his newborn twins, Marshall decides to recruit more clients to increase the possibility of getting a promotion. To do so, he begins analyzing the Income Statements of the companies that many potential new clients would be interested in. These companies include Workday, Inc (ticker: WDAY). Marshall collects the following statements and notices that the first line item on Workday's Income Statement is net revenue which is the same as the first line item on most companies' Income Statements. After noticing this, he consults his boss, Phil Dunphy, who then suggests that it is because interest expense has been deducted from the calculation of gross revenue to get net revenue. Dunphy further suggests the reason that most companies' Income Statements begin with net revenue is that most companies have debt. Q: Is Dunphy's suggestion on the reason that most companies' Income Statements begin with net revenue justifiable? Why? Workday, Inc. (WDAY) Income Statements 2021 2020 2019 Net Revenue 4,299.23,621.12,829.2 1,186.11,065.3 835.0 808.1 721.7 636.8 Cost of Goods Sold (COGS) incl. D&A COGS excluding D&A Depreciation & Amortization Expense Gross Income Research & Development 378.0 343.6 198.1 3,113.12.555.81,994.2 1,690.21,549.91.211.8 Other SG&A 1,616.21,514.31,213.7 -193.4 -508.4 -431.3 EBIT (Operating Income) Nonoperating Income - Net 46.7 74.9 42.0 68.8 58.7 60.2 Interest Expense Unusual Expense - Net 59.7 -9.7 25.7 Pretax Income -275.1 -482.4 -423.8 Income Taxes 7.3 -1.8 -5.5 Consolidated Net Income -282.4 -480.7 -418.3 Net Income -282.4 -480.7 -418.3 Net Income available to Common -282.4 -480.7 -418.3 Tony Soprano recently joined the research department of the Investment Bank of Quebec as a financial analyst. His first task involves predicting predict future aggregate economic conditions. He notices that manufacturers' orders for defense capital goods such as small arms and navigation equipment increased more than expected and shipments rose solidly over the past year. Soprano believes this is a strong indication that business spending has been persistently increasing and thus suggests a positive view on the future aggregate economy condition. Q: Should Soprano predict future aggregate economic conditions using manufacturers' orders for defense capital goods? Why