Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $59,400. The equipment has

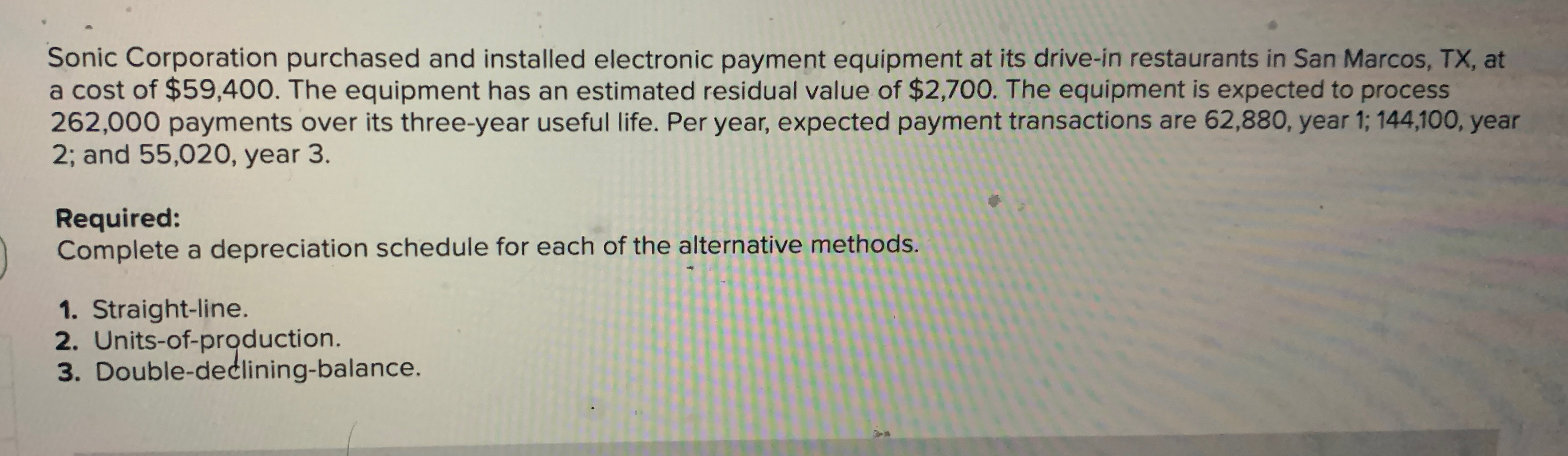

Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $59,400. The equipment has an estimated residual value of $2,700. The equipment is expected to process 262,000 payments over its three-year useful life. Per year, expected payment transactions are 62,880, year 1; 144,100, year 2; and 55,020, year 3. Required: Complete a depreciation schedule for each of the alternative methods. 1. Straight-line. 2. Units-of-production. 3. Double-declining-balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sonic Corporation Depreciation Schedule Information Cost 59400 Residual Value 2700 Useful Life 3 yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66429cfe94359_977874.pdf

180 KBs PDF File

66429cfe94359_977874.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started