Sony International has an investment opportunity to produce a new generation color TV. The required investment...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

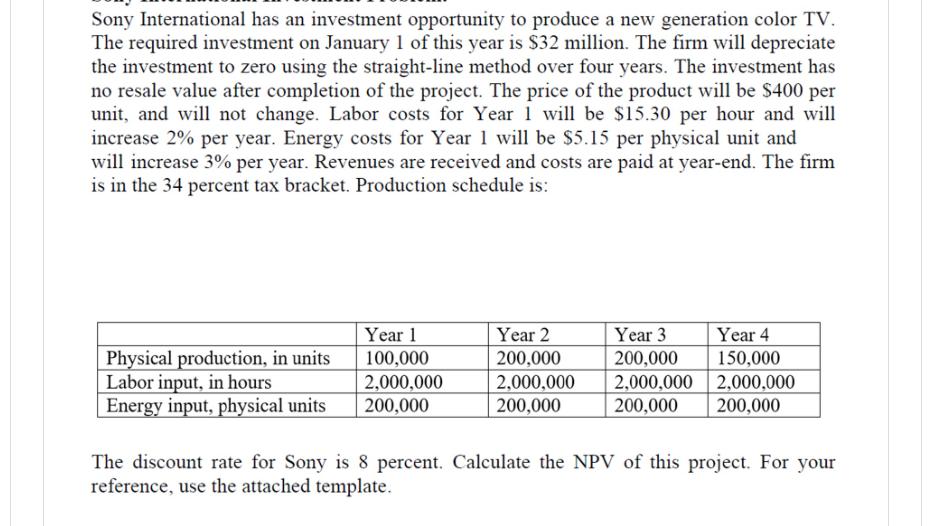

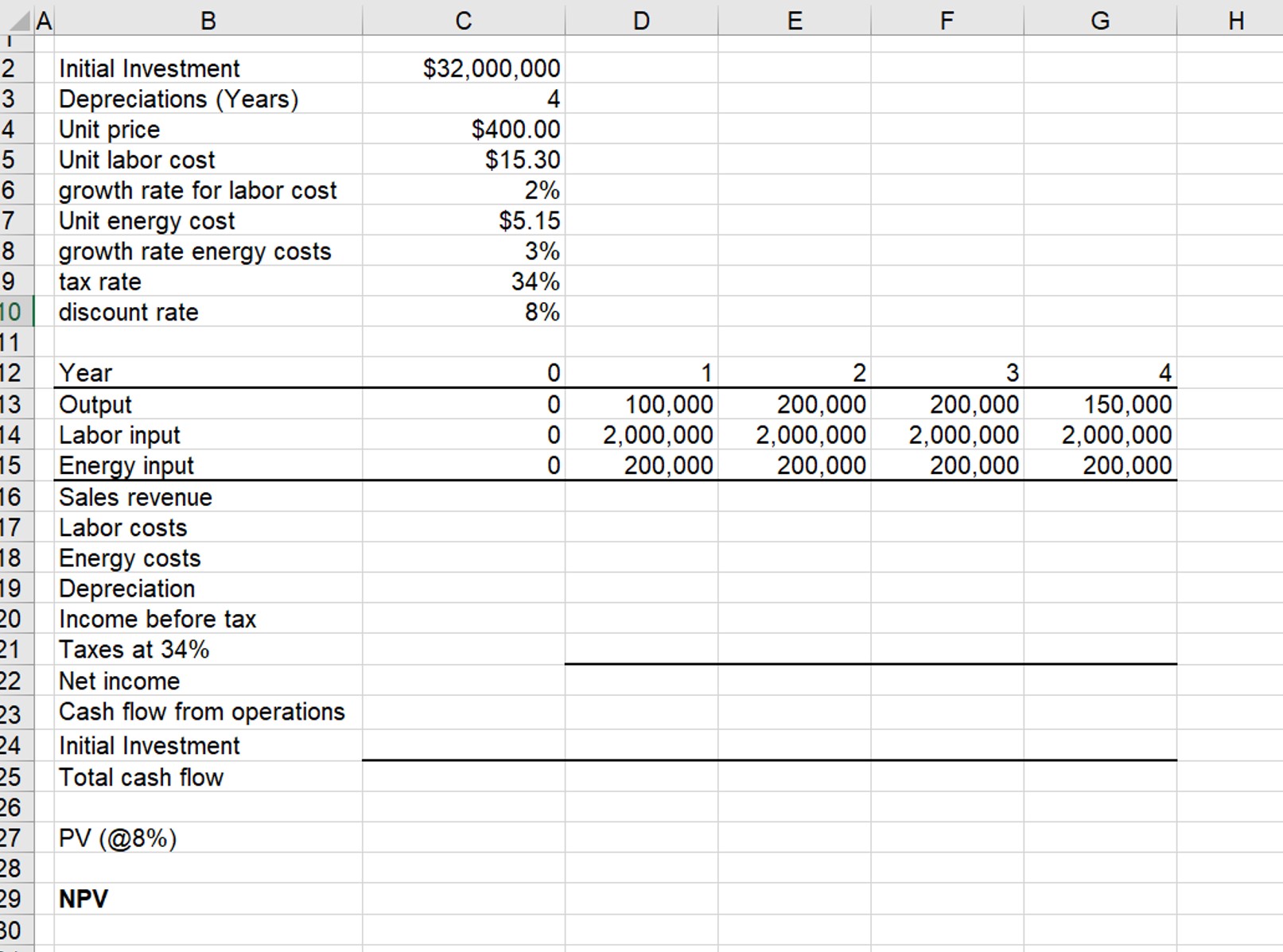

Sony International has an investment opportunity to produce a new generation color TV. The required investment on January 1 of this year is $32 million. The firm will depreciate the investment to zero using the straight-line method over four years. The investment has no resale value after completion of the project. The price of the product will be $400 per unit, and will not change. Labor costs for Year 1 will be $15.30 per hour and will increase 2% per year. Energy costs for Year 1 will be $5.15 per physical unit and will increase 3% per year. Revenues are received and costs are paid at year-end. The firm is in the 34 percent tax bracket. Production schedule is: Physical production, in units Year 1 100,000 Year 2 200,000 Year 3 200,000 Year 4 150,000 Labor input, in hours 2,000,000 2,000,000 2,000,000 2,000,000 Energy input, physical units 200,000 200,000 200,000 200,000 The discount rate for Sony is 8 percent. Calculate the NPV of this project. For your reference, use the attached template. A T 23 4 B Initial Investment Depreciations (Years) Unit price C D E FL G H $32,000,000 4 $400.00 5 Unit labor cost $15.30 6 growth rate for labor cost 2% 7 Unit energy cost $5.15 8 growth rate energy costs 3% 9 tax rate 34% 10 discount rate 8% 11 12 Year 0 1 2 3 4 13 Output 0 100,000 200,000 200,000 150,000 14 Labor input 0 2,000,000 2,000,000 2,000,000 2,000,000 15 Energy input 200,000 200,000 200,000 200,000 16 Sales revenue 17 Labor costs 18 Energy costs 19 Depreciation 20 Income before tax 21 Taxes at 34% 22 Net income 23 Cash flow from operations 24 Initial Investment 25 Total cash flow 26 27 PV (@8%) 28 29 NPV 30 Sony International has an investment opportunity to produce a new generation color TV. The required investment on January 1 of this year is $32 million. The firm will depreciate the investment to zero using the straight-line method over four years. The investment has no resale value after completion of the project. The price of the product will be $400 per unit, and will not change. Labor costs for Year 1 will be $15.30 per hour and will increase 2% per year. Energy costs for Year 1 will be $5.15 per physical unit and will increase 3% per year. Revenues are received and costs are paid at year-end. The firm is in the 34 percent tax bracket. Production schedule is: Physical production, in units Year 1 100,000 Year 2 200,000 Year 3 200,000 Year 4 150,000 Labor input, in hours 2,000,000 2,000,000 2,000,000 2,000,000 Energy input, physical units 200,000 200,000 200,000 200,000 The discount rate for Sony is 8 percent. Calculate the NPV of this project. For your reference, use the attached template. A T 23 4 B Initial Investment Depreciations (Years) Unit price C D E FL G H $32,000,000 4 $400.00 5 Unit labor cost $15.30 6 growth rate for labor cost 2% 7 Unit energy cost $5.15 8 growth rate energy costs 3% 9 tax rate 34% 10 discount rate 8% 11 12 Year 0 1 2 3 4 13 Output 0 100,000 200,000 200,000 150,000 14 Labor input 0 2,000,000 2,000,000 2,000,000 2,000,000 15 Energy input 200,000 200,000 200,000 200,000 16 Sales revenue 17 Labor costs 18 Energy costs 19 Depreciation 20 Income before tax 21 Taxes at 34% 22 Net income 23 Cash flow from operations 24 Initial Investment 25 Total cash flow 26 27 PV (@8%) 28 29 NPV 30

Expert Answer:

Answer rating: 100% (QA)

To calculate the Net Present Value NPV of the project we need to consider the cash flows over ... View the full answer

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-0077905200

3rd edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford

Posted Date:

Students also viewed these finance questions

-

Questions: REH Corporation's most recent dividend was $3 per share, its expected annual rate of dividend growth is 5%, and the required return is now 15%. A variety of proposals are being considered...

-

Sony International has an investment opportunity to produce a new stereo HDTV. The required investment on January 1 of this year is $75 million. The firm will depreciate the investment to zero using...

-

Sony International has an investment opportunity to produce a new stereo HDTV. The required investment on January 1 of this year is $85 million. The firm will depreciate the investment to zero using...

-

Solve each equation in Exercises. Round decimal answers to four decimal places. log 3 (x 2 + 17) - log3 (x + 5) = 1

-

What factors should entities consider in choosing alternative measurement models?

-

Find two positive numbers with product 484 and whose sum is a minimum. Enter your answers in increasing order. First number: Number Second Number: Number

-

How does use of a separate payroll checking account improve control?

-

Birmingham Bowling Ball Company (BBBC) uses a job-order costing system to accumulate manufacturing costs. The companys work-in-process on December 31, 20x3, consisted of one job (no. 3088), which was...

-

How is entrepreneurial thinking different from managerial thinking? Give examples from the coursework where you have been able to use or had the possibility to use entrepreneurial thinking. What did...

-

What does HF include in an MRO environment? What are some of the ways that HF can be minimized in this environment? What are common maintenance errors and the resulting economic impact?

-

What do you think the future of strategic human resource management and the challenges it faces on issues such as working virtually, satisfying the needs of a diverse workforce, the impact of social...

-

The following data from the just-completed year are taken from the accounting records of Eccles Company: Sales Direct labour cost $776,000 109,000 Raw material purchases 151,000 Selling expenses...

-

9 If in the initial position is set at yo = 0, what is the final position y? Enter the numerical value in Sl units. Type your answer..... 11 2 points What is the initial velocity voy? Enter the...

-

A shaft of solid circular cross section has a diameter, d. The shaft is subjected to the torque, T, and compressive load, P, as shown in the figure. T=Pd/8 (A) Define the in-plane stresses on a...

-

For sgupta20: 700 words, Original Work, References Included, Plagerism free. In text citation included. Write a paper in which you examine the field of abnormal psychology. Address the following...

-

You're going to be conducting a pre-response conference. What are the key points for your agenda? (You only need to use brief bullet points.) 2. You work for a state-chartered bank, and are not...

-

(a) How far away can a human eye distinguish two ear headlights 2.0 m apart? Consider only diffraction effects and assume an eye pupil diameter of 5.0 mm and a wavelength of 550 nm. (b) What is the...

-

Label each of the following characteristics of a corporation as either an (A) advantage or a (D) disadvantage: a. Organizational costs b. Continuity of existence c. Capital raising capability d....

-

Channey Corporation was organized on July 1. The company's charter authorizes 100,000 shares of \(\$ 2\) par value common stock. On August 1 , the attorney who helped organize the corporation...

-

The following information relates to Menlo, Inc.: a. Calculate the company's return on common stockholders' equity for 2018 and 2019. b. Calculate the company's dividend yield for 2018 and 2019. c....

Study smarter with the SolutionInn App