Answered step by step

Verified Expert Solution

Question

1 Approved Answer

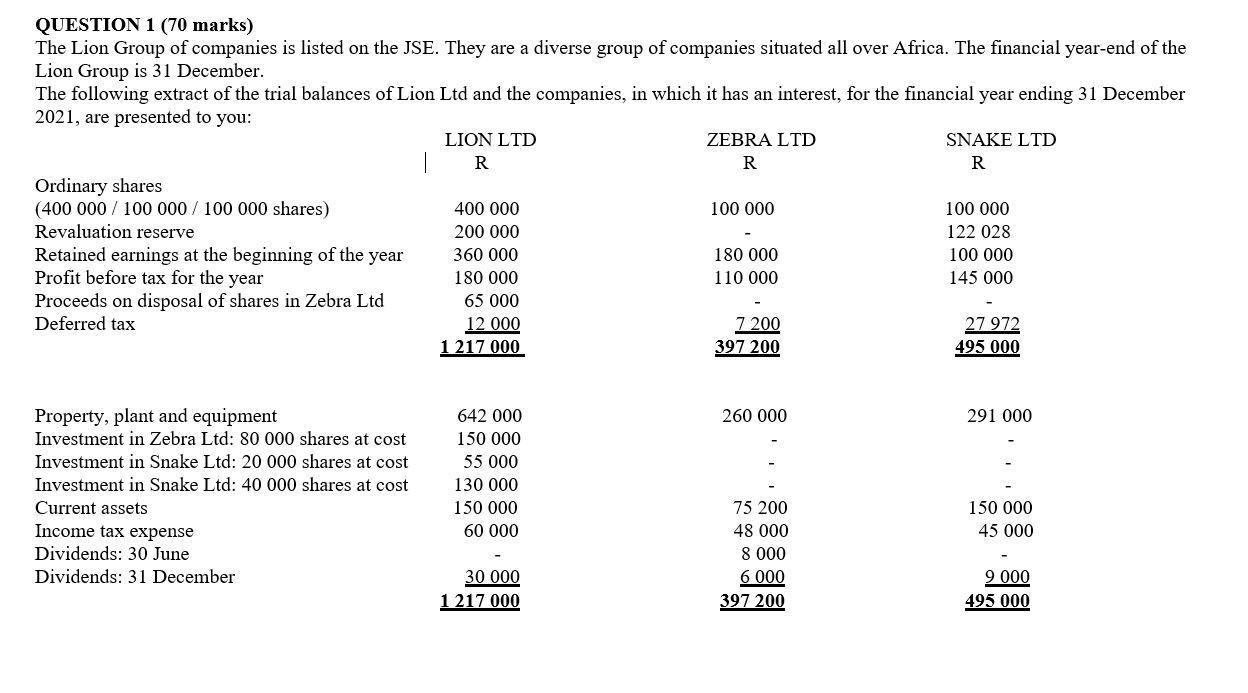

QUESTION 1 (70 marks) The Lion Group of companies is listed on the JSE. They are a diverse group of companies situated all over

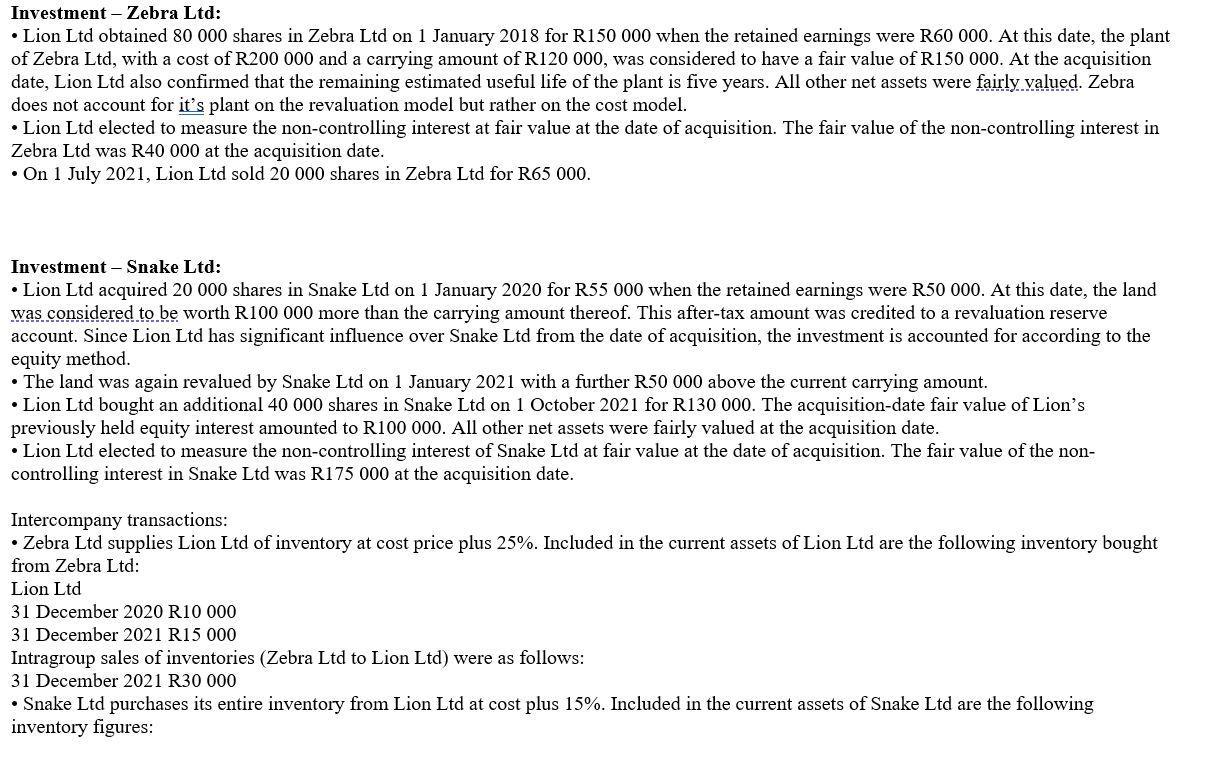

QUESTION 1 (70 marks) The Lion Group of companies is listed on the JSE. They are a diverse group of companies situated all over Africa. The financial year-end of the Lion Group is 31 December. The following extract of the trial balances of Lion Ltd and the companies, in which it has an interest, for the financial year ending 31 December 2021, are presented to you: Ordinary shares (400 000 100 000 / 100 000 shares) Revaluation reserve Retained earnings at the beginning of the year Profit before tax for the year Proceeds on disposal of shares in Zebra Ltd Deferred tax Property, plant and equipment Investment in Zebra Ltd: 80 000 shares at cost Investment in Snake Ltd: 20 000 shares ost Investment in Snake Ltd: 40 000 shares at cost Current assets Income tax expense Dividends: 30 June Dividends: 31 December LION LTD R 400 000 200 000 360 000 180 000 65 000 12 000 1 217 000 642 000 150 000 55 000 130 000 150 000 60 000 30 000 1 217 000 ZEBRA LTD R 100 000 180 000 110 000 7 200 397 200 260 000 75 200 48 000 8 000 6 000 397 200 SNAKE LTD R 100 000 122 028 100 000 145 000 27 972 495 000 291 000 150 000 45 000 9.000 495 000 Investment - Zebra Ltd: Lion Ltd obtained 80 000 shares in Zebra Ltd on 1 January 2018 for R150 000 when the retained earnings were R60 000. At this date, the plant of Zebra Ltd, with a cost of R200 000 and a carrying amount of R120 000, was considered to have a fair value of R150 000. At the acquisition date, Lion Ltd also confirmed that the remaining estimated useful life of the plant is five years. All other net assets were fairly valued. Zebra does not account for it's plant on the revaluation model but rather on the cost model. Lion Ltd elected to measure the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest in Zebra Ltd was R40 000 at the acquisition date. On 1 July 2021, Lion Ltd sold 20 000 shares in Zebra Ltd for R65 000. Investment - Snake Ltd: Lion Ltd acquired 20 000 shares in Snake Ltd on 1 January 2020 for R55 000 when the retained earnings were R50 000. At this date, the land was considered to be worth R100 000 more than the carrying amount thereof. This after-tax amount was credited to a revaluation reserve account. Since Lion Ltd has significant influence over Snake Ltd from the date of acquisition, the investment is accounted for according to the equity method. The land was again revalued by Snake Ltd on 1 January 2021 with a further R50 000 above the current carrying amount. Lion Ltd bought an additional 40 000 shares in Snake Ltd on 1 October 2021 for R130 000. The acquisition-date fair value of Lion's previously held equity interest amounted to R100 000. All other net assets were fairly valued at the acquisition date. Lion Ltd elected to measure the non-controlling interest of Snake Ltd at fair value at the date of acquisition. The fair value of the non- controlling interest in Snake Ltd was R175 000 at the acquisition date. Intercompany transactions: Zebra Ltd supplies Lion Ltd of inventory at cost price plus 25%. Included in the current assets of Lion Ltd are the following inventory bought from Zebra Ltd: Lion Ltd 31 December 2020 R10 000 31 December 2021 R15 000 Intragroup sales of inventories (Zebra Ltd to Lion Ltd) were as follows: 31 December 2021 R30 000 Snake Ltd purchases its entire inventory from Lion Ltd at cost plus 15%. Included in the current assets of Snake Ltd are the following inventory figures: Snake Ltd 31 December 2020 R30 000 31 December 2021 R60 000 Inventory is usually realised within three months. Additional information regarding investments: The profit before tax of Zebra Ltd and Snake Ltd was evenly earned during the year. The profit before tax of Lion Ltd includes dividends received. The group's policy is to account for associates on the equity method as none of the exceptions in IAS 28 apply. Lion Ltd measure investments at cost in terms of IAS 27.10 and IAS 28.44 in its separate financial statements. Goodwill was not considered impaired from the time the investments were acquired to the end of the current reporting period. . Assume a tax rate of 28% and CGT 66.6% thereof. Ignore Dividend tax. REQUIRED: 1.1) Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 of Lion Ltd Group to comply with International Financial Reporting Standards. (48 marks) 1.2) Prepare the Consolidated Statement of Changes in Equity for the year ended 31 December 2021 of Lion Ltd Group to comply with International Financial Repo Standards. (52 marks)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 Income Profit before tax of Lion Ltd 18000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started