Question

Soporific Games is expecting revenues of $782,431 next year. Last year, net property, plant, and equipment was $88,464 and debt was $11,469. Assume a

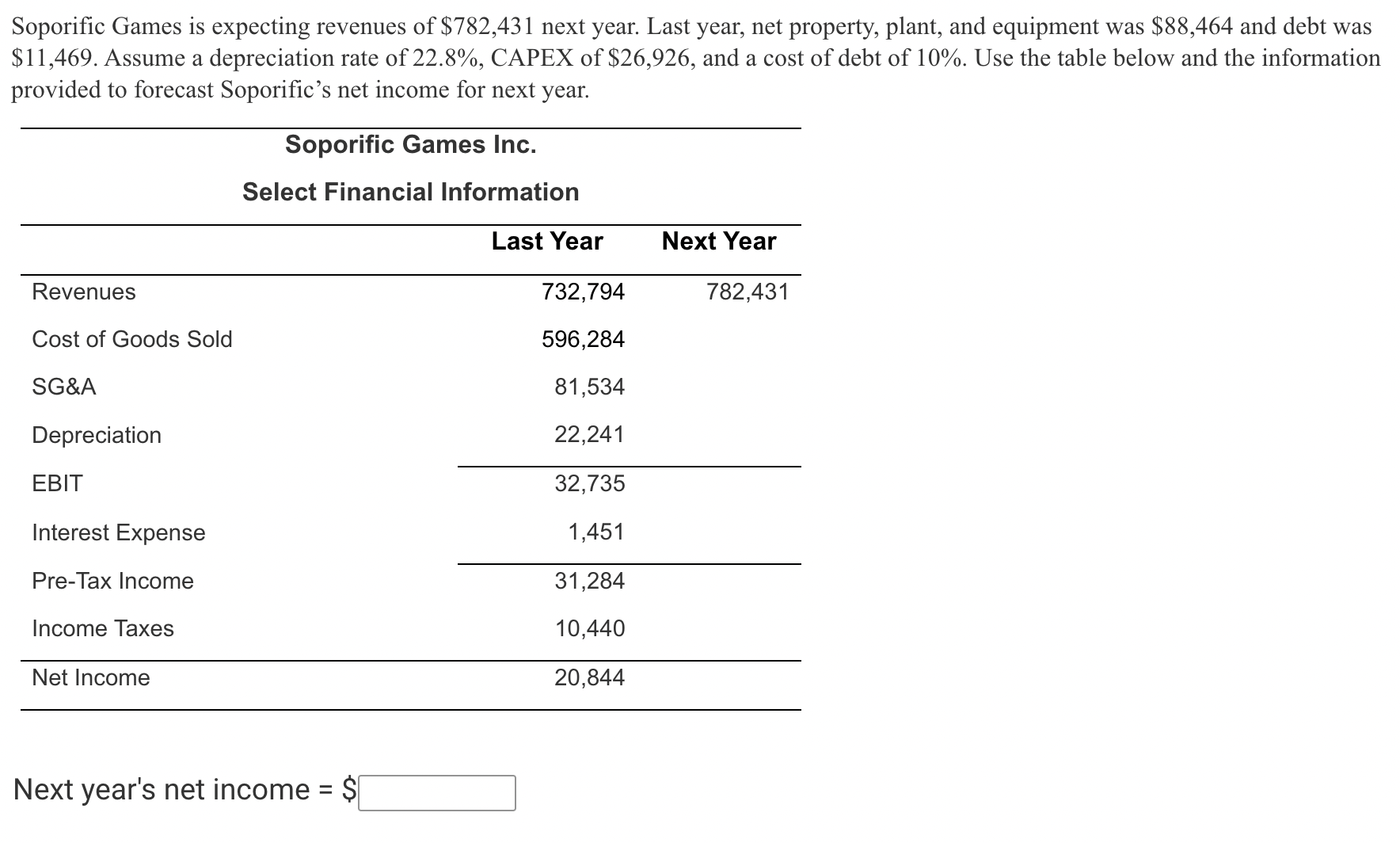

Soporific Games is expecting revenues of $782,431 next year. Last year, net property, plant, and equipment was $88,464 and debt was $11,469. Assume a depreciation rate of 22.8%, CAPEX of $26,926, and a cost of debt of 10%. Use the table below and the information provided to forecast Soporific's net income for next year. Soporific Games Inc. Select Financial Information Last Year Revenues Cost of Goods Sold SG&A Depreciation EBIT Interest Expense Pre-Tax Income Income Taxes Net Income Next year's net income = $ 732,794 596,284 81,534 22,241 32,735 1,451 31,284 10,440 20,844 Next Year 782,431

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To forecast Soporifics net income for next year we can start by calculating the depreciation exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis and Valuation

Authors: Clyde P. Stickney

6th edition

324302959, 978-0324302967, 324302967, 978-0324302950

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App