sorry about that

I submitted another

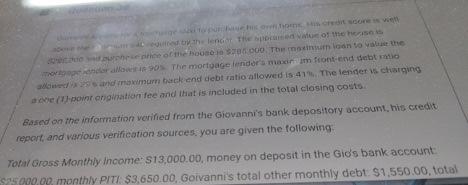

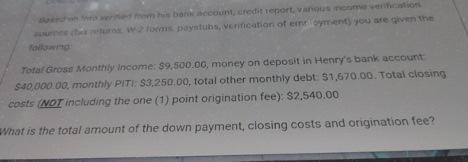

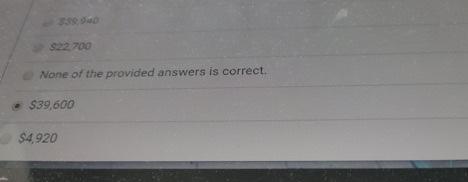

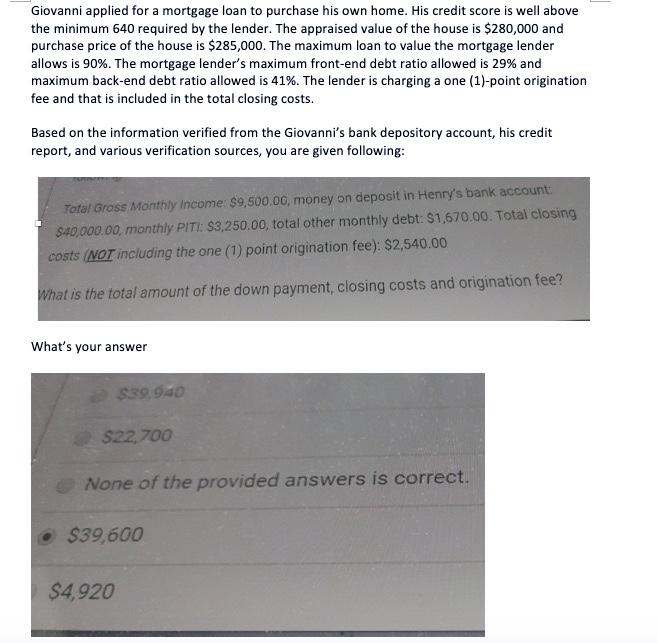

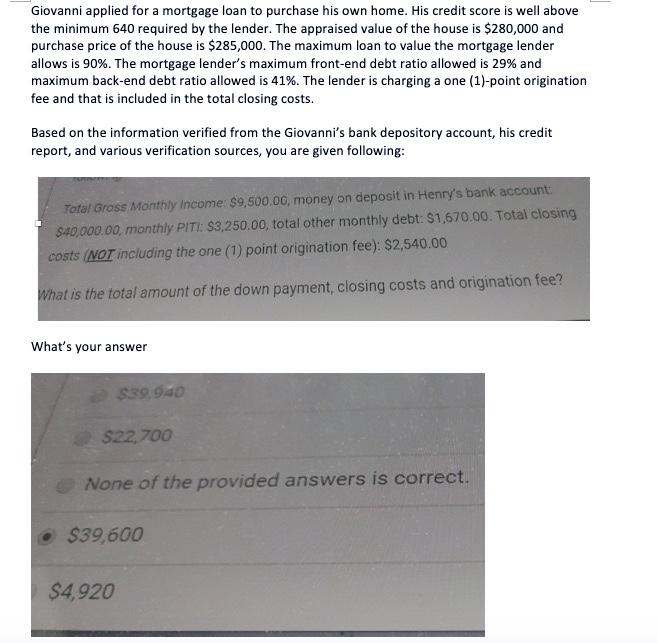

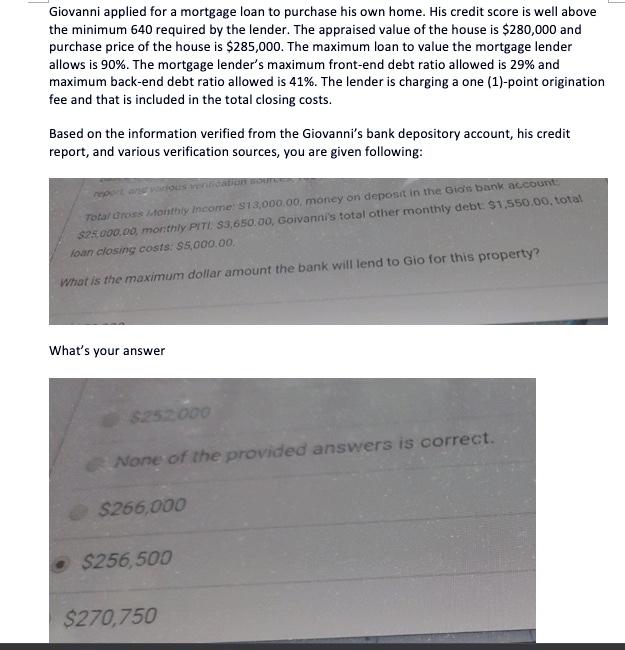

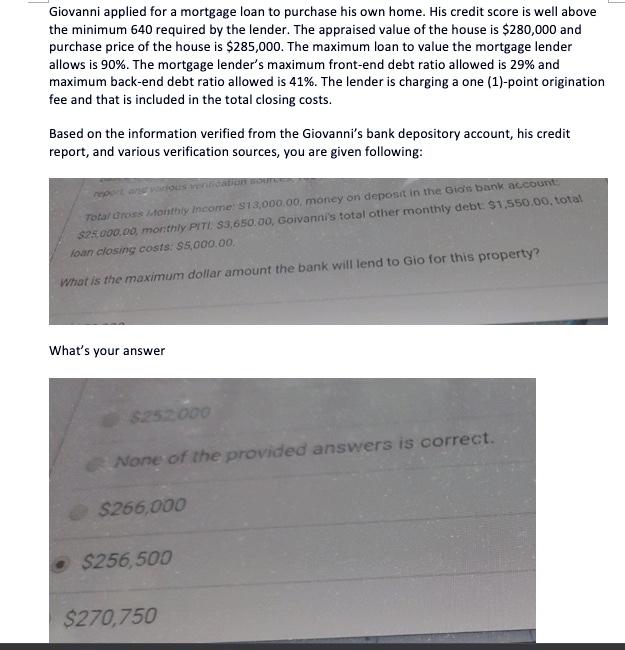

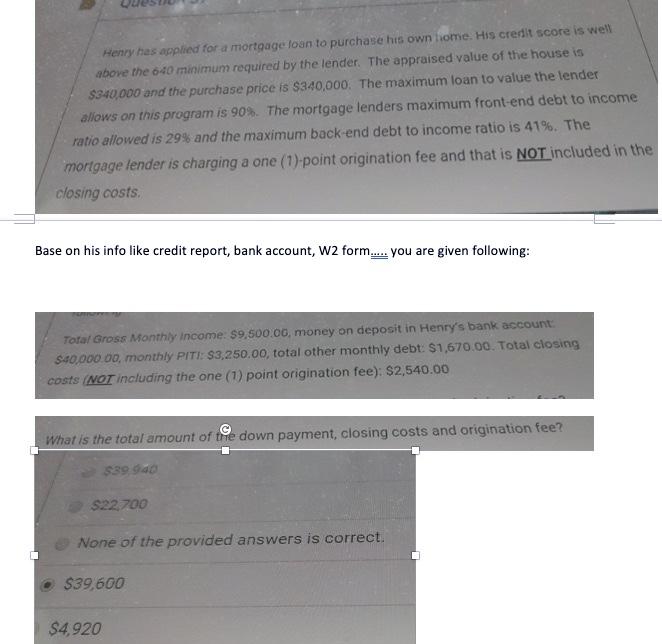

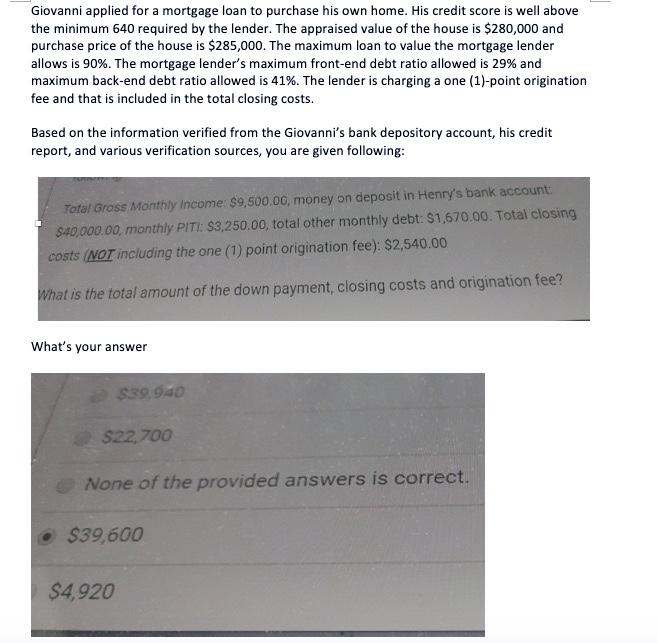

$22.700 None of the provided answers is correct. $39,600 $4.920 Giovanni applied for a mortgage loan to purchase his own home. His credit score is well above the minimum 640 required by the lender. The appraised value of the house is $280,000 and purchase price of the house is $285,000. The maximum loan to value the mortgage lender allows is 90%. The mortgage lender's maximum front-end debt ratio allowed is 29% and maximum back-end debt ratio allowed is 41%. The lender is charging a one (1)-point origination fee and that is included in the total closing costs. Based on the information verified from the Giovanni's bank depository account, his credit report, and various verification sources, you are given following: Total Crossbonthly income: 913,000.00 money on deposit in the Gio's bank account 525000.00 monthly PITE: $3,650.00, Goivanni's total other monthly debt $1,550.00 total loan closing costs $5,000.00 What is the maximum dollar amount the bank will lend to Gio for this property? What's your answer 5.252000 None of the provided answers is correct. $266,000 $256,500 $270,750 Henry has applied for a mortgage loan to purchase his own home. His credit score is well above the 640 minimum required by the lender. The appraised value of the house is $340,000 and the purchase price is $340,000. The maximum loan to value the lender allows on this program is 90%. The mortgage lenders maximum front-end debt to income ratio allowed is 29% and the maximum back-end debt to income ratio is 41%. The mortgage lender is charging a one (1) point origination fee and that is NOT included in the closing costs Base on his info like credit report, bank account, W2 form.... you are given following: Total Gross Monthly income: $9,500.00, money on deposit in Henry's bank account: $40,000.00 monthly PITI: $3,250.00, total other monthly debt: $1,670.00. Total closing costs NOT including the one (1) point origination fee): $2,540.00 What is the total amount of the down payment, closing costs and origination fee? $39 90 $22.700 None of the provided answers is correct. $39,600 $4.920 $22.700 None of the provided answers is correct. $39,600 $4.920 Giovanni applied for a mortgage loan to purchase his own home. His credit score is well above the minimum 640 required by the lender. The appraised value of the house is $280,000 and purchase price of the house is $285,000. The maximum loan to value the mortgage lender allows is 90%. The mortgage lender's maximum front-end debt ratio allowed is 29% and maximum back-end debt ratio allowed is 41%. The lender is charging a one (1)-point origination fee and that is included in the total closing costs. Based on the information verified from the Giovanni's bank depository account, his credit report, and various verification sources, you are given following: Total Crossbonthly income: 913,000.00 money on deposit in the Gio's bank account 525000.00 monthly PITE: $3,650.00, Goivanni's total other monthly debt $1,550.00 total loan closing costs $5,000.00 What is the maximum dollar amount the bank will lend to Gio for this property? What's your answer 5.252000 None of the provided answers is correct. $266,000 $256,500 $270,750 Henry has applied for a mortgage loan to purchase his own home. His credit score is well above the 640 minimum required by the lender. The appraised value of the house is $340,000 and the purchase price is $340,000. The maximum loan to value the lender allows on this program is 90%. The mortgage lenders maximum front-end debt to income ratio allowed is 29% and the maximum back-end debt to income ratio is 41%. The mortgage lender is charging a one (1) point origination fee and that is NOT included in the closing costs Base on his info like credit report, bank account, W2 form.... you are given following: Total Gross Monthly income: $9,500.00, money on deposit in Henry's bank account: $40,000.00 monthly PITI: $3,250.00, total other monthly debt: $1,670.00. Total closing costs NOT including the one (1) point origination fee): $2,540.00 What is the total amount of the down payment, closing costs and origination fee? $39 90 $22.700 None of the provided answers is correct. $39,600 $4.920