Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sorry the question says answer 3 out of the 5. C,D,E please wg uestIon. TOur answer or each part should be no longer, than two

sorry the question says answer 3 out of the 5. C,D,E please

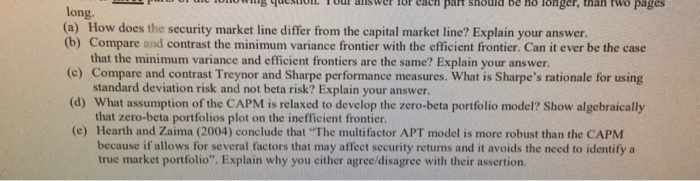

wg uestIon. TOur answer or each part should be no longer, than two pages long. (a) How does the security market line differ from the capital market line? Explain your answer. (b) Compare and contrast the minimum variance frontier with the efficient frontier. Can it ever be the case that the minimum variance and efficient frontiers are the same? Explain your answer. (c) Compare and contrast Treynor and Sharpe performance measures. What is Sharpe's rationale for using standard deviation risk and not beta risk? Explain your answer. (d) What assumption of the CAPM is relaxed to develop the zero-beta portfolio model? Show algebraically that zero-beta portfolios plot on the inefficient frontier. (e) Hearth and Zaima (2004) conclude that "The multifactor APT model is more robust than the CAPM because if allows for several factors that may affect security returns and it avoids the need to identify a truc market portfolio". Explain why you cither agree/disagree with their assertion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started