Sorry they are out of order!

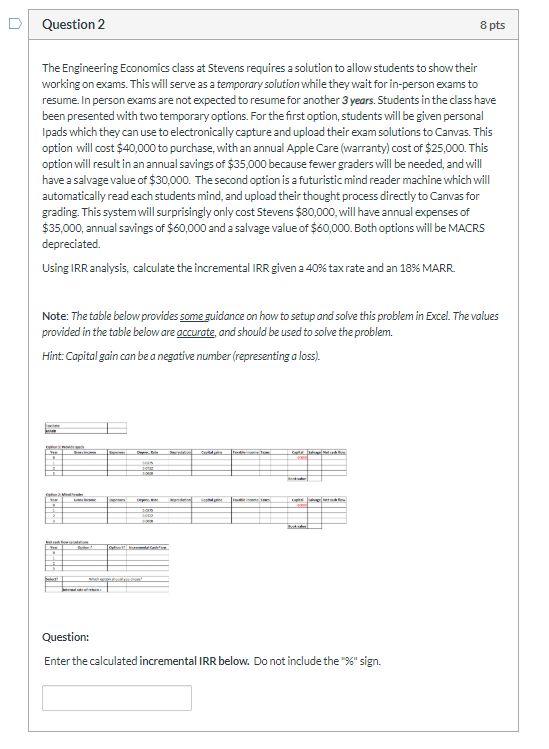

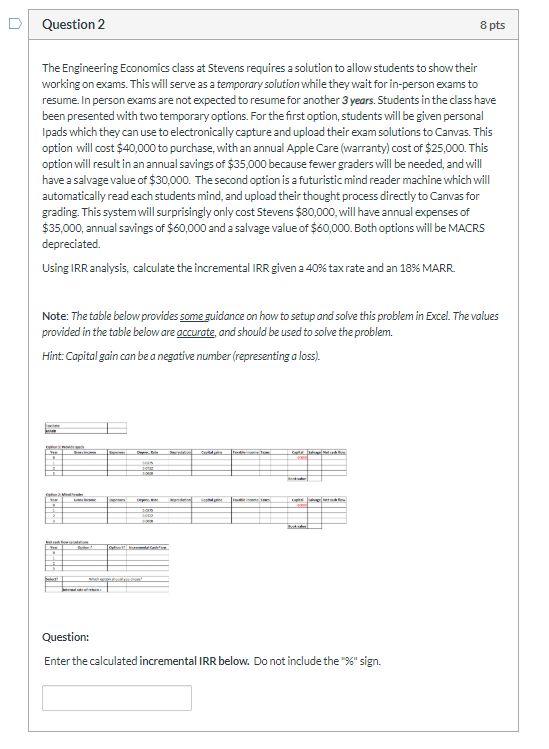

Question 3 2 pts The Engineering Economics class at Stevens requires a solution to allow students to show their working on exams. This will serve as a temporary solution while they wait for in-person exams to resume. In person exams are not expected to resume for another 3 years. Students in the class have been presented with two temporary options. For the first option, students will be given personal Ipads which they can use to electronically capture and upload their exam solutions to Canvas. This option will cost $40,000 to purchase, with an annual Apple Care (warranty) cost of $25,000. This option will result in an annual savings of $35,000 because fewer graders will be needed, and will have a salvage value of $30,000. The second option is a futuristic mind reader machine which will automatically read each students mind, and upload their thought process directly to Canvas for grading. This system will surprisingly only cost Stevens $30,000, will have annual expenses of $35,000, annual savings of $60,000 and a salvage value of $60,000. Both options will be MACRS depreciated. Question: Based on your IRR analysis, which is the best option? No partial credit is available for this question O Mind Reader Option Ipad Option O None of the Options Both Options D Question 2 8 pts The Engineering Economics class at Stevens requires a solution to allow students to show their working on exams. This will serve as a temporary solution while they wait for in-person exams to resume. In person exams are not expected to resume for another 3 years. Students in the class have been presented with two temporary options. For the first option, students will be given personal Ipads which they can use to electronically capture and upload their exam solutions to Canvas. This option will cost $40,000 to purchase, with an annual Apple Care (warranty) cost of $25,000. This option will result in an annual savings of $35,000 because fewer graders will be needed, and will have a salvage value of $30,000. The second option is a futuristic mind reader machine which will automatically read each students mind, and upload their thought process directly to Canvas for grading. This system will surprisingly only cost Stevens $30,000, will have annual expenses of $35,000, annual savings of $60,000 and a salvage value of $60,000. Both options will be MACRS depreciated. Using IRR analysis, calculate the incremental IRR given a 40% tax rate and an 18% MARR. Note: The table below provides some guidance on how to setup and solve this problem in Excel. The values provided in the table below are accurate and should be used to solve the problem. Hint: Capital gain can be a negative number (representing a loss). Question: Enter the calculated incremental IRR below. Do not include the %" sign. Question 3 2 pts The Engineering Economics class at Stevens requires a solution to allow students to show their working on exams. This will serve as a temporary solution while they wait for in-person exams to resume. In person exams are not expected to resume for another 3 years. Students in the class have been presented with two temporary options. For the first option, students will be given personal Ipads which they can use to electronically capture and upload their exam solutions to Canvas. This option will cost $40,000 to purchase, with an annual Apple Care (warranty) cost of $25,000. This option will result in an annual savings of $35,000 because fewer graders will be needed, and will have a salvage value of $30,000. The second option is a futuristic mind reader machine which will automatically read each students mind, and upload their thought process directly to Canvas for grading. This system will surprisingly only cost Stevens $30,000, will have annual expenses of $35,000, annual savings of $60,000 and a salvage value of $60,000. Both options will be MACRS depreciated. Question: Based on your IRR analysis, which is the best option? No partial credit is available for this question O Mind Reader Option Ipad Option O None of the Options Both Options D Question 2 8 pts The Engineering Economics class at Stevens requires a solution to allow students to show their working on exams. This will serve as a temporary solution while they wait for in-person exams to resume. In person exams are not expected to resume for another 3 years. Students in the class have been presented with two temporary options. For the first option, students will be given personal Ipads which they can use to electronically capture and upload their exam solutions to Canvas. This option will cost $40,000 to purchase, with an annual Apple Care (warranty) cost of $25,000. This option will result in an annual savings of $35,000 because fewer graders will be needed, and will have a salvage value of $30,000. The second option is a futuristic mind reader machine which will automatically read each students mind, and upload their thought process directly to Canvas for grading. This system will surprisingly only cost Stevens $30,000, will have annual expenses of $35,000, annual savings of $60,000 and a salvage value of $60,000. Both options will be MACRS depreciated. Using IRR analysis, calculate the incremental IRR given a 40% tax rate and an 18% MARR. Note: The table below provides some guidance on how to setup and solve this problem in Excel. The values provided in the table below are accurate and should be used to solve the problem. Hint: Capital gain can be a negative number (representing a loss). Question: Enter the calculated incremental IRR below. Do not include the %" sign