Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sorry this question is so long. Question 5 Pt.2 The following income and expenso accounts appeared in the book accounting records of Ramage Corporation, ap

Sorry this question is so long. Question 5 Pt.2

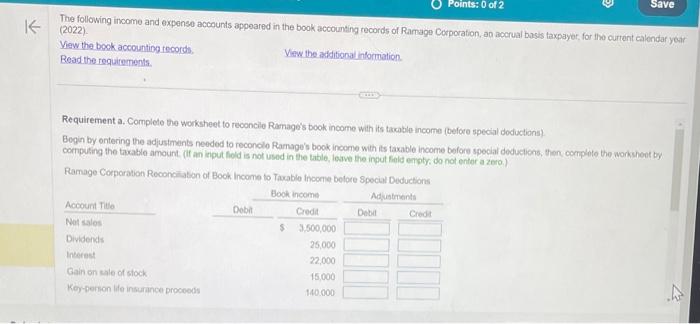

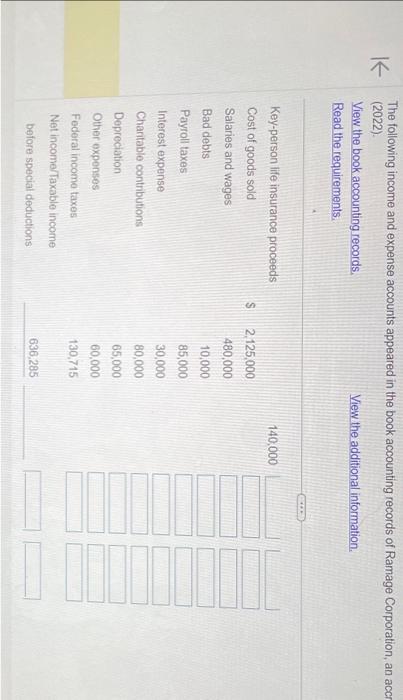

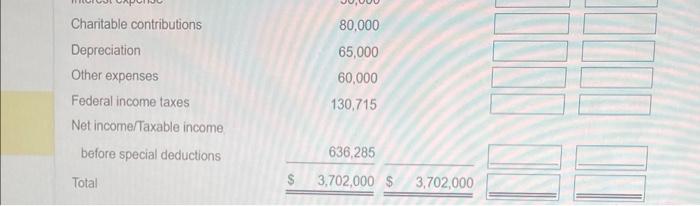

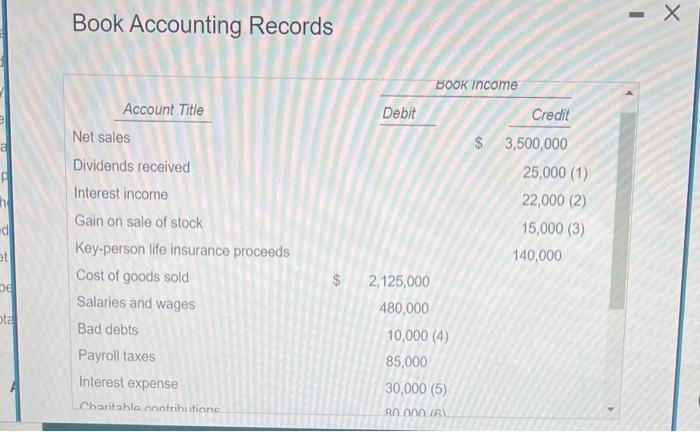

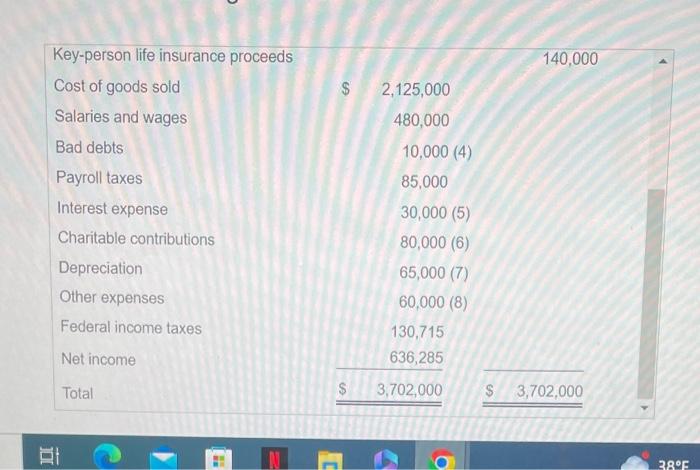

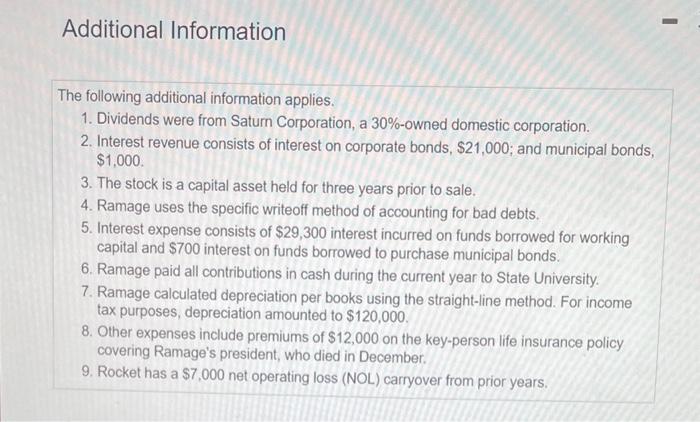

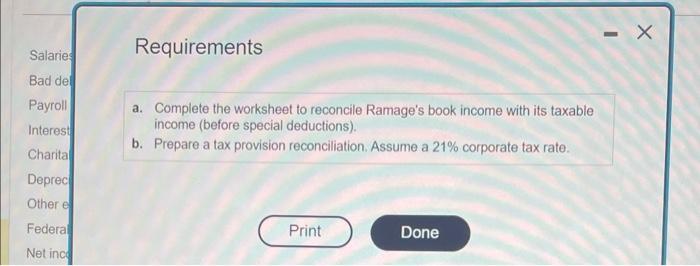

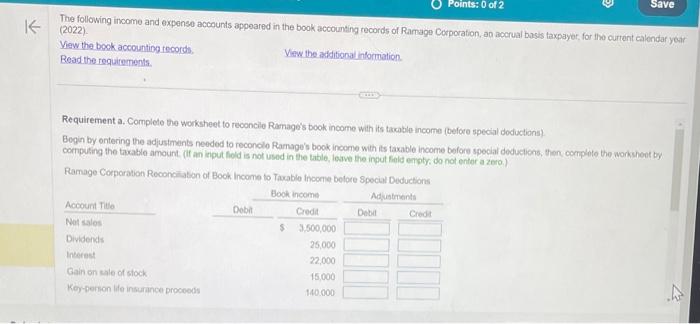

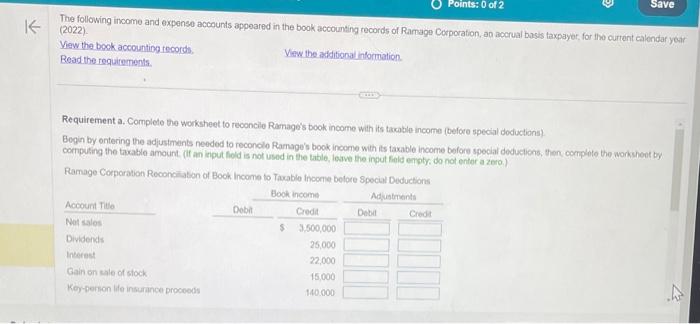

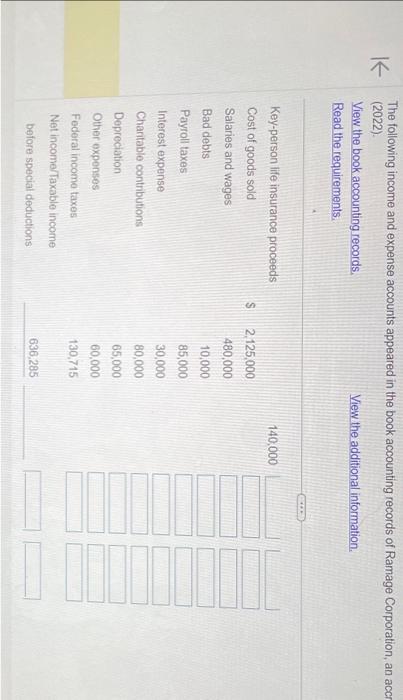

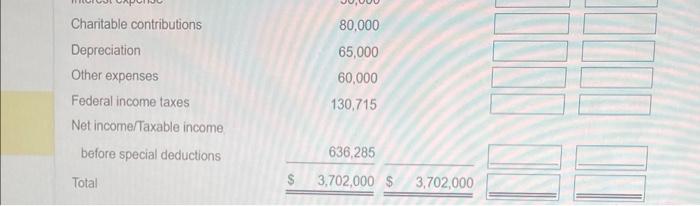

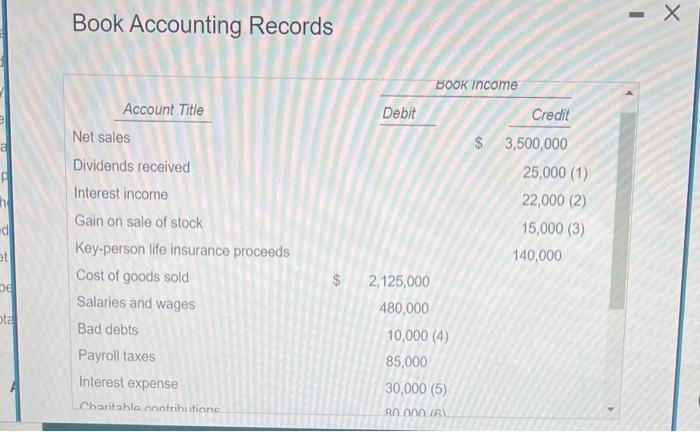

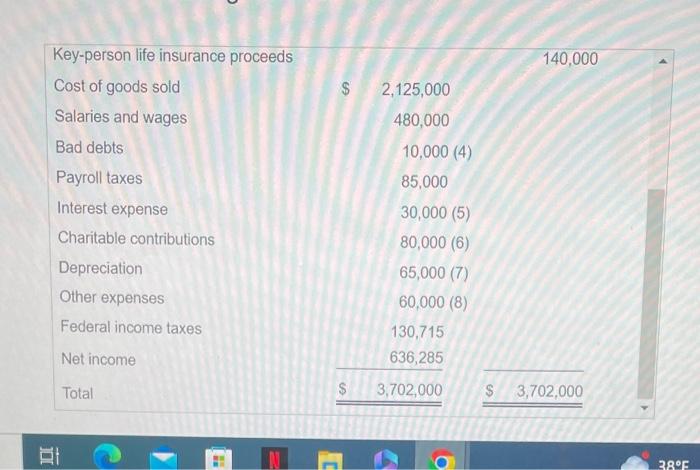

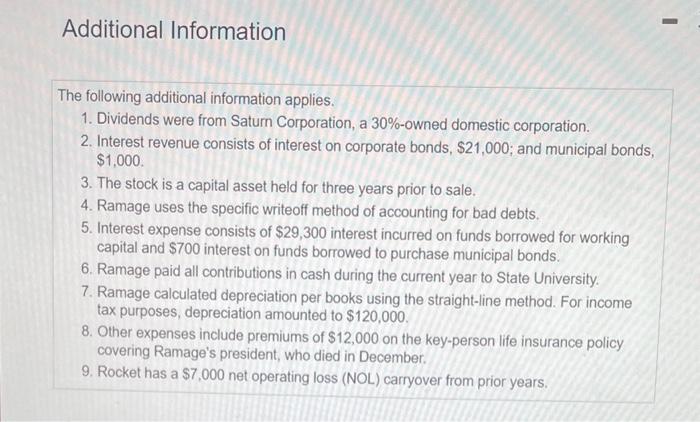

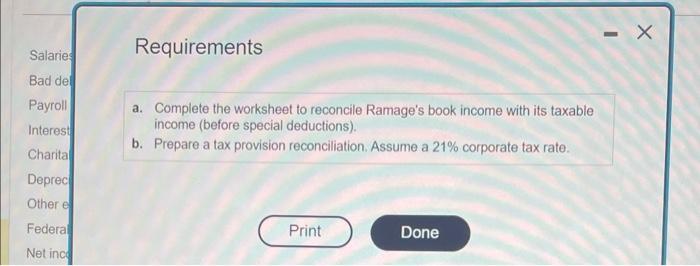

The following income and expenso accounts appeared in the book accounting records of Ramage Corporation, ap acerual basks taxpayer, for tho curtent calendar you (2022) View the book accountiog tecords. Read the roquirements. Vifw the additional infortiation. Requirement a. Complete the worksheet to reconcile Ramage's book income with its tacoble income (before special doductions) Begin by ontering the adjusiments needed to reconclo Ramage's book income with its taxable income belore spocial deduclicns, then complate the worksoet by cornpesing the takable amount (if an input fiodd is not used in the table, leave the input field erpoty, do not entor a zero.). The following income and expense accounts appeared in the book accounting records of Ramage Corporation, an acc (2022). View the book accounting records. Read the requirements. Charitable contributions 80.000 Depreciation 65,000 Other expenses 60,000 Federal income taxes 130,715 Net incomerTaxable income before special deductions Total Book Accounting Records Additional Information The following additional information applies. 1. Dividends were from Saturn Corporation, a 30%-owned domestic corporation. 2. Interest revenue consists of interest on corporate bonds, $21,000; and municipal bonds, $1,000 3. The stock is a capital asset held for three years prior to sale. 4. Ramage uses the specific writeoff method of accounting for bad debts. 5. Interest expense consists of $29,300 interest incurred on funds borrowed for working capital and $700 interest on funds borrowed to purchase municipal bonds. 6. Ramage paid all contributions in cash during the current year to State University. 7. Ramage calculated depreciation per books using the straight-line method. For income tax purposes, depreciation amounted to $120,000. 8. Other expenses include premiums of $12,000 on the key-person life insurance policy covering Ramage's president, who died in December. 9. Rocket has a $7,000 net operating loss (NOL) carryover from prior years. Requirements a. Complete the worksheet to reconcile Ramage's book income with its taxable income (before special deductions). b. Prepare a tax provision reconciliation. Assume a 21% corporate tax rate. The following income and expenso accounts appeared in the book accounting records of Ramage Corporation, ap acerual basks taxpayer, for tho curtent calendar you (2022) View the book accountiog tecords. Read the roquirements. Vifw the additional infortiation. Requirement a. Complete the worksheet to reconcile Ramage's book income with its tacoble income (before special doductions) Begin by ontering the adjusiments needed to reconclo Ramage's book income with its taxable income belore spocial deduclicns, then complate the worksoet by cornpesing the takable amount (if an input fiodd is not used in the table, leave the input field erpoty, do not entor a zero.). The following income and expense accounts appeared in the book accounting records of Ramage Corporation, an acc (2022). View the book accounting records. Read the requirements. Charitable contributions 80.000 Depreciation 65,000 Other expenses 60,000 Federal income taxes 130,715 Net incomerTaxable income before special deductions Total Book Accounting Records Additional Information The following additional information applies. 1. Dividends were from Saturn Corporation, a 30%-owned domestic corporation. 2. Interest revenue consists of interest on corporate bonds, $21,000; and municipal bonds, $1,000 3. The stock is a capital asset held for three years prior to sale. 4. Ramage uses the specific writeoff method of accounting for bad debts. 5. Interest expense consists of $29,300 interest incurred on funds borrowed for working capital and $700 interest on funds borrowed to purchase municipal bonds. 6. Ramage paid all contributions in cash during the current year to State University. 7. Ramage calculated depreciation per books using the straight-line method. For income tax purposes, depreciation amounted to $120,000. 8. Other expenses include premiums of $12,000 on the key-person life insurance policy covering Ramage's president, who died in December. 9. Rocket has a $7,000 net operating loss (NOL) carryover from prior years. Requirements a. Complete the worksheet to reconcile Ramage's book income with its taxable income (before special deductions). b. Prepare a tax provision reconciliation. Assume a 21% corporate tax rate

The following income and expenso accounts appeared in the book accounting records of Ramage Corporation, ap acerual basks taxpayer, for tho curtent calendar you (2022) View the book accountiog tecords. Read the roquirements. Vifw the additional infortiation. Requirement a. Complete the worksheet to reconcile Ramage's book income with its tacoble income (before special doductions) Begin by ontering the adjusiments needed to reconclo Ramage's book income with its taxable income belore spocial deduclicns, then complate the worksoet by cornpesing the takable amount (if an input fiodd is not used in the table, leave the input field erpoty, do not entor a zero.). The following income and expense accounts appeared in the book accounting records of Ramage Corporation, an acc (2022). View the book accounting records. Read the requirements. Charitable contributions 80.000 Depreciation 65,000 Other expenses 60,000 Federal income taxes 130,715 Net incomerTaxable income before special deductions Total Book Accounting Records Additional Information The following additional information applies. 1. Dividends were from Saturn Corporation, a 30%-owned domestic corporation. 2. Interest revenue consists of interest on corporate bonds, $21,000; and municipal bonds, $1,000 3. The stock is a capital asset held for three years prior to sale. 4. Ramage uses the specific writeoff method of accounting for bad debts. 5. Interest expense consists of $29,300 interest incurred on funds borrowed for working capital and $700 interest on funds borrowed to purchase municipal bonds. 6. Ramage paid all contributions in cash during the current year to State University. 7. Ramage calculated depreciation per books using the straight-line method. For income tax purposes, depreciation amounted to $120,000. 8. Other expenses include premiums of $12,000 on the key-person life insurance policy covering Ramage's president, who died in December. 9. Rocket has a $7,000 net operating loss (NOL) carryover from prior years. Requirements a. Complete the worksheet to reconcile Ramage's book income with its taxable income (before special deductions). b. Prepare a tax provision reconciliation. Assume a 21% corporate tax rate. The following income and expenso accounts appeared in the book accounting records of Ramage Corporation, ap acerual basks taxpayer, for tho curtent calendar you (2022) View the book accountiog tecords. Read the roquirements. Vifw the additional infortiation. Requirement a. Complete the worksheet to reconcile Ramage's book income with its tacoble income (before special doductions) Begin by ontering the adjusiments needed to reconclo Ramage's book income with its taxable income belore spocial deduclicns, then complate the worksoet by cornpesing the takable amount (if an input fiodd is not used in the table, leave the input field erpoty, do not entor a zero.). The following income and expense accounts appeared in the book accounting records of Ramage Corporation, an acc (2022). View the book accounting records. Read the requirements. Charitable contributions 80.000 Depreciation 65,000 Other expenses 60,000 Federal income taxes 130,715 Net incomerTaxable income before special deductions Total Book Accounting Records Additional Information The following additional information applies. 1. Dividends were from Saturn Corporation, a 30%-owned domestic corporation. 2. Interest revenue consists of interest on corporate bonds, $21,000; and municipal bonds, $1,000 3. The stock is a capital asset held for three years prior to sale. 4. Ramage uses the specific writeoff method of accounting for bad debts. 5. Interest expense consists of $29,300 interest incurred on funds borrowed for working capital and $700 interest on funds borrowed to purchase municipal bonds. 6. Ramage paid all contributions in cash during the current year to State University. 7. Ramage calculated depreciation per books using the straight-line method. For income tax purposes, depreciation amounted to $120,000. 8. Other expenses include premiums of $12,000 on the key-person life insurance policy covering Ramage's president, who died in December. 9. Rocket has a $7,000 net operating loss (NOL) carryover from prior years. Requirements a. Complete the worksheet to reconcile Ramage's book income with its taxable income (before special deductions). b. Prepare a tax provision reconciliation. Assume a 21% corporate tax rate

Sorry this question is so long. Question 5 Pt.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started