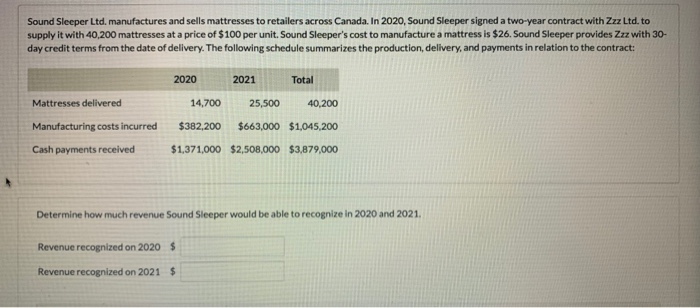

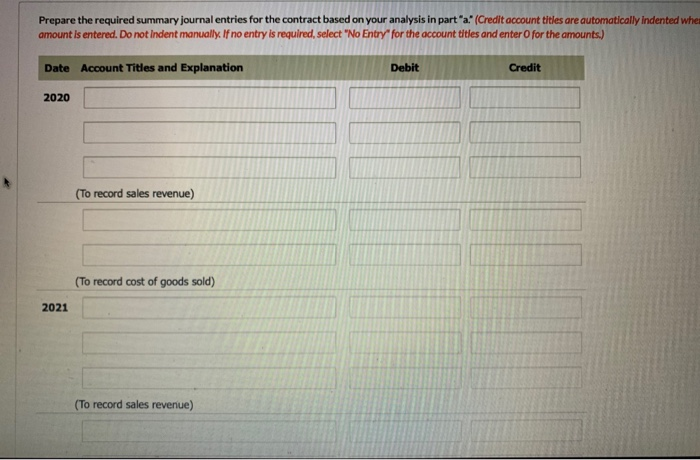

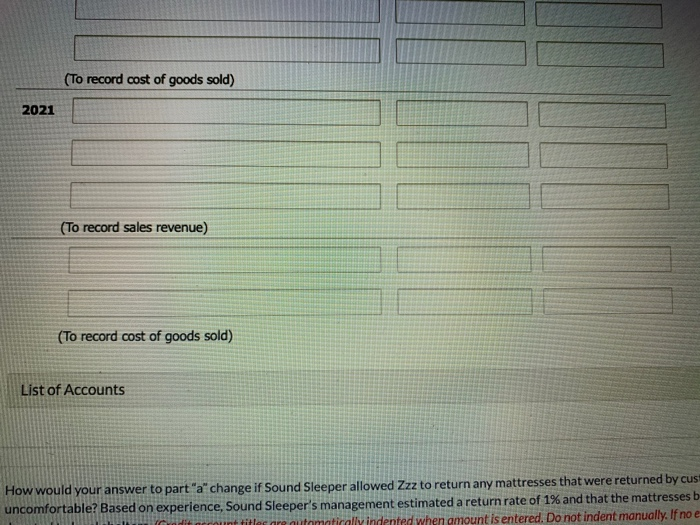

Sound Sleeper Ltd. manufactures and sells mattresses to retailers across Canada. In 2020, Sound Sleeper signed a two-year contract with Zzz Ltd. to supply it with 40,200 mattresses at a price of $100 per unit. Sound Sleeper's cost to manufacture a mattress is $26. Sound Sleeper provides Zzz with 30- day credit terms from the date of delivery. The following schedule summarizes the production, delivery, and payments in relation to the contract: Mattresses delivered 2020 2021 Total 14,700 25,500 40,200 $382,200 $663,000 $1,045,200 $1,371,000 $2,508,000 $3,879,000 Manufacturing costs incurred Cash payments received Determine how much revenue Sound Sleeper would be able to recognize in 2020 and 2021. Revenue recognized on 2020 $ Revenue recognized on 2021 $ Prepare the required summary journal entries for the contract based on your analysis in part"a." (Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit 2020 (To record sales revenue) (To record cost of goods sold) 2021 (To record sales revenue) (To record cost of goods sold) 2021 (To record sales revenue) (To record cost of goods sold) List of Accounts How would your answer to part"a" change if Sound Sleeper allowed Zzz to return any mattresses that were returned by cus uncomfortable? Based on experience, Sound Sleeper's management estimated a return rate of 1% and that the mattresses b it tilanne trimating indented when amount is entered. Do not indent manually. If no How would your answer to part"a change if Sound Sleeper allowed Zzz to return any mattresses that were returned by customers who found them uncomfortable? Based on experience, Sound Sleeper's management estimated a return rate of 1% and that the mattresses being returned would be donated to local shelters. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Credit 2020 (To record sales revenue) (To record sales revenue) (To record cost of goods sold) 2021 (To record sales revenue) (To record cost of goods sold) List of Accounts