Question

South America Limited uses a job-order costing system and applies manufacturing overheads to jobs using a predetermined overhead rate based on direct labour-hours. Last year

South America Limited uses a job-order costing system and applies manufacturing overheads to jobs using a predetermined overhead rate based on direct labour-hours. Last year manufacturing overhead and direct labour-hours were estimated at $90,000 and 30,000 hours, respectively.

In August, the company completed Job #50, among others. Job #50 contained 525 units, for whichmaterial costs were $9000, and labour costs were $5000 at $10 per hour. At the end of the year, it was determined that the company worked 28,000 direct labour-hours for the year and incurred $84,000 in actual manufacturing overhead costs.

Based on the above information, the companys current assistant accountant, Healy Abid, needs to determine the unit product cost that would appear on the job cost sheet for Job #50 as well as how much would be the overapplied or underapplied overhead amount and their impact on the net operating income. However, Healy has recently joined the company and this is her first assignment. She also does not have much experience in this regard. She has asked for help from her manager, Josh Chen, to help her with this issue.

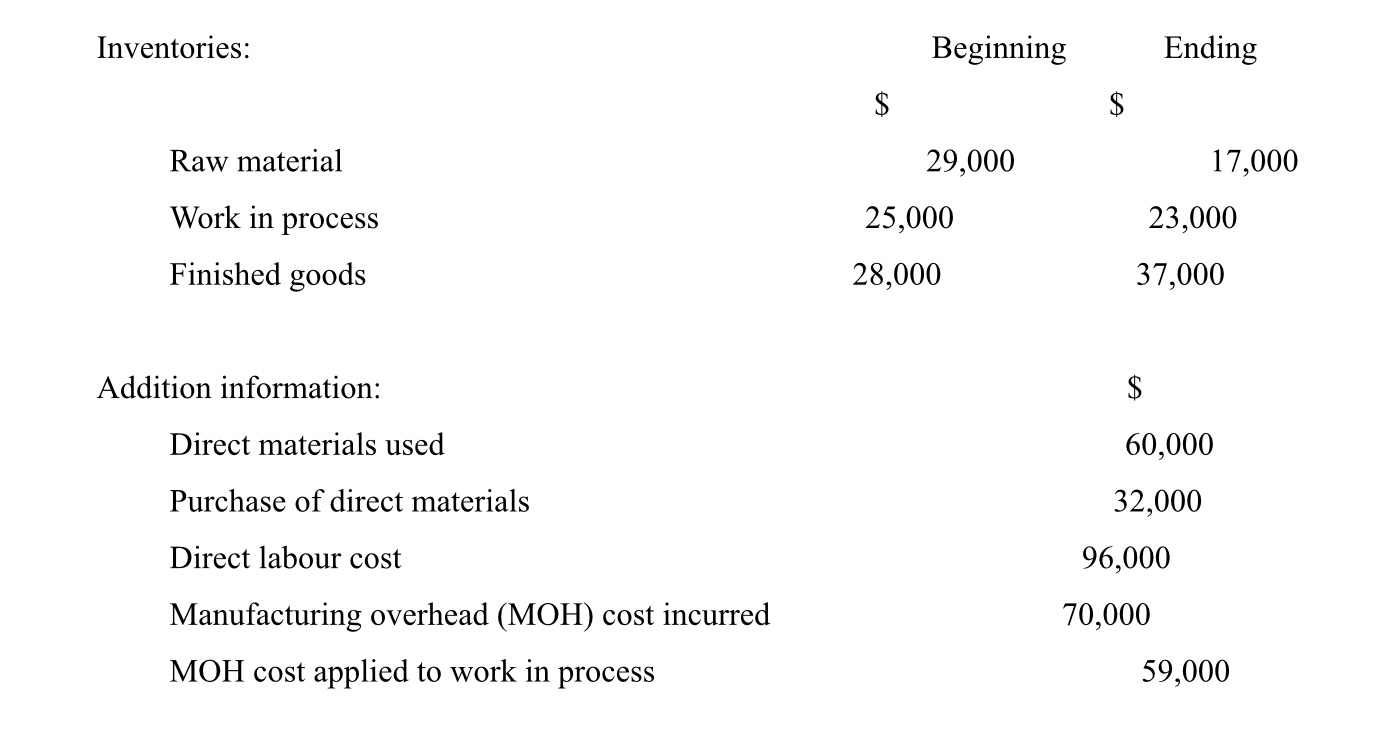

Healy also got a second assignment where she needs to calculate the costs of goods manufactured based on the below information:

However, Healy believes there is inadequate information here to calculate the cost of goodsmanufactured. This is because she cannot see any figure for total manufacturing costs that are an important part of the costs of goods manufactured calculation. Being lost, she again asked for Joshs help in this regard.

Required (show your calculation)

\begin{tabular}{lcc} Inventories: & Beginning & Ending \\ & $ & $ \\ Raw material & 29,000 & 17,000 \\ Work in process & 25,000 & 23,000 \\ Finished goods & 28,000 & 37,000 \\ & \\ Addition information: & $ \\ Direct materials used & 60,000 \\ Purchase of direct materials & 32,000 \\ Direct labour cost & 96,000 \\ Manufacturing overhead (MOH) cost incurred & 70,000 \\ MOH cost applied to work in process & \multicolumn{2}{c}{59,000} \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started