Answered step by step

Verified Expert Solution

Question

1 Approved Answer

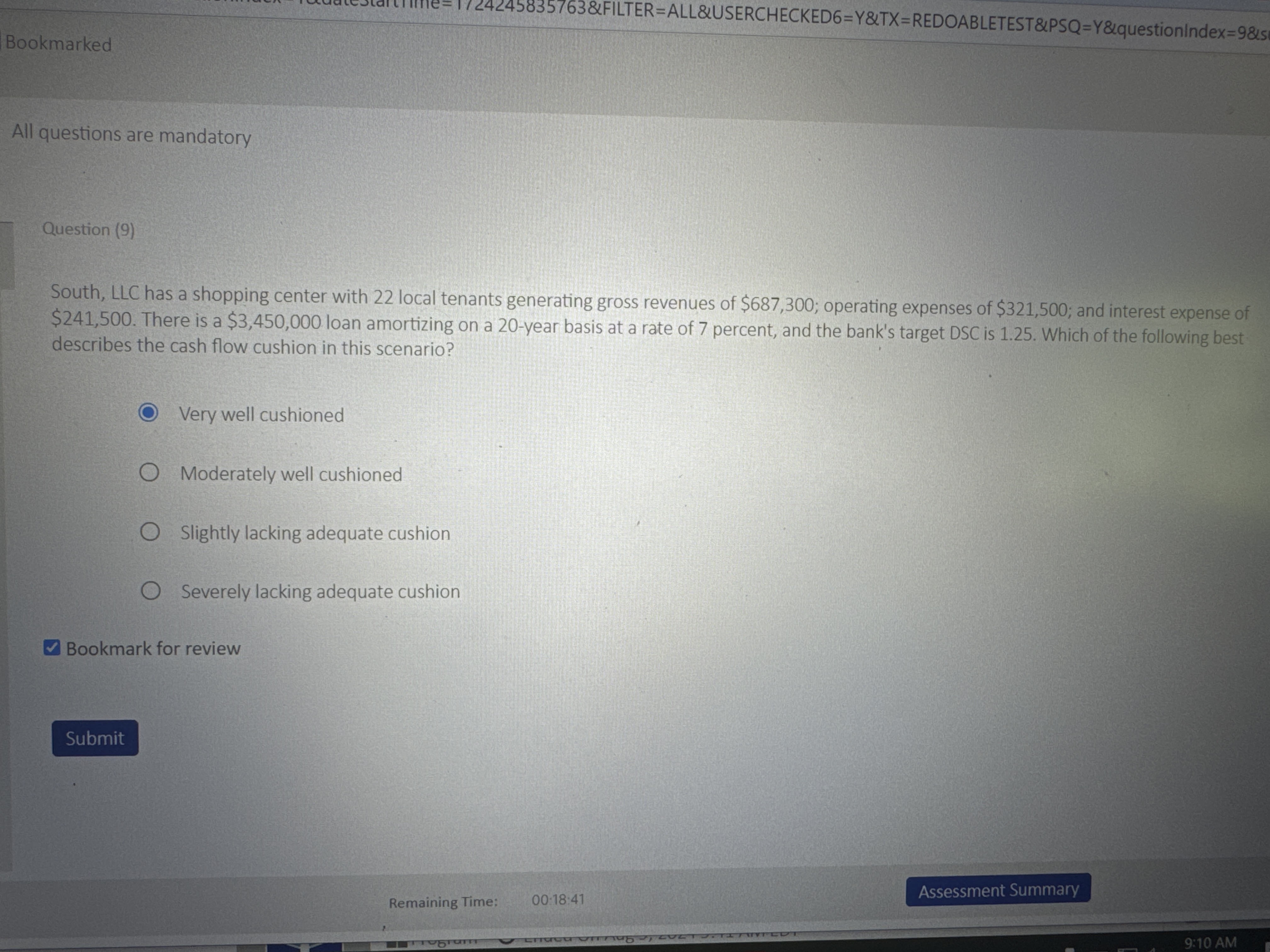

South, LLC has a shopping center with 2 2 local tenants generating gross revenues of $ 6 8 7 , 3 0 0 ; operating

South, LLC has a shopping center with local tenants generating gross revenues of $; operating expenses of $; and interest expense of

$ There is a $ loan amortizing on a year basis at a rate of percent, and the bank's target DSC is Which of the following best

describes the cash flow cushion in this scenario?

Very well cushioned

Moderately well cushioned

Slightly lacking adequate cushion

Severely lacking adequate cushion

Bookmark for review

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started