Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Southem Machine & Dye bought a machine on January 2, 2023, for $414,000 The machine was expected to remain in service for three years

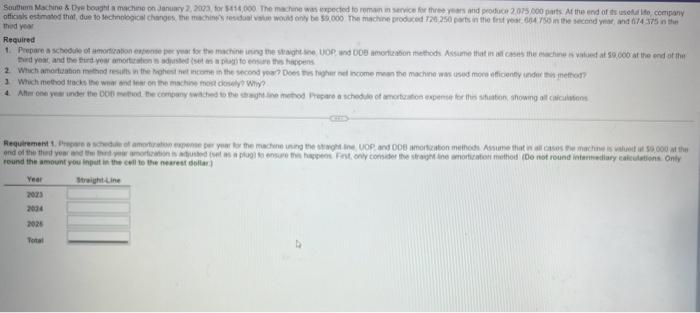

Southem Machine & Dye bought a machine on January 2, 2023, for $414,000 The machine was expected to remain in service for three years and produce 2.075 000 parts: At the end of its useful ito, company officials estimated that, due to technological changes, the machine's residual value would only be $5,000 The machine produced 720,250 parts in the first year 604 750 in the second year, and 674 375 in the thed year Required 1. Prepare a schedule of amortization expense per year for the machine using the straight line, UOP, and DDB amortization methods. Assume that in all cases the machine is valued at $9,000 at the end of the third year, and the third year amortization in adusted (set as a plug) to ensure this happens 2. Which amortization method results in the highest net income in the second year? Does this higher net income mean the machine was used more efficiently under this method? 3 Which method tracks the wear and tear on the machine most closely? Why? 4. After one year under the DOB method the company switched to the straight line method Prepare a schedule of amortization expense for this situation, showing all calculations Requirement 1. Prepare a schedule of amortization expense per year for the machine using the straight ine UOP and DDB amortization methods. Assume that in all cases the machine is valued at $9,000 at the end of the third year and the third year amortization is adjusted (set as a plug) to ensure this happens. First, only consider the straight line amortization method (Do not round intermediary calculations Only round the amount you input in the cell to the nearest dollar) Year Straight-Line 2023 2034 2026 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started