Question

Southern Corp., an S corporation, has no corporate E&P from years as a C corp. At the end of the year, it distributes a

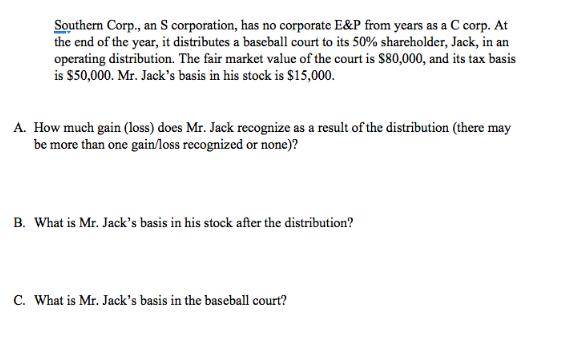

Southern Corp., an S corporation, has no corporate E&P from years as a C corp. At the end of the year, it distributes a baseball court to its 50% shareholder, Jack, in an operating distribution. The fair market value of the court is $80,000, and its tax basis is $50,000. Mr. Jack's basis in his stock is $15,000. A. How much gain (loss) does Mr. Jack recognize as a result of the distribution (there may be more than one gain/loss recognized or none)? B. What is Mr. Jack's basis in his stock after the distribution? C. What is Mr. Jack's basis in the baseball court?

Step by Step Solution

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Management And Economics Abbreviated

Authors: Gerald Keller

10th Edition

978-1-305-0821, 1285869648, 1-305-08219-2, 978-1285869643

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App