Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Southville Corporation owns assets that can be valued at RM8 million or RM3.5 million in one-year time with equal probability. The risk-free rate

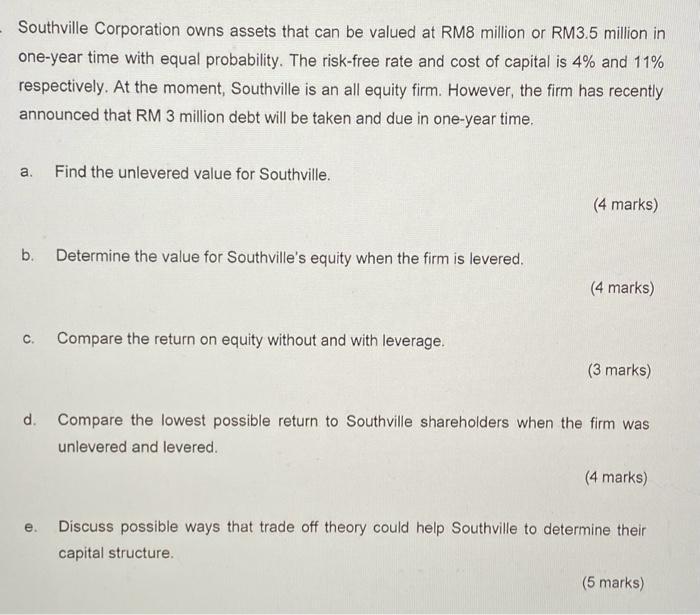

- Southville Corporation owns assets that can be valued at RM8 million or RM3.5 million in one-year time with equal probability. The risk-free rate and cost of capital is 4% and 11% respectively. At the moment, Southville is an all equity firm. However, the firm has recently announced that RM 3 million debt will be taken and due in one-year time. a. Find the unlevered value for Southville. b. Determine the value for Southville's equity when the firm is levered. C. Compare the return on equity without and with leverage. (4 marks) (4 marks) (3 marks) d. Compare the lowest possible return to Southville shareholders when the firm was unlevered and levered. (4 marks) e. Discuss possible ways that trade off theory could help Southville to determine their capital structure. (5 marks)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Unlevered Value Probability of RM8 million x RM8 million Probability of RM35 million x RM35 millio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started