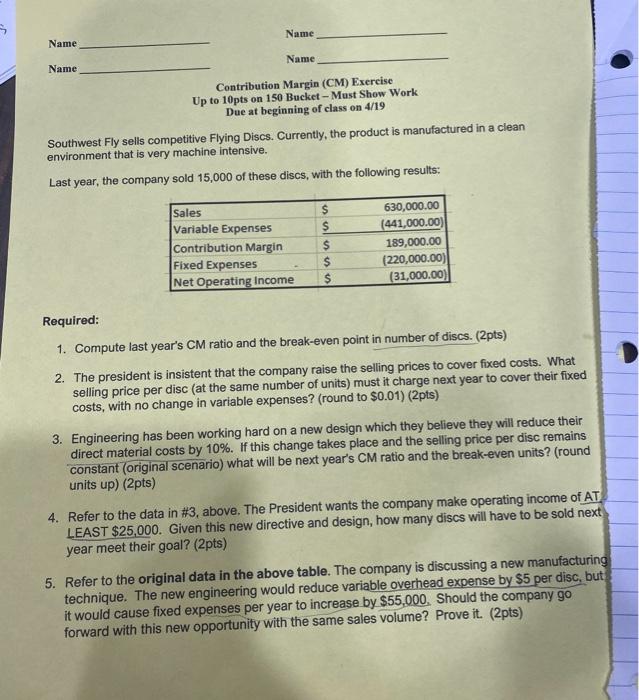

Southwest Fly sells competitive Flying Discs. Currently, the product is manufactured in a clean environment that is very machine intensive. Last year, the company sold 15,000 of these discs, with the following results: Required: 1. Compute last year's CM ratio and the break-even point in number of discs. (2pts) 2. The president is insistent that the company raise the selling prices to cover fixed costs. What selling price per disc (at the same number of units) must it charge next year to cover their fixed costs, with no change in variable expenses? (round to $0.01 ) (2pts) 3. Engineering has been working hard on a new design which they believe they will reduce their direct material costs by 10%. If this change takes place and the selling price per disc remains constant (original scenario) what will be next year's CM ratio and the break-even units? (round units up) (2pts) 4. Refer to the data in #3, above. The President wants the company make operating income of AT LEAST $25,000. Given this new directive and design, how many discs will have to be sold next year meet their goal? (2pts) 5. Refer to the original data in the above table. The company is discussing a new manufacturing technique. The new engineering would reduce variable overhead expense by $5 per disc, but it would cause fixed expenses per year to increase by $55,000. Should the company go forward with this new opportunity with the same sales volume? Prove it. (2pts) Southwest Fly sells competitive Flying Discs. Currently, the product is manufactured in a clean environment that is very machine intensive. Last year, the company sold 15,000 of these discs, with the following results: Required: 1. Compute last year's CM ratio and the break-even point in number of discs. (2pts) 2. The president is insistent that the company raise the selling prices to cover fixed costs. What selling price per disc (at the same number of units) must it charge next year to cover their fixed costs, with no change in variable expenses? (round to $0.01 ) (2pts) 3. Engineering has been working hard on a new design which they believe they will reduce their direct material costs by 10%. If this change takes place and the selling price per disc remains constant (original scenario) what will be next year's CM ratio and the break-even units? (round units up) (2pts) 4. Refer to the data in #3, above. The President wants the company make operating income of AT LEAST $25,000. Given this new directive and design, how many discs will have to be sold next year meet their goal? (2pts) 5. Refer to the original data in the above table. The company is discussing a new manufacturing technique. The new engineering would reduce variable overhead expense by $5 per disc, but it would cause fixed expenses per year to increase by $55,000. Should the company go forward with this new opportunity with the same sales volume? Prove it. (2pts)