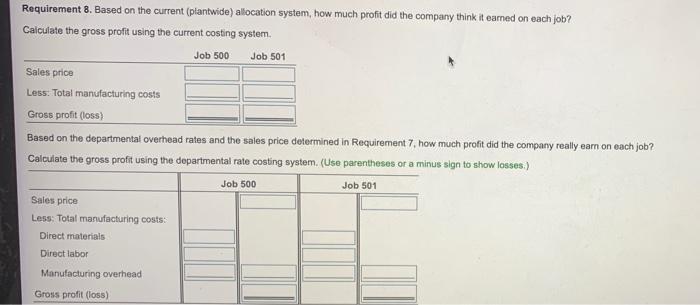

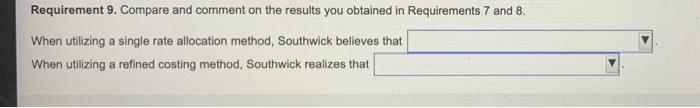

Southwick Products manufactures is products in two separate departments Machining and Assembly Total manufacturing overhead costs for the year are budged 51,056.000. Othis amount, the Stachning Department incurs 5600.000 (primarly for machine operation and depreciation while the Assembly Department nous 458.000 The company estimates that wil hour 4000 machine hours in the Machining Department and 9.600 direct bor hours (1.600 in the Machining Department and 2.000 in the Assembly Department during the ye ick the icon to view the additional in Read the requirements Requirement 1, Compute the company's current plantside overhead rate Round your answer to the newest coat) Bon by determining the tomus, the computer Jose Di nost Requirement 2. Computronederoverhead Derning the form the compound you to dow) Machining Aby DOLU Data table Southwick Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department: Machining Assembly Department Department Job 500 9 MH 15 DL hours 2 DL hours Job 501 18 MH 15 DL hours 2 DL hours Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benefits total $30 per direct labor hour. Southwick Products prices its products at 120% of total manufacturing costs. the other Requirement 3. Which job (Job 500 or Job 501) uses more of the company's resources? Explain of the company's resources machine hours than the other job. The accounting system should show that one job actuly Requirement 4. Compute the total amount of overhead located to each job if the company uses is current plantside overhead rale. Job 500 Job 501 Total direct labor hours - Plantwide allocation rate Overhead allocation Requirements. Compute the total amount of overhead allocated to each jobs it the company uses departmental overhead whes. Job 500 Job 501 Overhead location - Machining Department Overhead stocation Assembly Department Tot overhead location Requirement &. Do tom of the location tema accurately reflect the resources cach job red? Explain The single plantwide overhead resigned of overhead to both jobs. The departmental rates mision 10400 901 an Job 60 du sooms Requirement 7. Compute the total manufacturing out and sales price of each job uning the company's curent plantwide overhead rate. Round amounts to the nearest dolar Enter the percentage as a whole Job 500 Job 501 Directa Director Manching oversed Total manufacturing Markup for pring () Sales Requirement 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Calculate the gross profit using the current costing system Job 500 Job 501 Sales price Less: Total manufacturing costs Gross profit (loss) Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did the company really earn on each job? Calculate the gross profit using the departmental rate costing system. (Use parentheses or a minus sign to show losses.) Job 500 Job 501 Sales price Less: Total manufacturing costs: Direct materials Direct labor Manufacturing overhead Gross profit (loss) Requirement 9. Compare and comment on the results you obtained in Requirements 7 and 8. When utilizing a single rate allocation method, Southwick believes that When utilizing a refined costing method, Southwick realizes that