Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Sovereign Default Model) Let it be a risk free rate on the T-Bills. Let D, be the amount of debt. When the government issues

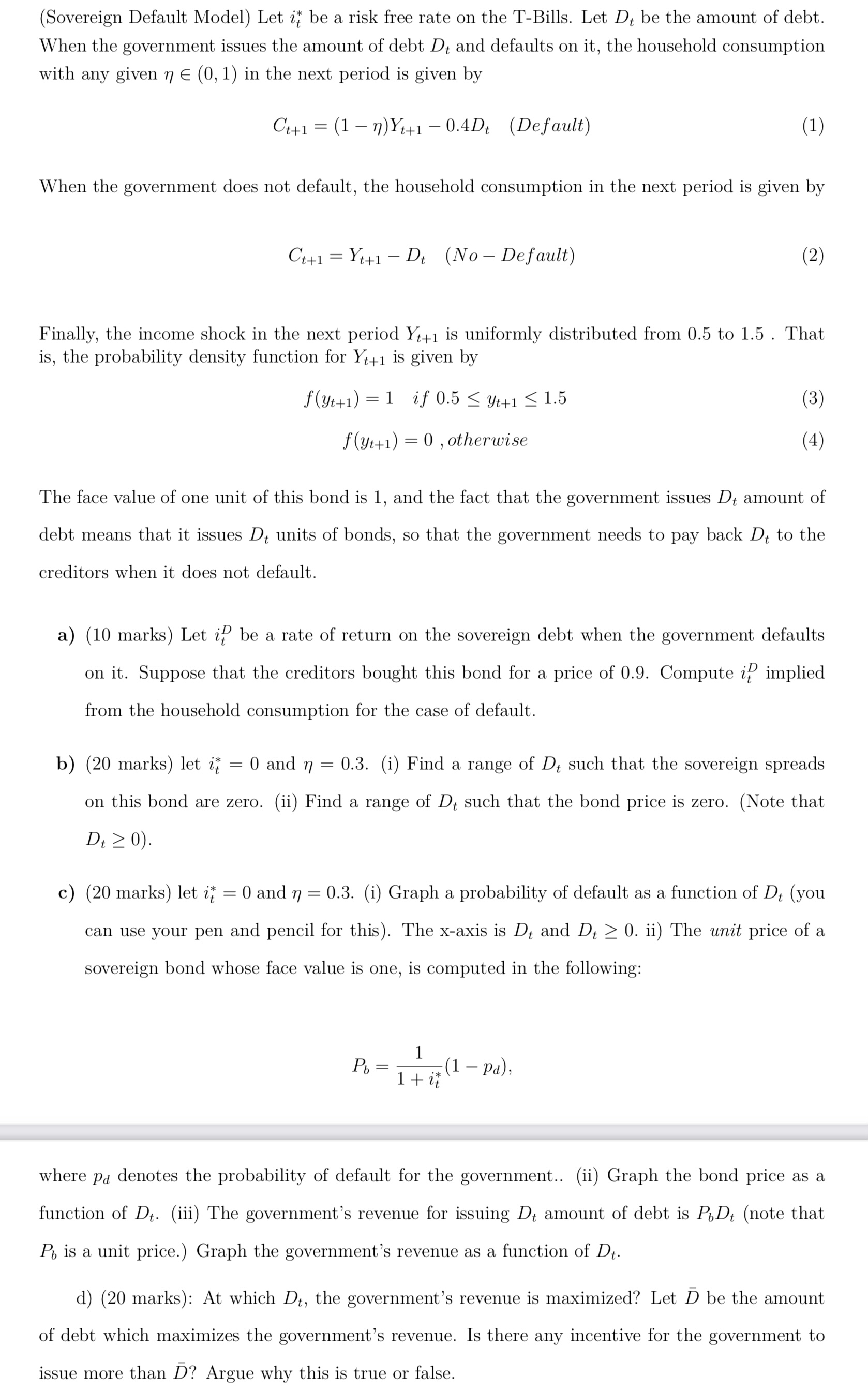

(Sovereign Default Model) Let it be a risk free rate on the T-Bills. Let D, be the amount of debt. When the government issues the amount of debt Dt and defaults on it, the household consumption with any given (0, 1) in the next period is given by Ct+1 = (1-n)Yt+1 -0.4Dt (Default) When the government does not default, the household consumption in the next period is given by Ct+1=Yt+1Dt (No- Default) Finally, the income shock in the next period Y+1 is uniformly distributed from 0.5 to 1.5. That is, the probability density function for Yt+1 is given by f(yt+1)=1 if 0.5 yt+1 1.5 f(yt+1) = 0, otherwise = The face value of one unit of this bond is 1, and the fact that the government issues De amount of debt means that it issues D units of bonds, so that the government needs to pay back D to the creditors when it does not default. a) (10 marks) Let i be a rate of return on the sovereign debt when the government defaults on it. Suppose that the creditors bought this bond for a price of 0.9. Compute i implied from the household consumption for the case of default. 0 and n (1) b) (20 marks) let it 0.3. (i) Find a range of D, such that the sovereign spreads on this bond are zero. (ii) Find a range of Dt such that the bond price is zero. (Note that Dt 0). = (2) Pb = (3) (4) c) (20 marks) let i = 0 and n = 0.3. (i) Graph a probability of default as a function of Dt (you can use your pen and pencil for this). The x-axis is D, and Dt 0. ii) The unit price of a sovereign bond whose face value is one, is computed in the following: 1 1 + it (1 pa), where p denotes the probability of default for the government.. (ii) Graph the bond price as a function of Dt. (iii) The government's revenue for issuing D, amount of debt is PDt (note that P is a unit price.) Graph the government's revenue as a function of Dt. d) (20 marks): At which Dt, the government's revenue is maximized? Let D be the amount of debt which maximizes the government's revenue. Is there any incentive for the government to issue more than D? Argue why this is true or false.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a 10 marks To compute the implied rate of return itD when the government defaults we equate the pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started