Answered step by step

Verified Expert Solution

Question

1 Approved Answer

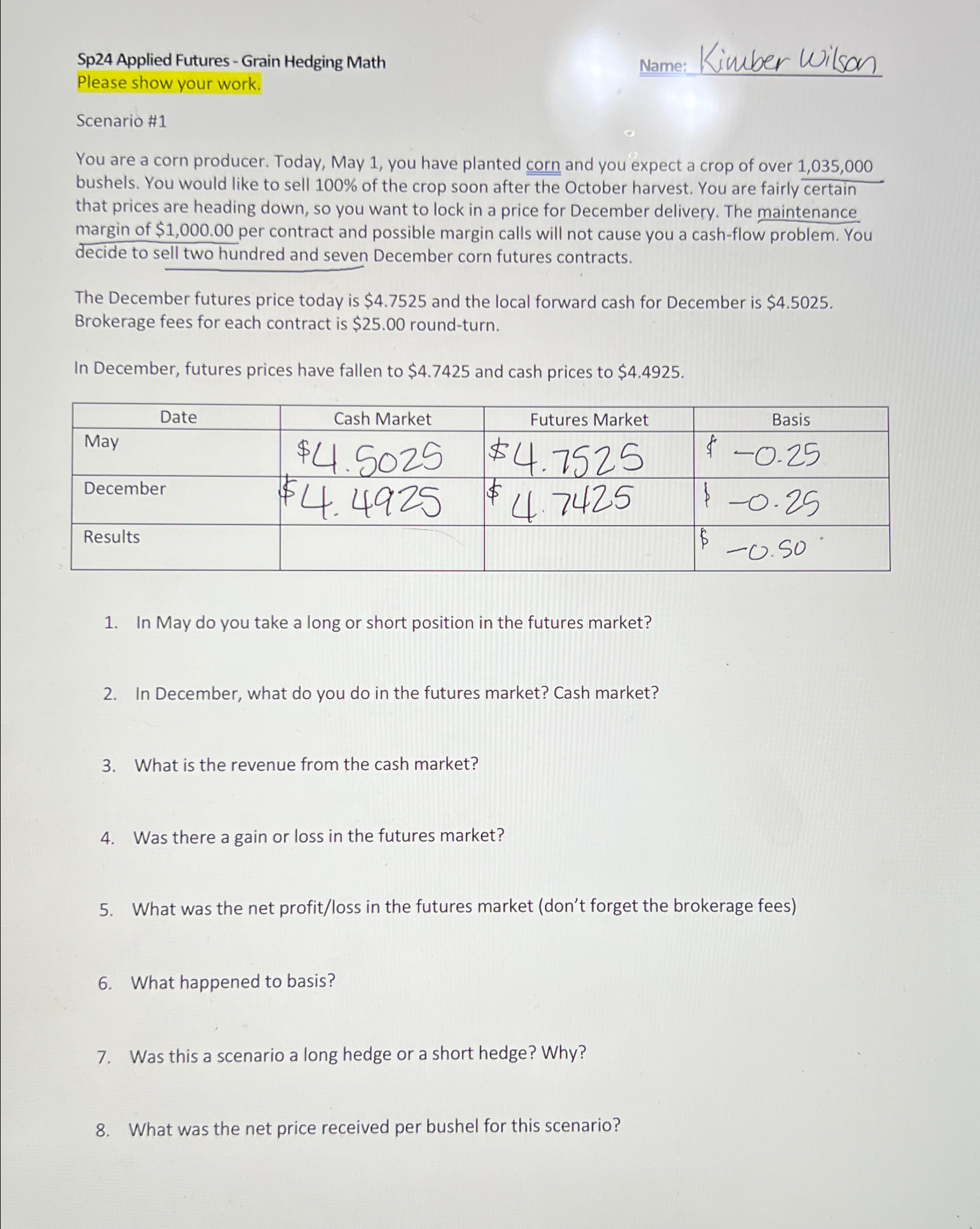

Sp 2 4 Applied Futures - Grain Hedging Math Please show your work. Name: Kimber Wilson Scenario # 1 You are a corn producer. Today,

Sp Applied Futures Grain Hedging Math

Please show your work.

Name: Kimber Wilson

Scenario #

You are a corn producer. Today, May you have planted corn and you expect a crop of over bushels. You would like to sell of the crop soon after the October harvest. You are fairly certain that prices are heading down, so you want to lock in a price for December delivery. The maintenance margin of $ per contract and possible margin calls will not cause you a cashflow problem. You decide to sell two hundred and seven December corn futures contracts.

The December futures price today is $ and the local forward cash for December is $ Brokerage fees for each contract is $ roundturn.

In December, futures prices have fallen to $ and cash prices to $

tableDateCash Market,Futures Market,BasisMay$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started