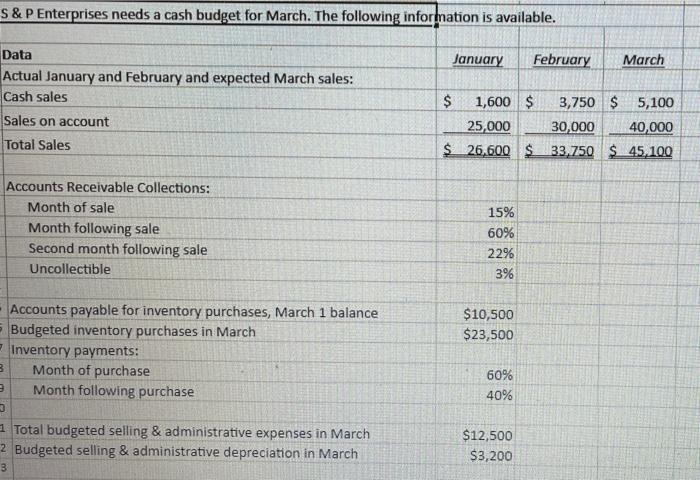

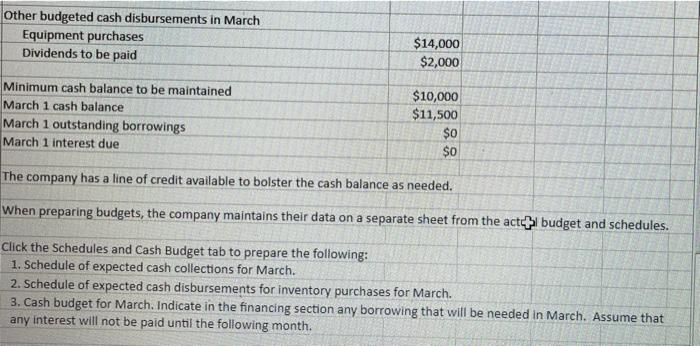

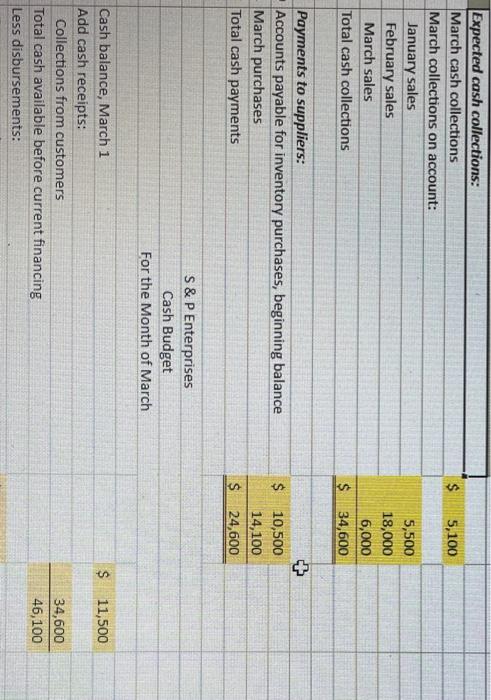

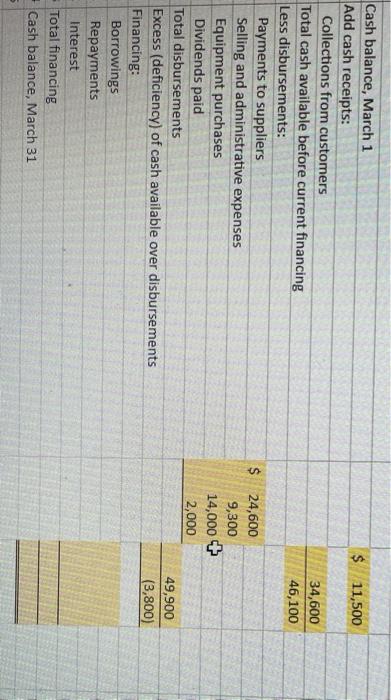

S&P Enterprises needs a cash budget for March. The following information is available. January February March Data Actual January and February and expected March sales: Cash sales Sales on account Total Sales $ 1,600 $ 3,750 $ 5,100 25,000 30,000 40,000 $ 26,600 S 33,750 $ 45,100 Accounts Receivable Collections: Month of sale Month following sale Second month following sale Uncollectible 15% 60% 22% 3% $10,500 $23,500 - Accounts payable for inventory purchases, March 1 balance Budgeted inventory purchases in March Inventory payments: 3 Month of purchase Month following purchase 3 60% 40% 3 Total budgeted selling & administrative expenses in March 2 Budgeted selling & administrative depreciation in March 3 $12,500 $3,200 Other budgeted cash disbursements in March Equipment purchases Dividends to be paid $14,000 $2,000 Minimum cash balance to be maintained March 1 cash balance March 1 outstanding borrowings March 1 interest due $10,000 $11,500 $0 $0 The company has a line of credit available to bolster the cash balance as needed. When preparing budgets, the company maintains their data on a separate sheet from the act budget and schedules. Click the Schedules and Cash Budget tab to prepare the following: 1. Schedule of expected cash collections for March. 2. Schedule of expected cash disbursements for inventory purchases for March. 3. Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that any interest will not be paid until the following month. $ 5,100 Expected cash collections: March cash collections March collections on account: January sales February sales March sales Total cash collections 5,500 18,000 6,000 34,600 $ + $ Payments to suppliers: Accounts payable for inventory purchases, beginning balance March purchases Total cash payments 10,500 14,100 $ 24,600 S & P Enterprises Cash Budget For the Month of March $ 11,500 Cash balance, March 1 Add cash receipts: Collections from customers Total cash available before current financing Less disbursements: 34,600 46,100 $ 11,500 34,600 46,100 Cash balance, March 1 Add cash receipts: Collections from customers Total cash available before current financing Less disbursements: Payments to suppliers Selling and administrative expenses Equipment purchases Dividends paid Total disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest - Total financing Cash balance, March 31 $ 24,600 9,300 14,000 + 2,000 49,900 (3,800)