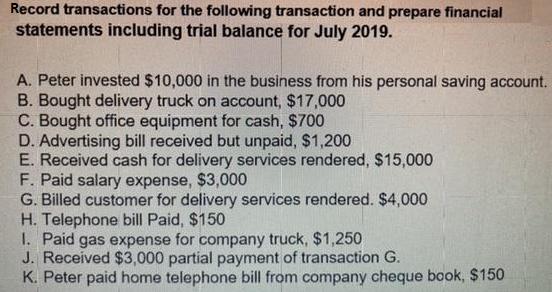

Record transactions for the following transaction and prepare financial statements including trial balance for July 2019. A. Peter invested $10,000 in the business from

Record transactions for the following transaction and prepare financial statements including trial balance for July 2019. A. Peter invested $10,000 in the business from his personal saving account. B. Bought delivery truck on account, $17,000 C. Bought office equipment for cash, $700 D. Advertising bill received but unpaid, $1,200 E. Received cash for delivery services rendered, $15,000 F. Paid salary expense, $3,000 G. Billed customer for delivery services rendered. $4,000 H. Telephone bill Paid, $150 I. Paid gas expense for company truck, $1,250 J. Received $3,000 partial payment of transaction G. K. Peter paid home telephone bill from company cheque book, $150

Step by Step Solution

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started