Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spacely Sprockets Inc is a new start - up evaluating a new project. They worry that they don't have all the requisite operating information they

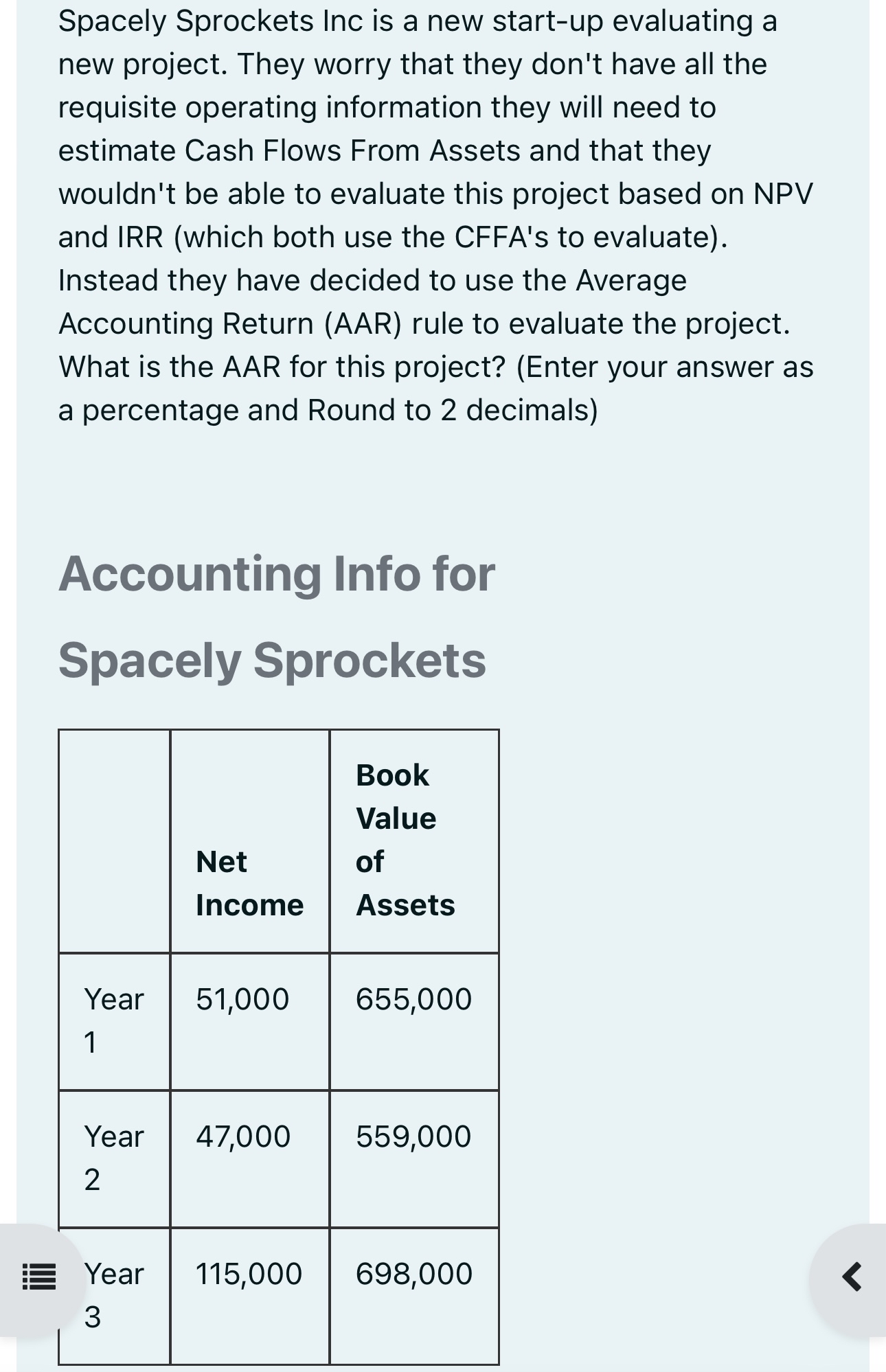

Spacely Sprockets Inc is a new startup evaluating a new project. They worry that they don't have all the requisite operating information they will need to estimate Cash Flows From Assets and that they wouldn't be able to evaluate this project based on NPV and IRR which both use the CFFA's to evaluate Instead they have decided to use the Average Accounting Return AAR rule to evaluate the project. What is the AAR for this project? Enter your answer as a percentage and Round to decimals

Accounting Info for

Spacely Sprockets

tabletableNetIncometableBookValueAssetstableYeartableYeartableYear

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started